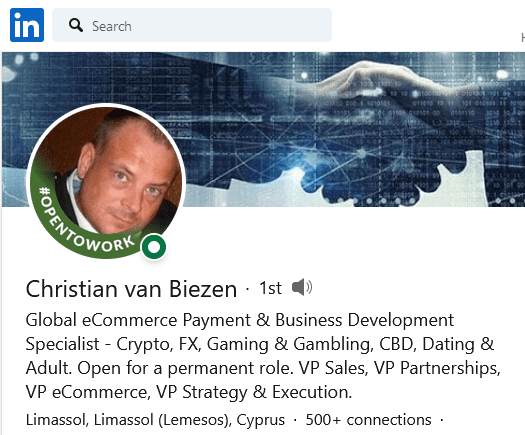

According to his LinkedIn profile, Christian van Biezen lives and works in Limassol, Cyprus, one of the European powerhouses of Forex brokers, which are part of a high-risk industry, whether regulated or unregulated. Consequently, a highly active high-risk payment processor scene has developed around these Cypriot forex brokers. OctaPay was one of them, and Christian van Biezen was its director until he realized it was defrauding its merchants. So he left in December 2020, exposing the crime. As a result, OctaPay and its people vanished with most of its customer funds.

Killing the Messenger

The LinkedIn profile of Christian van Biezen (LinkedIn) tells us that he was OctoPay’s Director of Strategic Partnerships and after being promoted to the CEO of OctaPay Europe (office to be set up in Cyprus), he actually resigned after finding out fake persons with documents represented OctaPay. The real reason for its very existence seemed to defraud its clients (mostly high-risk merchants) and finally running off with their money.

His departure from OctaPay might have been a rather dirty business we hear from insiders and a setup to try to let him take the fall. Unfortunately, the old saying “the messenger is always dead” is still valid. Make no mistake. Thanks to his exposure, many merchants have not lost money with OctaPay.

We reached out to van Biezen. He is available for a new role. However, he presents himself cautious in choosing his next adventure after having suffered the OctaPay trauma. With this experience, he may be the right guy to steer a payment company through the difficult waters. We wish him all the best and thank him for exposing the fraud and reporting them to Visa, MasterCard, and FinTelegram. Sadly enough, it seems that OctaPay managed to run away with some client’s money.

The OctoPay Fraud in a nutshell

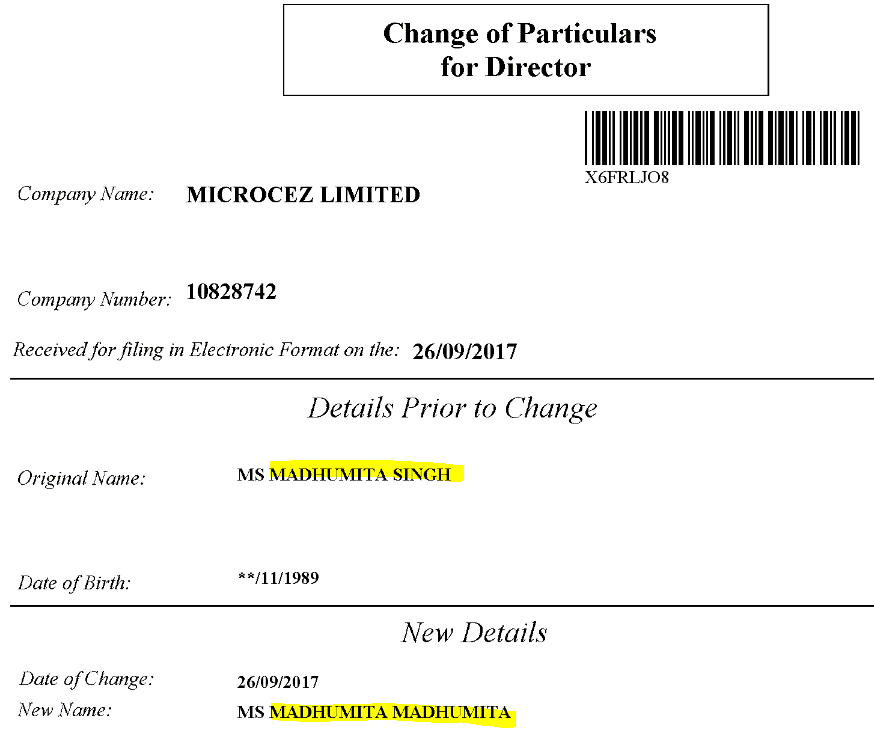

The beneficial owners of the OctaPay scheme applied for a voluntary strike-off of OctaPay Ltd in February 2021. The UK Companies House suspended the application in March 2021 after third parties objected. Madhumita Madhumita (previously known as Madhumita Singh) resigned as a director in March 2021. OctaPay’s various websites have disappeared, as have its LinkedIn profiles.

