Disclaimer: the FinTelegram “Headline News” format curates news about financial markets, investors, and investor protection. The “Headline News” articles do not contain extensive research but either provide short updates on relevant subjects, organizations, and individuals or refer to 3rd-party findings and opinions.

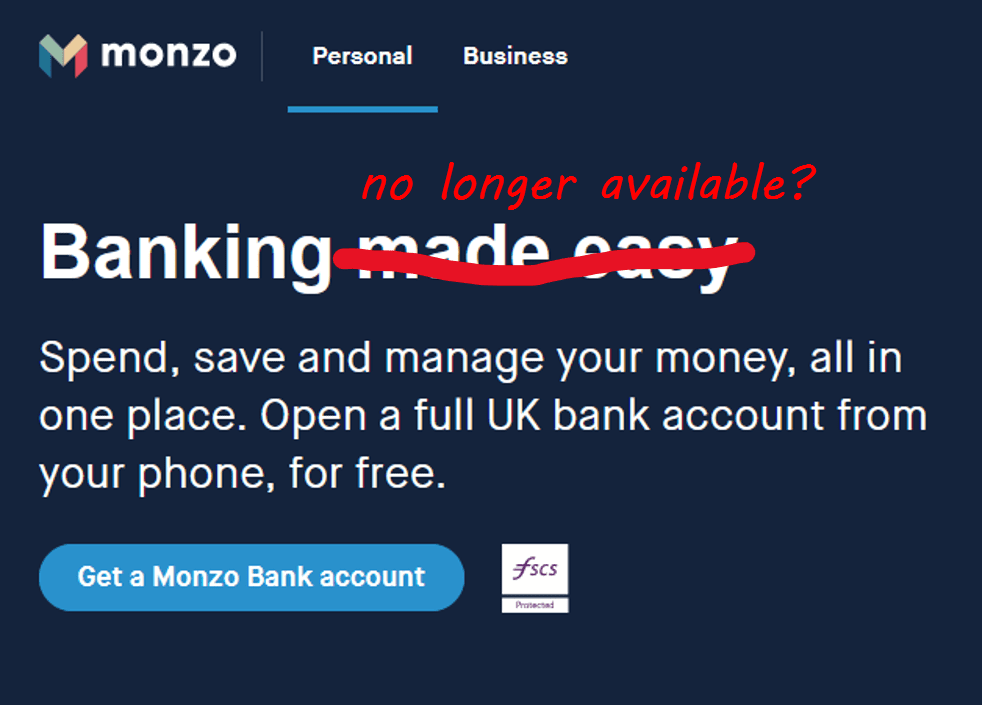

The Biden era is not off to a good start for CyberFinance. Cryptocurrencies are crashing, and some FinTech could face collapse, some analysts argue. According to GlobalData analyst Katherine Long, UK FinTech unicorn Monzo could be the second major collapse in the FinTech universe after the collapse of Australia’s Xinja. Monzo is becoming an “increasingly expensive charitable cause for the UK market” and could be the first big UK challenger bank to collapse unless it changes its approach towards a more sustainable future.

Long draws parallels between the sudden collapse of Australian FinTech Xinja and the struggles of UK digital bank Monzo.

“The lack of focus on essential revenue-generating products, and the reluctance to incentivize customers to pursue mutually beneficial outcomes.”

Katharina Long (Source: OpenData Analysis)

Long’s research—Beyond the Hype: Insight into Digital Challenger—states that Xinja’s above-market deposit rates, while being unable to redeploy its capital as loans, is not dissimilar from Monzo (read the Xinja story here). Following Long, Monzo has done well to attract and engage with its customers. However, the FinTech threatens to throw that away by not concentrating on the essential. Instead of trying to sell what was once free, Monzo should focus on making the most of revenue-generating products such as loans and wealth services.

As a matter of fact, Monzo’s 2019 results show losses reaching £113.8m on revenues of £67.2m, with the bank’s directors and auditors EY warning that the results had “material uncertainties, which may cast doubt over the Group’s ability to continue as a going concern.”

Just a few days ago, Monzo founder Tom Blomfield resigned over mental health. He announced that he is retiring completely from Monzo after stepping down already as CEO in May 2020 to become president. His exit is probably not really a vote of confidence either.

Sources: GlobalData, AltFi, TechCrunch