In October 2022, we issued a warning against the offshore brokerage scheme Opofinance, operated by offshore entities in the Seychelles and St. Vincent & The Grenadines. Opofinance operates under a securities dealer license from the FSA Seychelles in most regulatory regimes worldwide without a license. In doing so, Opofinance also violates regulatory requirements and falsely claims that membership with the Financial Commission will protect investor funds. Compliance rating: Red!

Key data

| Trading name | Opofinance |

| Domain | www.opofinance.com |

| Social media | LinkedIn, Facebook, Instagram, Twitter |

| Legal entity | Opo Group LLC (est. Feb 2021), SVG Opo Group Ltd, Seychelles Opo Finance, Inc. |

| Corporate advisor | Wilfred Services Ltd |

| Jurisdiction | St. Vincent & The Grenadines Seychelles Cyprus, Turkey |

| Related individuals | David Wojo |

| Authorized | FSA Seychelles Securities Dealer with license no SD124 |

| Leverage | up 1:500 |

| Membership | The Financial Commission (link) |

| Investor protection | No |

| Payment options | Bank wire, crypto, e-wallet, bank wire |

| Payment processors | TC Pay, Perfect Money, Advcash, FasaPay, FastAsiaPay, UnionPay VirtualPay, Help2Pay |

| Compliance Rating | Red |

The Short Narrative

On its LinkedIn profile, Opofinance lists Tehran, Iran, and Hong Kong as its headquarters. The broker scheme works with offshore entities in St. Vincent & The Grenadines and the Seychelles. Nothing is known about the controlling persons. We think that Turkish nationals control Opofinance.

In a press release in December 2022, Opofinance claimed to be based in Cyprus. David Wojo was presented as the owner. However, we have not been able to confirm his identity. In other press releases, Opofinance presents itself as a broker for Gen-Z traders.

Opofinance is a member of the Financial Commission and claims on its website that this would protect customers’ deposits of up to €20,000 per case. This is not true, as the Financial Commission has confirmed to us.

