Today was not actually a good day for the shares of the crisis-ridden Veltyco Group on the London Stock Exchange. It lost almost 40% of its value in the late afternoon of 16 July 2019. The reason for this loss was a press release from the company. It stated that the June results were below the expectations of the Board and that financial problems had arisen as a result. Allegedly, this would have been the result of a large customer win, which would have cost the company liquidity. The sentence sounds strange and raises more questions than it answers. That’s what Veltyco press releases are all about. They are usually false, incomplete or misleading.

Running out of money

Through the press release, the Board lets the public know that the company urgently needs money. If no investors are found, it could be very tight for the company. The Board will therefore not be paying any more salaries for the time being.

The Directors continue to be of the view that further funding will be required. Whilst the Group has a number of ongoing discussions with regards to potential funding options there is no certainty that such funding will be available and/or the terms of such funding.

Veltyco press release published on July 16, 2019

Since the arrest of its founder Uwe Lenhoff in February 2019, his Veltyco Group has been staggering. Lenhoff was arrested in Austria on suspicion of financial crime, money laundering, and aggravated fraud. The new board around Paul Duffen wants to focus the company on its own sports betting brand Bet90 and, additionally, marketing for other online gaming companies. That doesn’t sound like a clean strategic positioning, does it?

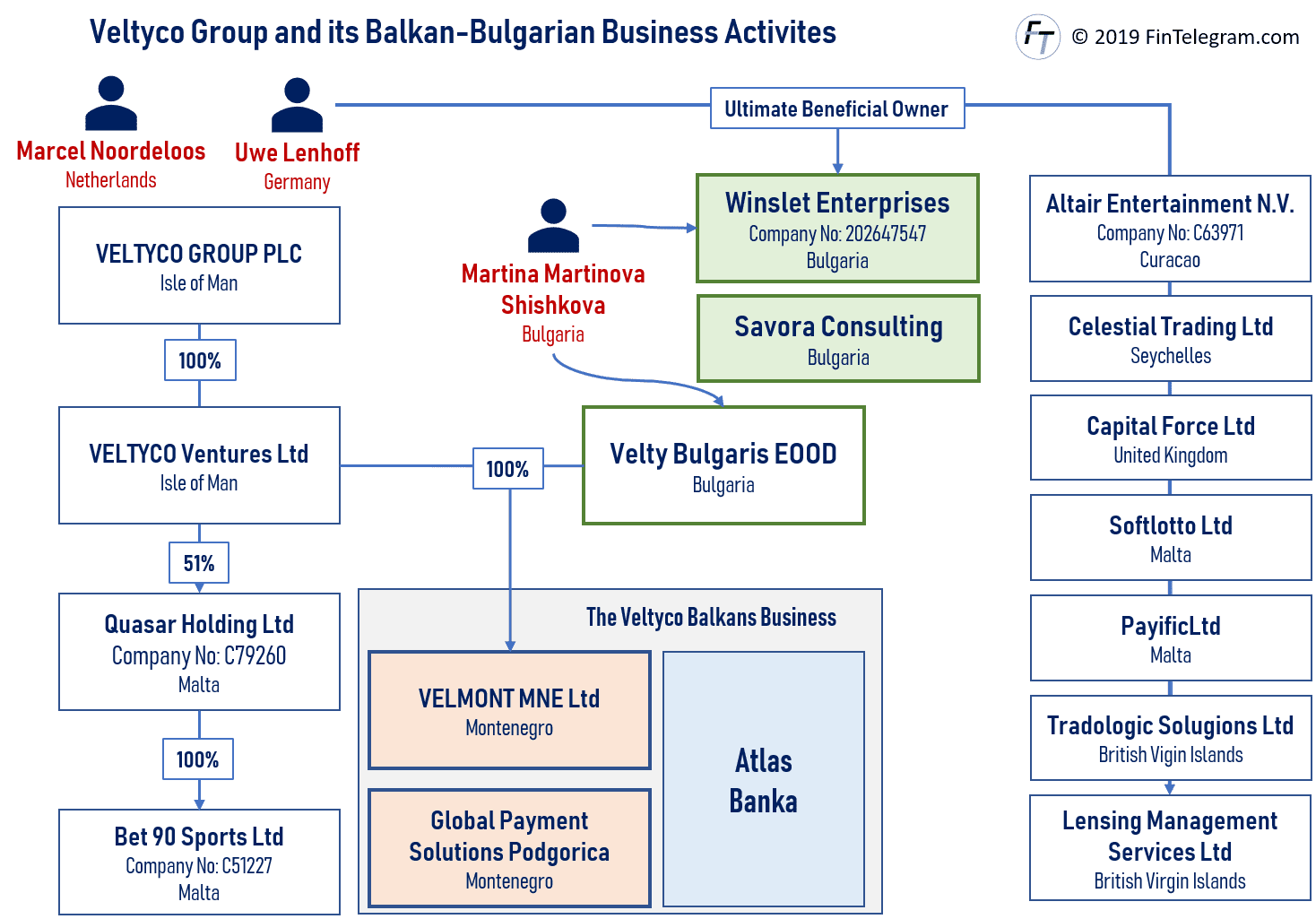

The shareholders of Veltyco as well as the media are wondering where the millions of Veltyco could have disappeared. One possible answer is Veltyco’s extensive business in the Balkans and Bulgaria.

