FinTelegram is known and hated primarily for its critical reviews. In this respect, we may (somewhat) disappoint this expectation with our new review of Moneta Markets by David Bily. We have upgraded the broker’s compliance rating from red to orange, honoring the regulatory actions taken in recent months and the positive customer feedback. However, some of the broker’s key target markets are still covered without regulatory permissions. Here is our updated review.

Key Data

Short Narrative

In December 2021, the Italian Consob issued a warning against Moneta Markets and the then-operator Vantage Global Limited. In 2022, Moneta Markets, founded by David Bily, spun off from the Vantage Group and embarked on an impressive expansion course.

Read more about the Vantage Group.

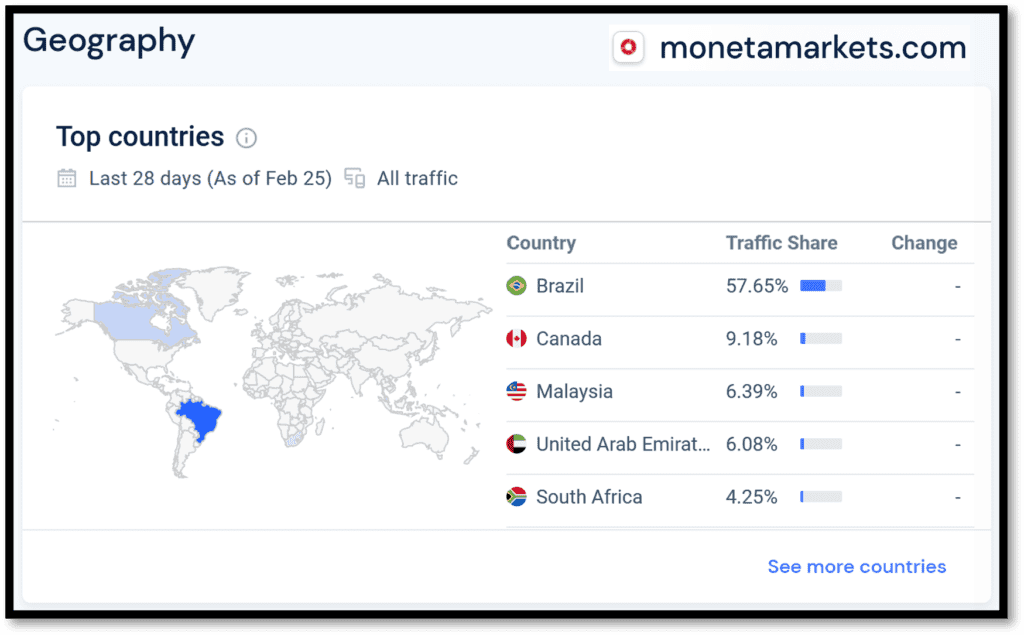

According to the Similarweb statistics for Feb 2023, more than 57% of the almost 80,000 visitors to the Moneta Markets website came from Brazil.

In our last reviews, most of Moneta Markets‘ website visitors were still from EEA jurisdictions. Most recently, the broker has hired Marcelo Morales Delgado as the new manager for LATAM. South America is likely to be the target market. In addition, the broker is also likely to move into the Asian market, where Kitty Yu works as Head of Business Development for APAC.

The rating of Moneta Markets has developed positively. Since our last review in October 2022, the Trustpilot rating has improved from 4.1 to 4.5 stars with a corresponding “Excellent” rating.