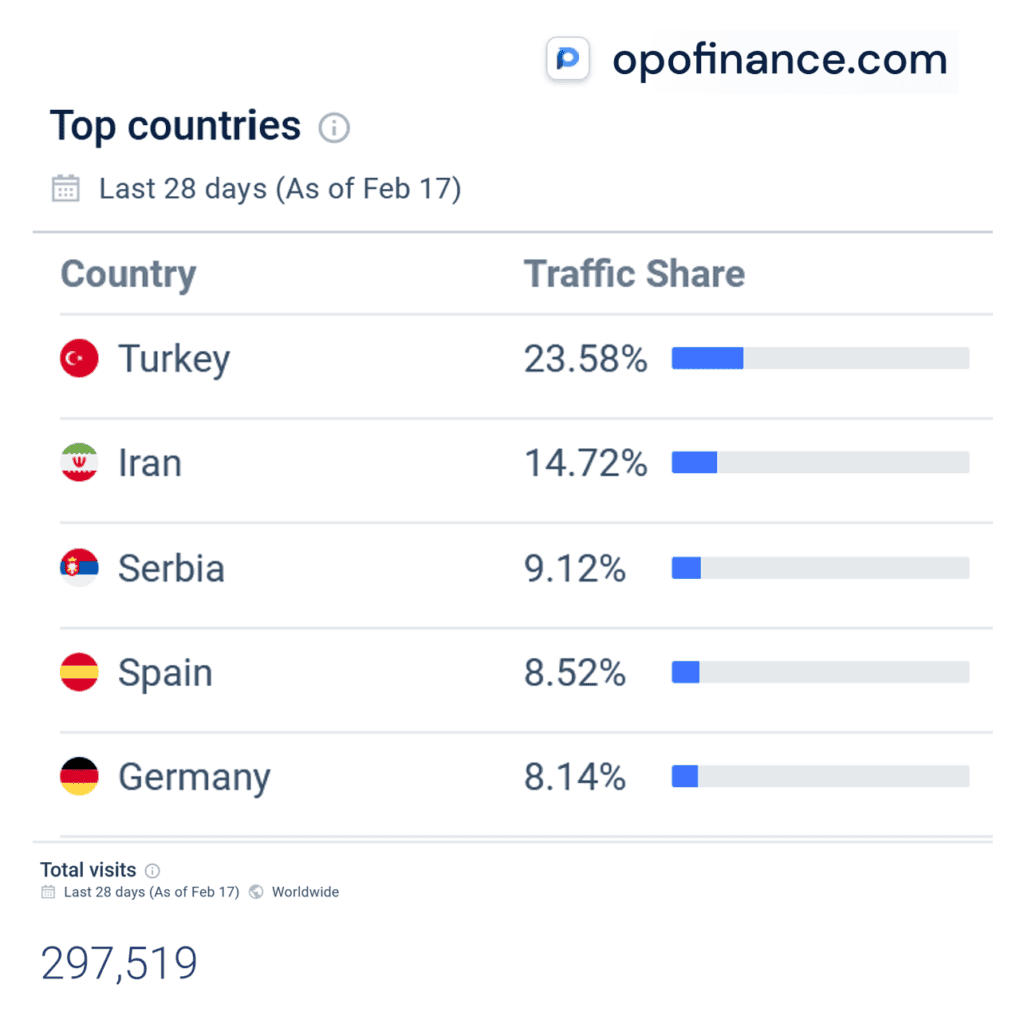

In the 28 days leading up to November 17, 2023, approximately 300,000 people visited the Opofinance website. Of these, more than 23% came from Turkey, but EEA jurisdictions are also among the top 5 visited countries (screenshot left).

As payment processors, we found TC Pay, Perfect Money, FasaPay, UnionPay, FastAsiaPay, and Advcash. Alternatively, clients can deposit in cryptocurrencies, including stablecoins.

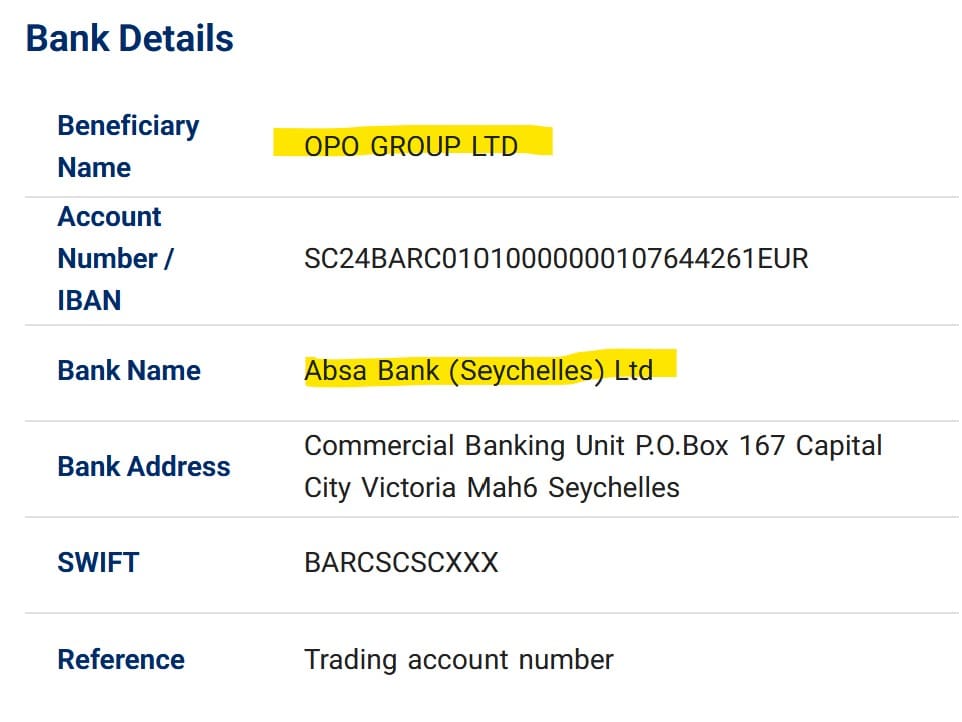

Bank deposits to Opofinance are made to the Opo Group account at Absa Bank Seychelles.

Regulatory Check

Opofinance‘s offering violates regulatory requirements in North America, Europe, and other regulatory regimes. Opofinance offers its financial services in the regulatory regimes of EEA, Turkey, and many other jurisdictions without authorization. It offers a leverage of up to 1:500, although in the EEA and most other regulatory regimes, only up to a maximum of 1:30 is allowed for retail clients.

Furthermore, pre-KYC deposits in theoretically unlimited amounts are possible via crypto or bank transfer.

Investor Protection And Rating

Opofinance has no authorization to offer its regulated services in any regulatory regime and violates regulatory rules and financial laws. Clients of unauthorized offshore brokers should be aware that they are not entitled to Investor Compensation Schemes or Financial Ombudsman assistance. This further increases the already super-high risk in the Forex, CFD, and Crypto space. It is statistically almost 100% likely that clients of offshore brokers are losing money.

Nothing is known about the operators and controlling individuals. The information provided on the website is not sufficient. Plus, we found regulatory violations. Thus, we included Opofinance in our “Red Compliance” list.

You should not increase your risk by working with offshore brokers, even if they are not a scam, especially in high-risk areas such as Forex, CFD, or Crypto. We, therefore, recommend you be careful with Opofinance.

Share Information

If you have any information about Opofinance, its operators, and partners, please let us know via our whistleblower system, Whistle42.