The Veltyco Case around the arrested founder Uwe Lenhoff seems to develop dramatically. FinTelegram has reported on the obvious financial problems of the company listed in the AIM segment of the London Stock Exchange. According to the press release of the Veltyco board around Paul Duffon and Marcel Noordeloos the results in June 2019 were worse than expected. This also had a negative impact on the company’s liquidity situation. The company needs fresh money and talks to investors and creditors. There is no guarantee, however, that these negotiations will be successful, according to the press release.

The Bet90 strategy without money?

As a matter of fact, the financial situation is likely to be even worse than feared. FinTelegram reported on the latest financial issued announced by the Veltyco board. After the arrest of its founder and main shareholder Uwe Lenhoff, the management board wanted to refocus the company on the development of its own sports betting brand Bet90. In addition, they wanted to offer marketing for other gambling companies. But now there should be problems with Bet90 as well, we learn.

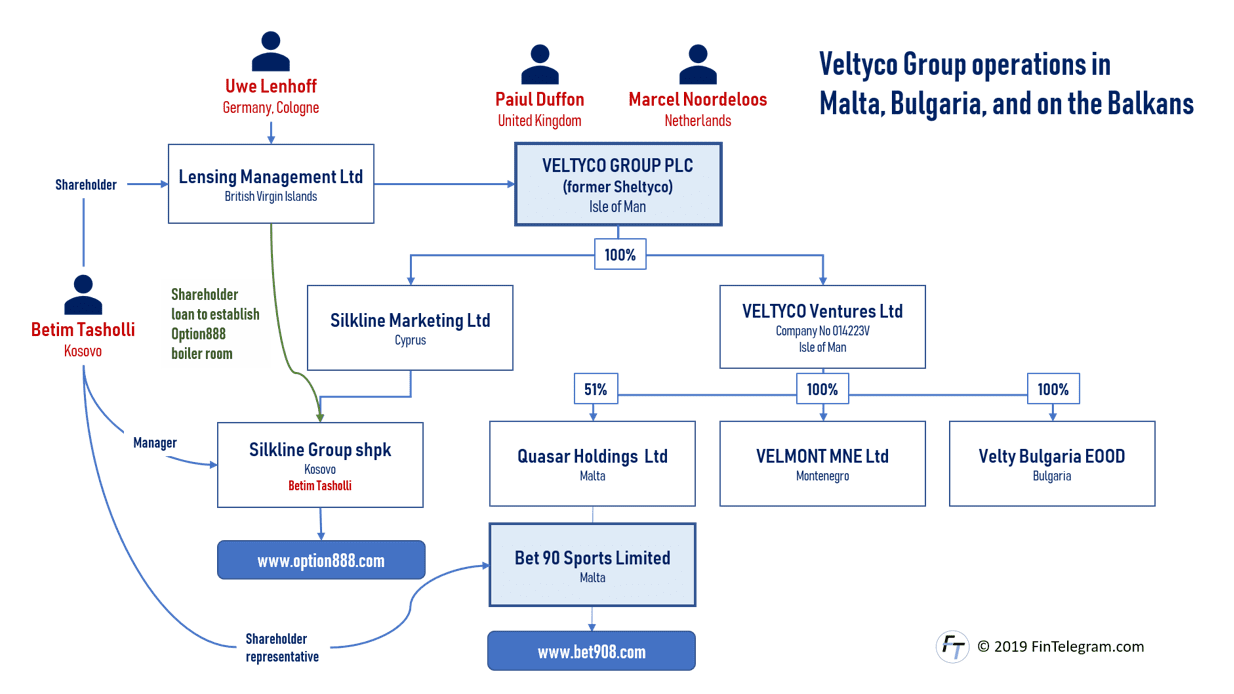

Bet 90 Sports Limited is a company registered in Malta and 100% owned by Quasar Holdings Ltd which is also registered in Malta. Quasar Holdings Ltd is 51% owned by Veltyco Ventures Ltd and thus controlled by Veltyco Group PLC. In addition to Quasar Holdings Ltd, Kosovar Betim Tasholli is registered in the Maltese Commercial Register as the representative of a shareholder of Bet 90 Sports Ltd.

Betim Tasholli – Lenhoff’s man for the Balkans

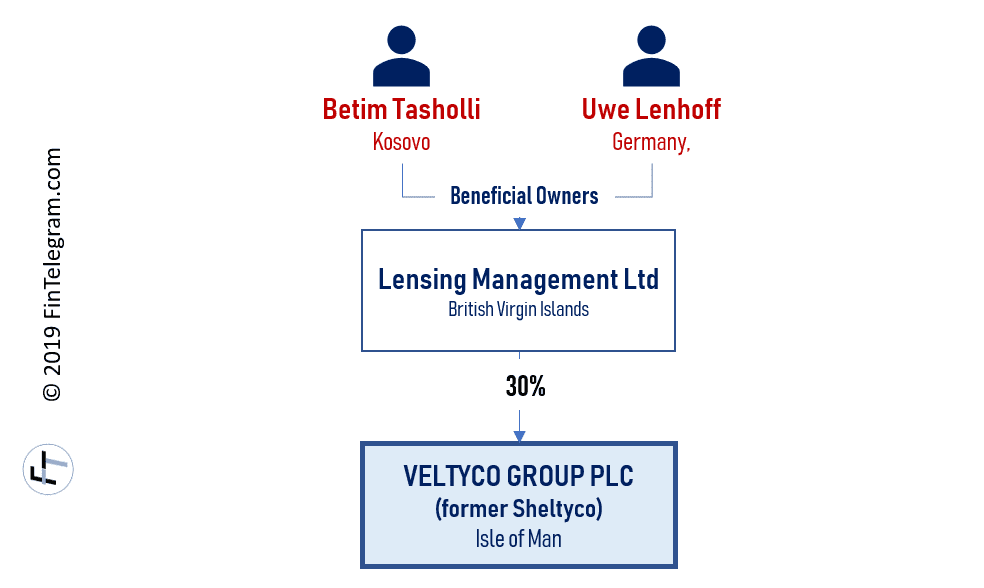

This Betim Tasholli is considered a close confidant of Uwe Lenhoff and has developed extensive activities for him in the Balkans. According to Lenhoff, Betim Tasholli is (or was) also a shareholder in Lensing Management Ltd (British Virgin Islands), which in turn is the main shareholder of Veltyco Group PLC. According to Lenhoff, Tasholli became a

Among others, Tasholli was responsible for the development and operation of the boiler room for Veltyco’s illegal and fraudulent binary options platform Option888 in Kosovo alongside Karin Zalcberg and James Azar. Via the Kosovo-registered Silkline Group

Betim Tasholli the one to blame?

Lenhoff delegates all operational responsibility for the Silkline Group and Option888 to Betim Tasholli. Personally, he wouldn’t have been involved. If there had been an investment fraud with harmed retail investors, it would have been Tasholli’s responsibility.

Betim Tasholli also participates in the Maltese companies of the Veltyco Group and is registered with Bet 90 Sports Limited as well as Quasar Holdings Ltd, SoftLotto Ltd

Employees of Veltyco’s Maltese companies have provided FinTelegram with information showing that Veltyco is currently not making any payments and that employees have not been receiving their salaries for some time. The Maltese police would have started a larger investigation of the Veltyco activities in Malta and questioned employees of the Maltese Veltyco companies. However, it is alleged that Veltyco’s Management Board has so far failed to reply to requests from the Maltese authorities.

It will be interesting to see what happens with Veltyco and what the main shareholders of the company will do or not do to get out of this situation. According to the information available to FinTelegram some larger shareholders are preparing legal action against the company and its people.