A Malta-based advisory firm has been charged along with its owners with defrauding clients out of more than $75 million, the U.S. Securities and Exchange Commission (SEC) announced. The company was licensed by the Malta Financial Services Authority (MFSA). In a statement, the financial watchdog said it had charged two North Carolina-based executives, Gregory Lindberg and Christopher Herwig, and their Malta-based registered investment advisory, Standard Advisory Services Limited.

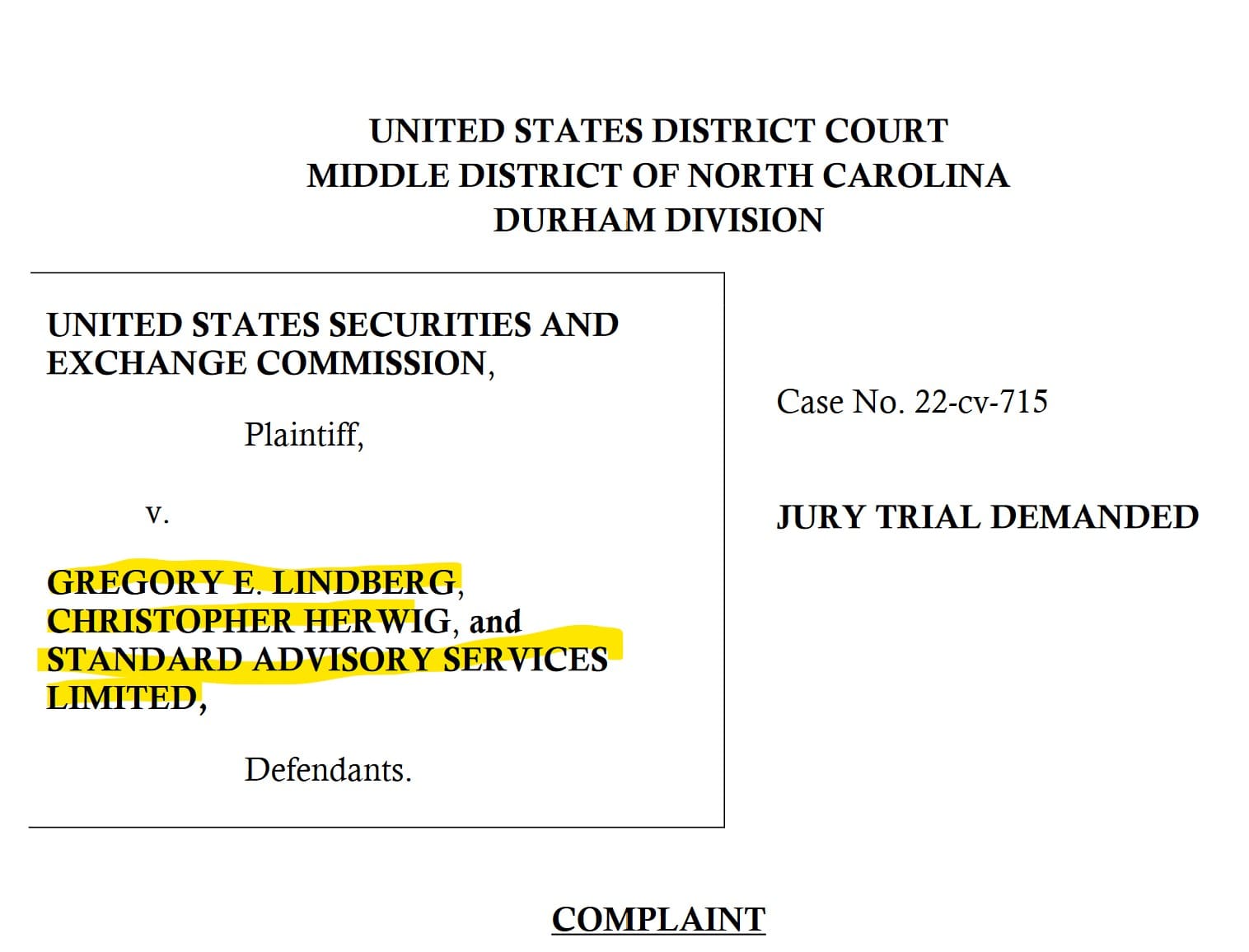

The SEC Complaint

They are believed to have defrauded clients through undisclosed transactions that benefited themselves and their companies in an elaborate insurance racket. The SEC’s complaint, which was filed in the U.S. District Court for the Middle District of North Carolina, charges Gregory Lindberg, Christopher Herwig, and Standard Advisory with violating the antifraud provisions of the US Investment Advisers Act of 1940 and seeks disgorgement plus prejudgment interest, penalties, and permanent injunctions.

According to the SEC complaint, from July 2017 through 2018, Lindberg and Herwig, through Standard Advisory, breached their fiduciary duties to their clients by fraudulently causing them to engage in undisclosed transactions that were not in their best interest.

The SEC complaint further alleges that the defendants misappropriated more than $57 million in client funds and that Standard Advisory collected more than $21.4 million in advisory fees generated in connection with these schemes.

Furthermore, to conceal the fraud, Lindberg allegedly orchestrated the schemes through complex investment structures and a web of affiliate companies and allegedly used the proceeds to pay themselves or divert the funds to Lindberg’s other businesses.

The Malta Entity

Standard Advisory Services Limited is registered with an address in Birkirkara, Malta, and is owned by Standard Malta Holdings Ltd, which is in turn owned by a company registered in North Carolina, Global Health Technology Group LLC.

The directors of the Maltese entity are Maltese national Joseph Grioli, US-based Marc Howard Greenspan, and Thomas Schildhammer, who has an address in Sliema. Previous directors include Christopher Herwig, Ray Busuttil, and Adrian Mallia. Miguel Cassar serves as company secretary, while Grant Thornton serves as auditors.

“We allege a massive fraudulent scheme, involving unique financial structures and various complex investments, orchestrated by the defendants for their own benefit over their advisory clients’ benefit,” said Osman Nawaz, Chief of the Division of Enforcement’s Complex Financial Instruments Unit at the SEC.

Regulatory Flexibility

Standard Advisory Services Limited had been handed an Investment Services licence by the Malta Financial Services Authority (MFSA), but this was voluntarily surrendered. It is not understood how the MFSA’s Executive Committee, which at the time included disgraced Joseph Cuschieri, his friend Edwina Licari, Christopher Buttigieg, Michelle Mizzi Buontempo, Michael Xuereb, and Ivan Zammit, did not investigate such fraud. These officials do not declare their conflicts of interest. Malta’s Financial Intelligence Analysis Unit (FIAU) never reprimanded or fined this company.