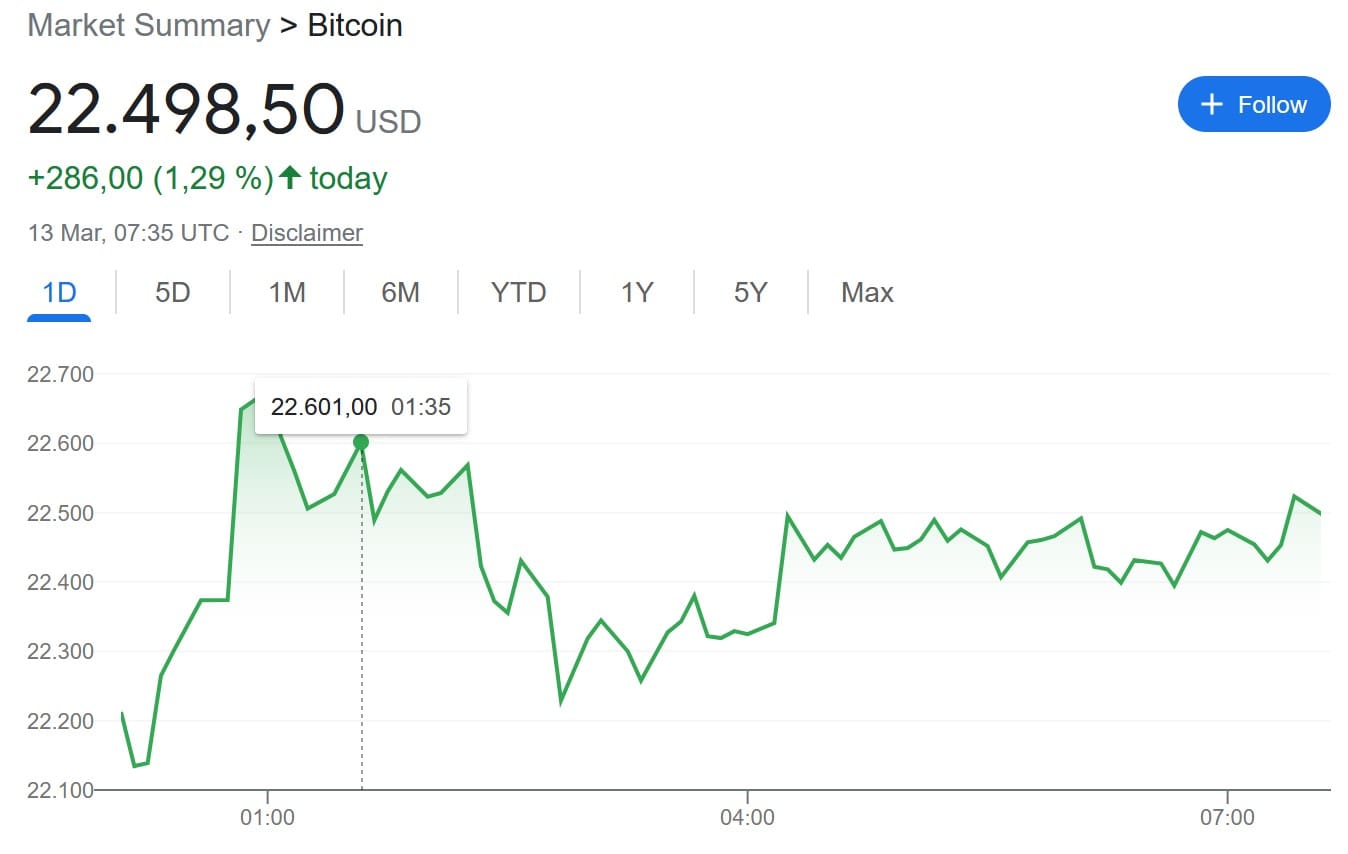

After a short period of weakness, the leading currencies of the crypto segment are unimpressed by the collapse of Silvergate, Silicon Valley Bank (SVB), and Signature Bank last week. Both Californian banks were also of systemic importance for the crypto segment. Bitcoin briefly fell below the $20,000 mark last week but is again showing at the beginning of the week at well over $22,000. Similarly, Ether has risen more than 9% to over $1,600. These price hikes are connected to the bail-out procedures announced by U.S. regulators.

This is impressive because the sudden death of Silicon Valley Bank (SVB) also affected the stablecoin USDC. The bank held around $3.3 billion that served as collateral for the USDC.

The strength may also have to do with the markets’ belief in a quick resolution to SVB‘s bailout. This would secure the funds of startups that were customers at SBV. On Monday, it became known that HSBC avoided a crisis in Britain’s tech sector by rescuing Silicon Valley Bank’s UK arm after all-night talks with British ministers led by Rishi Sunak and the Bank of England.

In the U.S., the Biden administration has announced that SVB and Signature Bank customers will have full access to their deposits, an extraordinary to backstop billions of dollars in uninsured money amid fears that the bank’s collapse could lead to greater panic.