Scam victims started to bring legal claims against ING subsidiary Payvision before the courts. Instead of dealing professionally with these claims, Payvision and its founder and former CEO Rudolf Booker started a tsunami of legal intimidation and defamatory campaigns to silence EFRI. They want the victims to lose trust in EFRI, thereby revictimizing the victims. A new climax was reached when Booker learned that Sixt was a speaker at the upcoming Financial Economic Crime event in Brussels. He retained a Belgian lawyer to send intimidating and defamatory threats to the event organizer and other event speakers to prevent Sixt from speaking.

The Scam Facilitator

In the summer of 2018, Fintelegram received and exposed tons of documentation about the fraudulent business activities of the Israeli Gal Barak, the Wolf of Sofia, his wife Marina Barak (previously Marina Andreeva), and his partners Vladislav Smirnov, Gery Shalon, and Uwe Lenhoff.

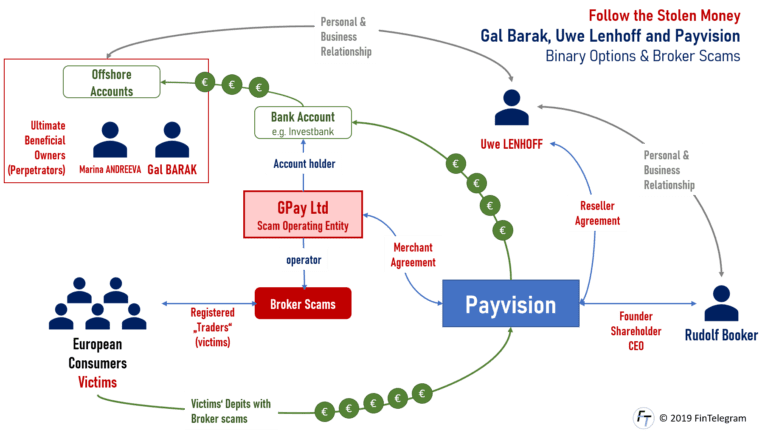

In this context, FinTelegram also exposed the scam facilitating activities of Payvision. The Amsterdam-based Fintech, founded by Rudolf Booker in 2000, was acquired by ING (one of the world-leading banks) in spring 2018. Under the tenure of Booker and his co-founders, Payvision was the main payment processor for credit/debit card payments of dozens of binary options and forex scams, defrauding thousands of innocent European retail customers.

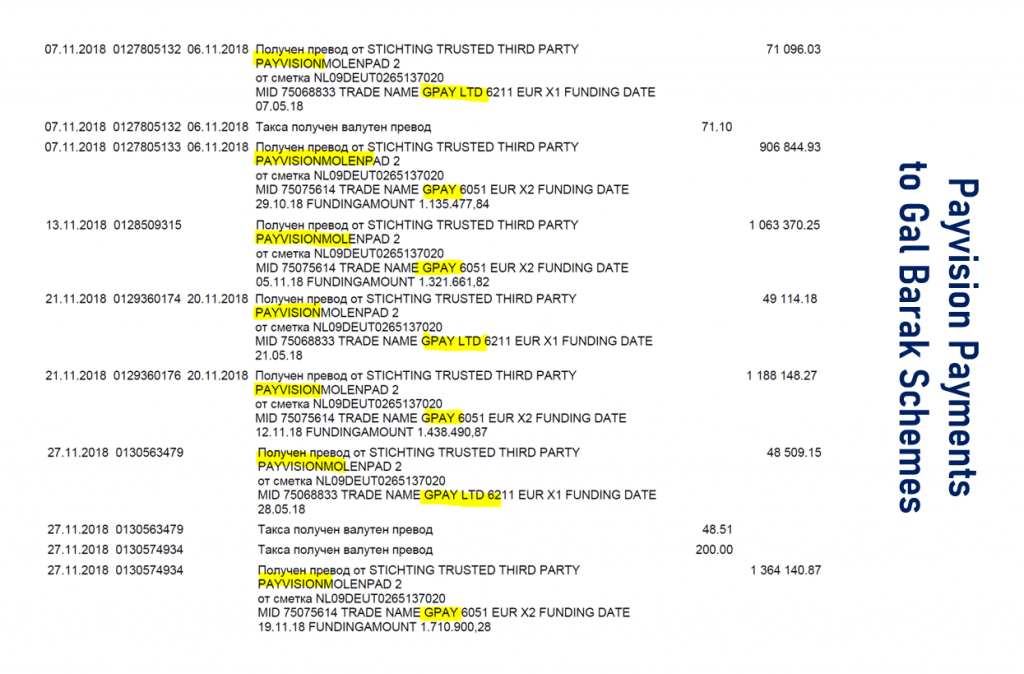

Until the Payvision clients Lenhoff and Barak were arrested in early 2019, Payvision transferred millions to their companies (see screenshot right). Lenhoff died in prison for unknown reasons in the summer of 2020, and Barak was sentenced in September 2020 to several years in prison and more than €4 million in restitution payments for investment fraud and money laundering.

Rudolf Booker became a friend of Uwe Lenhoff, the German principal of a vast cybercrime organization. They spent holidays together in Austria and coordinated their illicit activities via emails and WhatsApp. The law enforcement agencies found these incriminating communications after the arrest of Lenhoff in January 2019.

The conclusion from the criminal files is that Rudolf Booker knew without a shadow of a doubt about the scam and fraud activities of Lenhoff and Barak, and even actively assisted them with advice. Without Payvision, this systematic fraud against thousands of consumers would not have been possible.