The Serbian Heist

Indeed, Veltyco had the centers of its actual operational activity in Bulgaria and the Balkans (Montenegro, Serbia, Kosovo). The Bulgarian Martina Martinova Shishkova, for example, served as Director of the Bulgarian Veltyco subsidiary Velty Bulgaria EOOD and also as Manager of the Bulgarian Lenhoff company Winslet Enterprises. Lenhoff himself has since admitted that the Bulgarian Winslet Enterprises (which he personally owned) was the actual operating entity in the Veltyco-Lenhoff network of companies. However, Veltyco was not affiliated with Winslet Enterprises under company law. Veltyco never disclosed its business activities and subsidiaries in the Balkans and Bulgaria.

In Q3 2018, Lenhoff told the Veltyco board that its Serbian business partners allegedly had stolen about €7 million from Veltyco. These partners would have stolen money deposited by clients of Option888 and the other fraudulent broker schemes powered by Veltyco.

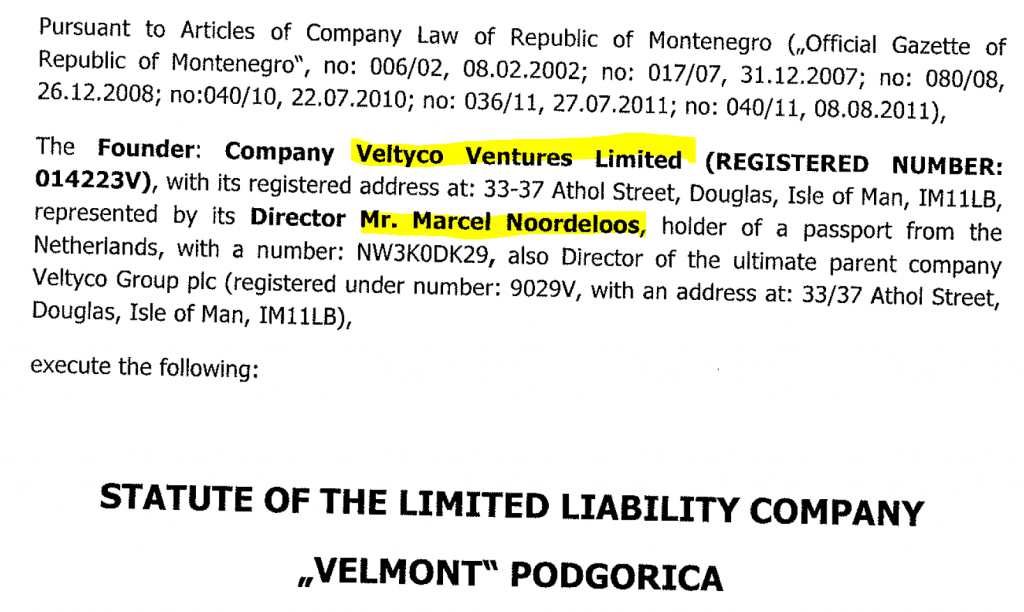

In fact, the two then Veltyco board members Uwe Lenhoff and Marcel Noordeloos founded the subsidiary Velmont MNE Podgorica (Velmont LLC) in Montenegro, which was to handle business in Serbia, Montenegro

According to the Serbian business partners, however, Lenhoff has tried to operate

They would not have stolen Veltyco’s money, but Veltyco or Lenhoff in its capacity as Veltyco’s board member would have caused them millions of damages. They and their partners would have invested millions into Veltyco but now the money is gone, as is Lenhoff. However, the Balkans-Bulgarian Veltyco business is a large construction site. The shareholders have not yet been informed of this. However, the authorities in several countries investigate these activities.

No disclosures

Interesting is the fact that the Veltyco Board did not publish this alleged heist by the Serbian partners. Although it was about 7 million euros. On the other hand, it had not been published before that they were even active in the Balkans and had a subsidiary company.

The Cybercrime Legacy

Veltyco has been the operator and marketing partner of several illegal and fraudulent broker platforms such as Option888,

Hundreds of victims have registered for our EFRI campaign for Veltyco platforms victims. EFRI has received Power of Attorney (POA) from dozens of these defrauded investors to claim their’ money from those responsible. Currently, EFRI is working on a class action campaign against Veltyco and its people. Among those responsible is certainly the board of Veltyco. In this regard, Veltyco and its Board members will still be subject to corresponding demands.

Some major shareholders have contacted FinTelegram and EFRI and provided factual information. They feel lied to by the board of Veltyco and want to make them responsible for their losses. The former external accounting firm of Veltyco has provided FinTelegram and the authorities with information showing that Veltyco’s accounting and balance sheet evidently have been manipulated.

The next few weeks will certainly be critical for Veltyco. In the press release sent out on 16 July 2019, the company is uncertain about its survival. And rightly so, because the aftermath of the discovery of the criminal network surrounding the founder will probably still hit Veltyco hard.

to be continued