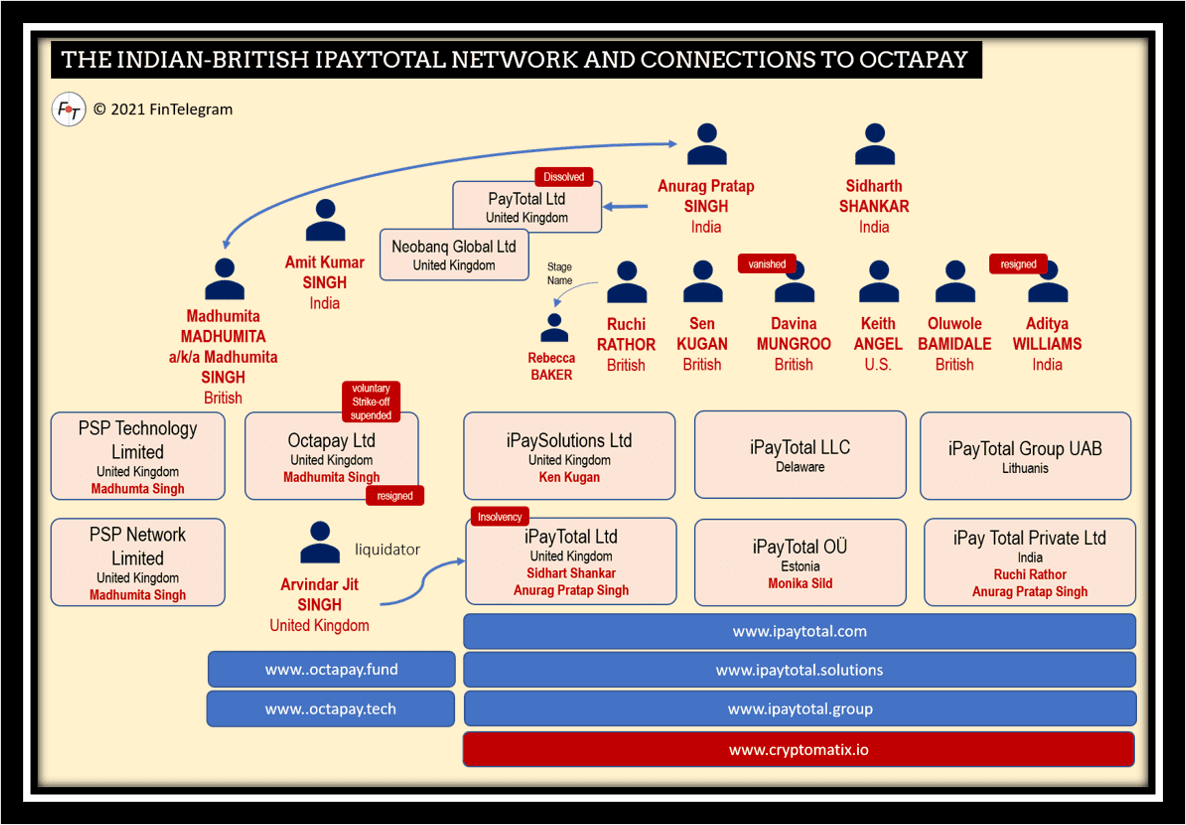

The web is full of complaints about OctaPay‘s fraudulent scheme. Christian van Biezen and some other whistleblowers have pointed out to FinTelegram that the same people are behind OctaPay as behind the notorious British-Indian iPayTotal (www.ipaytotal.com and www.ipaytotal.solutions). The latter is also a notorious high-risk payment provider that we have found to be a facilitator in many scams. According to our research, OctaPay actually was part of to the network of the British-Indian iPayTotal network around Madhumita Singh, Anurag Pratap Singh, Aditya Williams, Ruchi Rathor, and Sen Kugan.

The iPayTotal troubles

UK-registered iPayTotal Ltd was sent into insolvency by Court Order because a creditor had filed its claim with the court. Currently, the company is in liquidation under the leadership of liquidator Arvindar Jit Singh. Officially, iPayTotal is now managed by UK-registered IpaySolutions Ltd, which was founded in November 2019 and is controlled by British Senthooran Kuganathan (a/k/a Sen Kugan). Just recently, iPaytotal announced the launch of its unregulated Estonian crypto payment platform CryptoMatix (read the report here).

In December 2020, we were contacted by iPayTotal on LinkedIn. Specifically by Ruchi Rathor (LinkedIn) and Davina Mungroo. They wanted the reports on iPayTotal removed. Meanwhile, Davina Mungroo has not only disappeared from iPayTotal, but also from LinkedIn. Ruchi Rathor, like Madhumita Singh, said goodbye to iPayTotal in March 2021 (read the report here).

Companies, people, and funds are disappearing around the network of iPayTotal and OctaPay. What remains are many questions.