Regulatory actions

In 2019, EFRI, representing the interests of around 300 victims of Uwe Lenhoff and Gal Barak, started to take action against Payvision and urged the relevant supervising authorities to commence regulatory action against the payment processor and its board members.

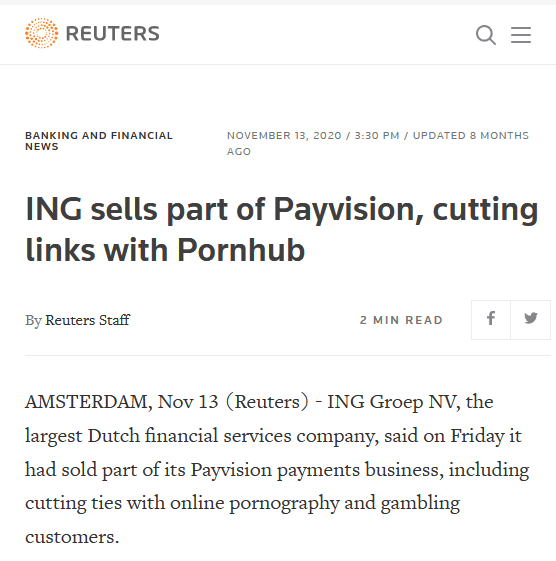

In early 2020, De Nederlandsche Bank (DNB) launched a probe into Payvision. In April 2020, Rudolf Booker and his co-founders Cheng Liem Li and Gijs op de Weegh resigned. Later that year, ING wrote off €200 million of goodwill it had shown in its books since the Payvision acquisition.

The FinCEN Leak

In Autumn 2020, the infamous FinCEN leak provided Dutch journalists with information that Payvision had been on the radar of US money-laundering watchdog FinCEN since 2013! For years, US banks filed suspicious transactions reports about Payvision and its wary clients. In addition, the FinCEN files revealed that employees of Deutsche Bank and Bank of New Cork Mellon warned several times about Payvision‘s approach of cutting large transactions into smaller amounts for no apparent reasons.

Triggered by the media reports, ING was quick to announce that the “risk criteria” of Payvision customers do not fulfill ING´s criteria, and it had already initiated a cleaning-up procedure. In September 2021, ING announced that after a thoughtful study McKinsey report was available, ING decided to close down Payvision.

While Payvision sold some of the high-risk businesses back to the Payvision founders (read the story here) for a symbolic price, neither ING nor Payvision has reimbursed the victims EFRI represents.

The Victims Voice

The NGO EFRI has more than 300 members that have been defrauded by Payvision clients controlled by Uwe Lenhoff and Gal Barak. They deposited their life savings to the scammers via Payvision trust accounts with Deutsche Bank or ING (acquiring services). Payvision accepted the offshore entities of these scammers as merchants and thus facilitated the money-laundering. All allegations raised against Payvision from EFRI are based on findings from the criminal files established by the Austrian and German law enforcement authorities.

EFRI also supports victims in addressing Payvision for refund in filing civil proceedings.

Silencing the Voice

For many months, Rudolf Booker and Payvision have been trying to silence EFRI and its founder and principal Elfriede Sixt. Again, they teamed up with scammers to spread defamatory fake information about EFRI.

In late 2021, Booker sued an Austrian company in which Elfriede Sixt is the Chairman of the supervisory board for alleged defamation and demanded a preliminary injunction. The competent court rejected this application for an injunction. In April 2022, Booker finally withdrew his legal claim and had to reimburse the costs.

When Rudolf Booker learned that the EFRI principal will talk about The Wolf of Sofia and its enablers (Payvision) in the upcoming Financial Economic Crime event, he retained the law firm elegis – Huybrechts, Engels, Craen & Vennoten (www.elegis.be) and instructed them to undertake all necessary steps to stop this event.

Evidently, Rudolf Booker is scared to death to hear the voice of the victims telling about the fraud he committed. His lawyers willingly and willfully told the event organizer that Elfriede Sixt would be lying and defaming Booker. Clearly, Booker’s fear is that Elfriede Sixt, as the voice of the victims, would once again point out Payvision‘s misconduct and its causation of harm to the victims.

Booker, like his former partner Lenhoff, acts with threats and intimidation. He has made a lot of money at the expense of the many victims and is using that to silence us. But I will continue to point to payment processors who act as facilitators of cybercrime. And I will continue to support victims with EFRI. Now, first of all, we are bringing the charges against Booker and Payvision.

Elfriede Sixt, EFRI Principal

Rudolf Booker and Payvision are doing everything they can to silence the voice of the victims. Including defamation and lies. Booker uses his fortune to retail lawyers across different jurisdictions to intimidate EFRI, Sixt, and their partners with daring threats.

What about the victims?

We understand that big companies make strategic investments, and we also understand that maybe no proper due diligence was done by ING. But we do not understand that a big bank like ING does not take over responsibility and try to find a solution for the victims of mistakes; instead, they invest money to hurt people who request justice for the victims like Elfriede Sixt.

Anyway, Elfriede Sixt finally instructed EFRI´s lawyers to prepare charges and complaints against Booker and his lawyers with the relevant authorities for defamation, slander, and threats.

This war seems to be far from over. With more indictments and trials against former Payvision clients in Germany, Austria, and other jurisdictions, the dirty Payvision business will be explained in the courts. Stay tuned!