Compliance Check

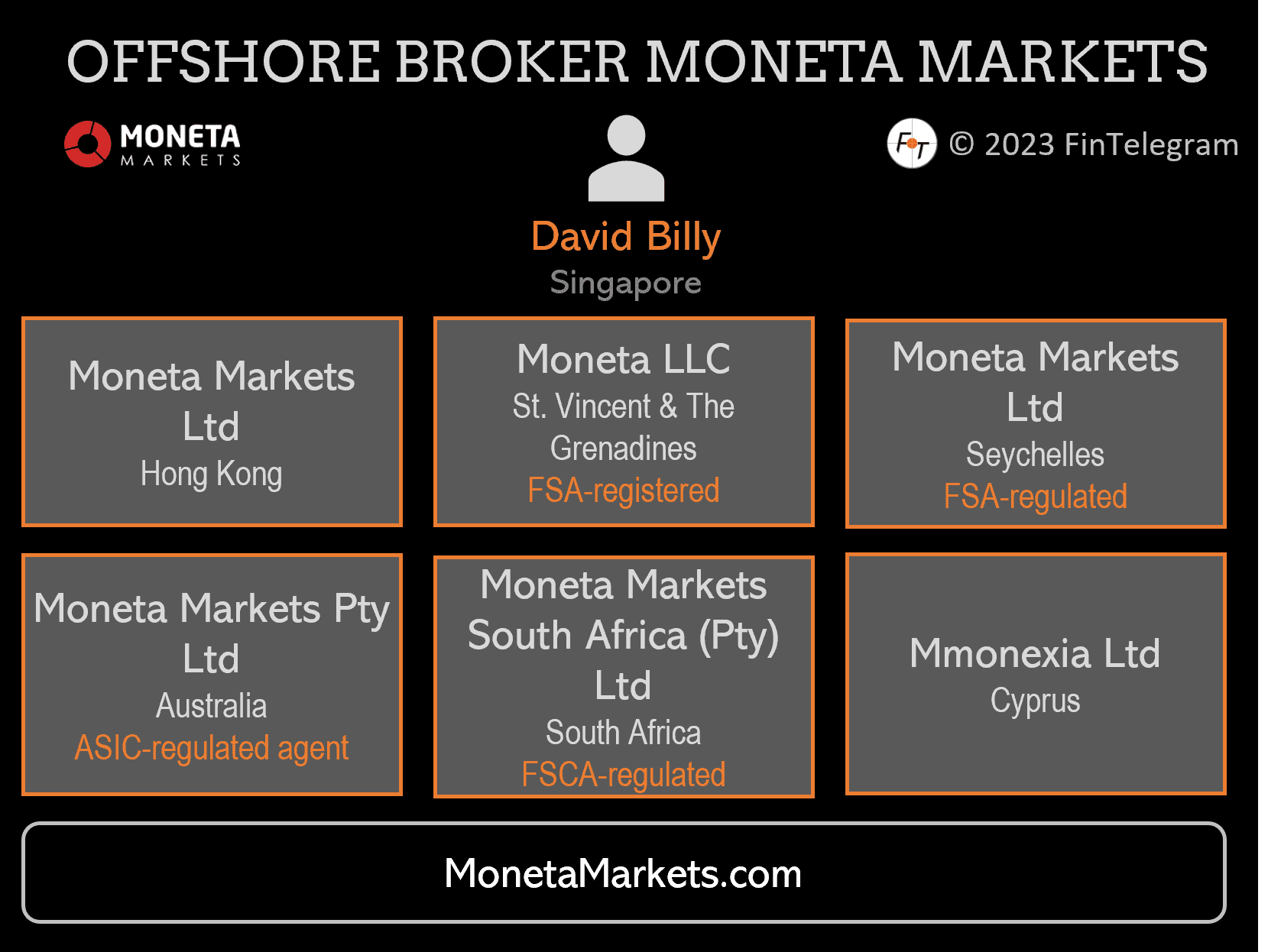

In recent months, the regulatory situation of Moneta Markets has improved in our view. In Australia, the broker acts as an ASIC-regulated agent of AGC Capital Securities Pty Ltd. In South Africa, the broker is regulated by FSCA. In addition, Moneta Markets is also registered as a Securities Dealer by FSA Seychelles.

However, it should still be noted that there is no regulatory permission for the current main markets in LATAM, North America UAE. With a maximum leverage of 1:1000, Moneta Markets violates regulatory requirements in most jurisdictions.

On a positive note, opening a live trading account is only possible after a KYC check. In this process, the identity and address of the new customers are confirmed. Pre-KYC deposits are not possible.

Moneta Markets clients from unregulated markets are not entitled to investor compensation schemes or Financial Ombudsman Services support. This is a significant risk for customers.

The regulatory situation of Moneta Markets has improved in recent months. Overall, we assign the broker an Orange Compliance rating, an upgrade from our previous red list rating.

Key Data

| Brands | Moneta Markets |

| Domain | www.monetamarkets.com |

| Social media | |

| Related legal entities | MMonexia LTD, Cyprus Moneta Markets South Africa (Pty) Ltd, South Africa Moneta Markets Ltd, Seychelles Moneta LLC, SVG Moneta Markets Pty Ltd, Australia Moneta Market Limited, Hong Kong AGC Capital Securities Pty Ltd |

| Jurisdictions | Cyprus South Africa St. Vincent & The Grenadines Australia |

| Regulators | ASIC (Australia) FSCA (South Africa) FSA (Seychelles) |

| Platform | |

| Leverate | up to 1:1000 |

| Payment processors | ZotaPay (cc), Finrax (crypto), BridgerPay, PerfectMoney |

| Related individuals | David Bily, CEO of Moneta Markets (LinkedIn) Raffaella Chiara Gianfilippi De Parenti, Director Kitty Yu (LinkedIn) Marcelo Morales Delgado (LinkedIn) Luis Fernando J (LinkedIn) |

| Regulatory warnings | Consob |

| Trustpilot rating | 4.5 stars with “Excellent” trust level |

| Compliance rating | Orange Compliance |

Share information

If you have any information about Moneta Markets, its operators, and facilitators, please share it with us through our whistleblower system, Whistle42.