In February 2022, we published our initial review of the OctaFX broker scheme. CySEC regulates Octa Markets Cyprus Ltd with license number 372/18. Like many other CySEC-regulated brokers, OctaFX also runs an offshore scheme via Octa Markets Incorporated, registered in St. Vincent & The Grenadines. The offshore scheme deploys different domains to solicit clients. Our new review on 16 January 2023 found that the offshore broker still accepts EEA residents.

Latest Updates

While just over 11,000 visitors visited the website of CySEC-regulated OctaFX (OctaFX.eu) in the last 28 days before February 13, 2023, offshore OctaFX (OctaFX.com) had more than 3 million visitors. This is an increase of more than 40% compared to December 2022. (Source: Similarweb). The top visitor countries are India, Nigeria, and Malaysia.

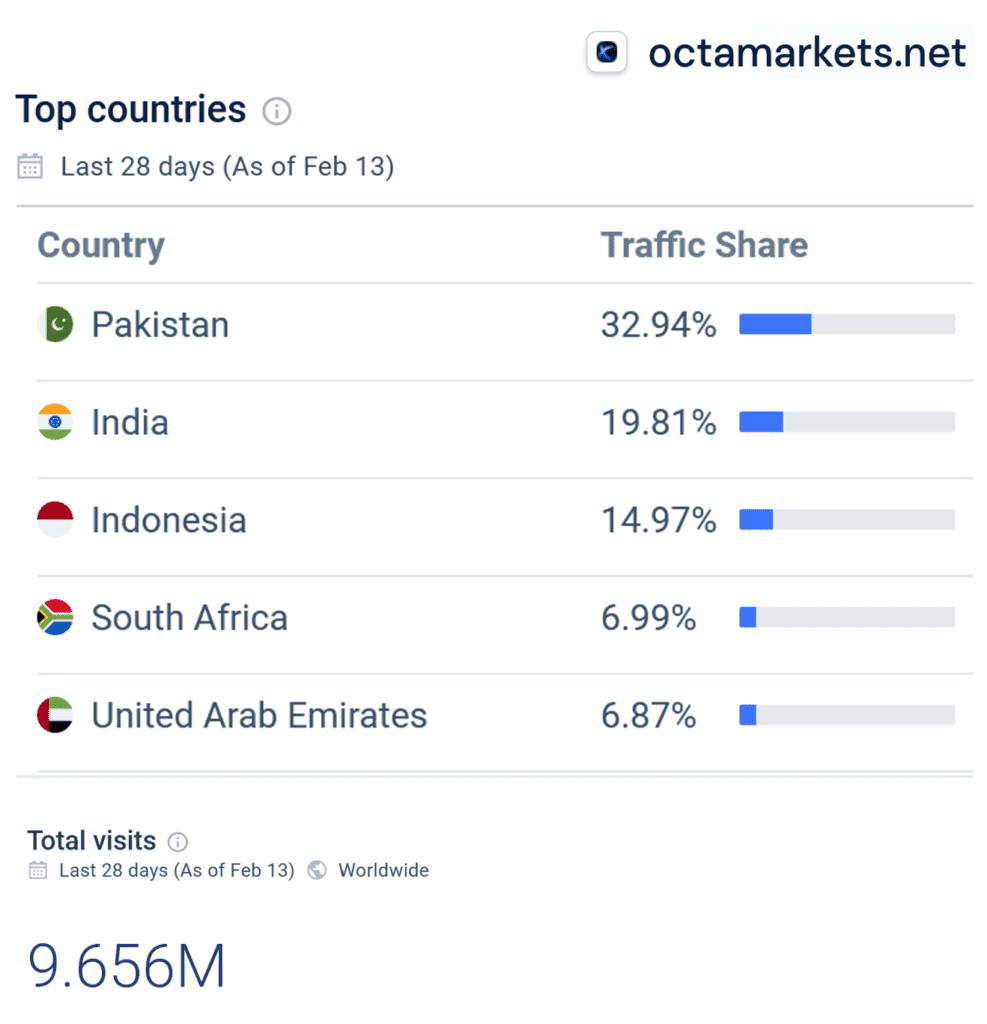

The OctaMarkets.net website has even recorded more than 9.6 million visitors in the last 28 days. Through this website, potential clients are redirected to OctaFX.com.

In any case, the growth of OctaFX over the last few weeks is impressive.

Key data

| Trading names | OctaFX Octa Markets |

| Domains | www.octafx.com (offshore) www.octamarkets.net (offshore) https://www.octafxmy.net (offshore) https://octaindia.net (offshore) www.octafx.eu (regulated) |

| Legal entities | Octa Markets Incorporated (SVG) Octa Markets Cyprus Ltd (Cyprus) |

| Jurisdictions | St. Vincent & The Grenadines Cyprus |

| Regulator | CySEC for www.octafx.eu and subdomains CySEC license 372/18 |

| Leverage | 1:500 (offshore) and 1:30 (regulated) |

| Proper KYC | no for offshore yes for regulated |

| Investor protection & Ombudsman | no for offshore yes for regulated |

| Related individuals | Anton Logvinovskyi, Pavel Prozorov Georgios Xydas, Georgios Pantzis |

The Review

OctaFX started as an offshore broker in 2011 and additionally obtained a CySEC license in 2018 to address EEA residents.

While the CySEC-regulated broker Octa Markets Cyprus Ltd does not offer its services to residents of Belgium, we have been able to register with the offshore scheme as a Belgian resident. The offshore entity of OctaFX has no authorization to solicit and onboard EEA residents, but it does so.

The offshore OctaFX offers leverage of 1:500, whereas ESMA only allows a maximum of 1:30.

Pre-KYC Deposits

After confirming the email, we would have been able to make unlimited deposits via crypto. At this time, OctaFX has not asked us to upload documents to verify our ID or address.

On the other hand, when onboarding at the CySEC-regulated OctaFX broker, all of these checks, as well as the risk assessment and financial literacy check, are done properly.

Only the offshore broker’s website links to OctaFX‘s social media accounts. On Facebook, OctaFX has more than 589k followers.

Preliminary conclusion

Our reviews show that OctaFX‘s offshore broker activities violate the regulatory rules in EEA regimes. On LinkedIn, OctaFX also presents itself as an offshore broker. The CySEC-regulated broker is of secondary importance. Traders are happy with the offshore OctaFX. On Trustpilot, the offshore broker maintains a 4.4-star rating with an Excellent trust level from more than 4,000 reviews. This is also impressive.

While OctaFX’s performance on social media is impressive, and its clients seem to be happy with the broker, its conduct does not seem to comply with ESMA and CySEC regulations.

There is no investor protection at offshore OctaFX and no right to assistance from the Financial Ombudsman in Cyprus. This massively increases the risk for investors. Also, the leverage of 1:500 suggests that the Offshore OctaFX mainly addresses investors with super-risk appetites outside any regulatory protection.

Share information

We would like to know more about OctaFX and its operators. If you have any information or experience, please share it with us via our whistleblower system, Whistle42.