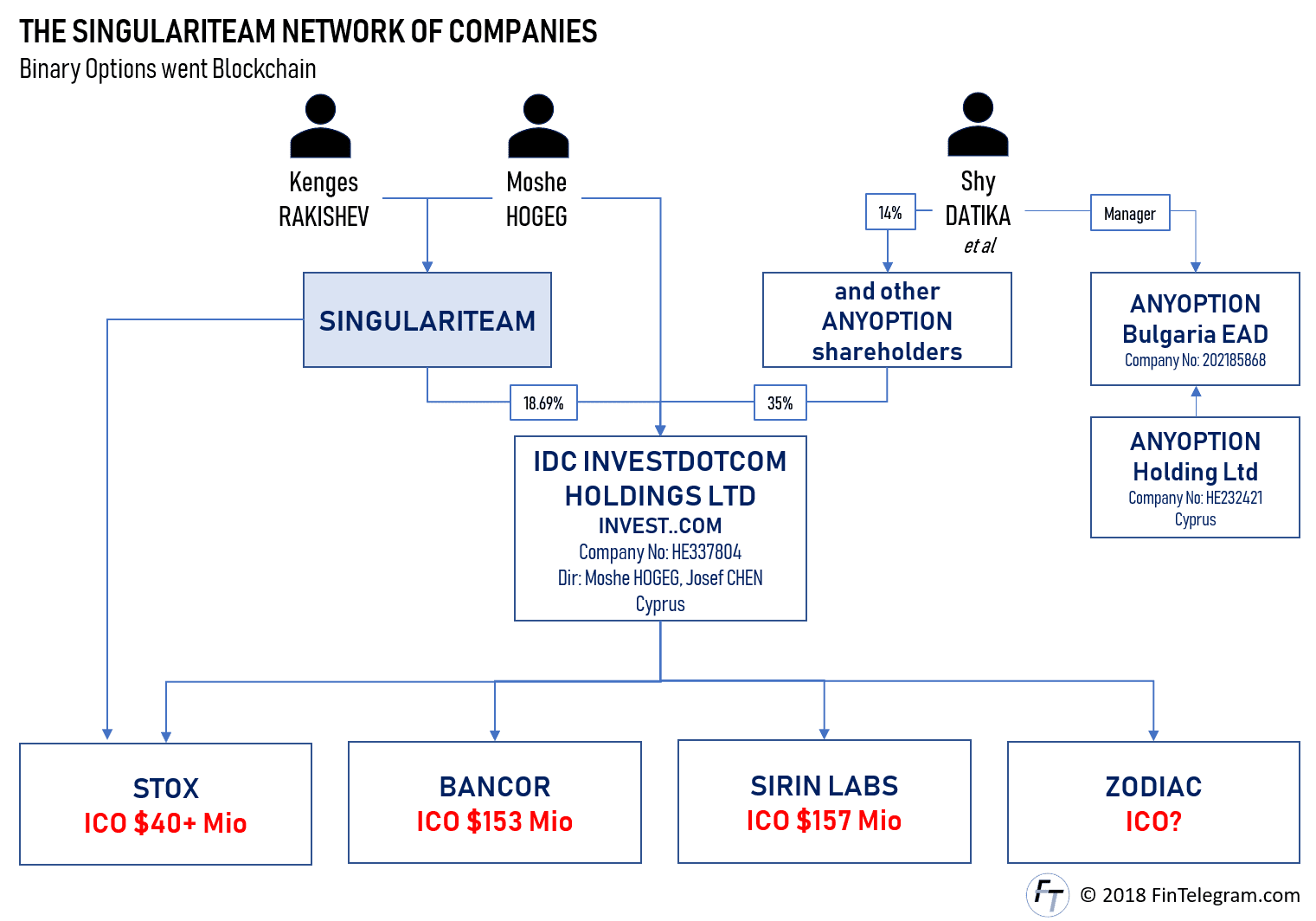

Update Nov 30, 2018: the Anyoption founder Shy DATIKA is not a shareholder of Anyoption Bulgaria but part of its management team. Evidently, as given in the picture, Anyoption itself never was a shareholder of IDC but the Anyoption shareholders. The latter exchanged their Anyoption shares against IDC shares.

The Israeli entrepreneur and investor Moshe HOGEG entered the online trading business in 2014. He and his venture capital vehicle SINGULARITEAM allegedly paid over $5 million to buy the domain invest.com. The goal was to penetrate the forex industry with an all assets brokerage site. The website was finally launched in 2016 after its operating entity IDC INVESTDOTCOM HOLDINGS LTD (“IDC“), registered in Cyprus, secured $20 million in funding.

Sometime in 2017, HOGEG and his people recognized the potential of cryptocurrencies and blockchains. While binary options were banned in many countries, they saw that naive crypto-investors were literally throwing their funds into Initial Coin Offerings (ICO). Hence, they transformed the gigantic Israeli binary options industry and their resources into crypto. The beginning of a tragedy for the new industry and its honest actors.

The Hype Master Enters Binary Options

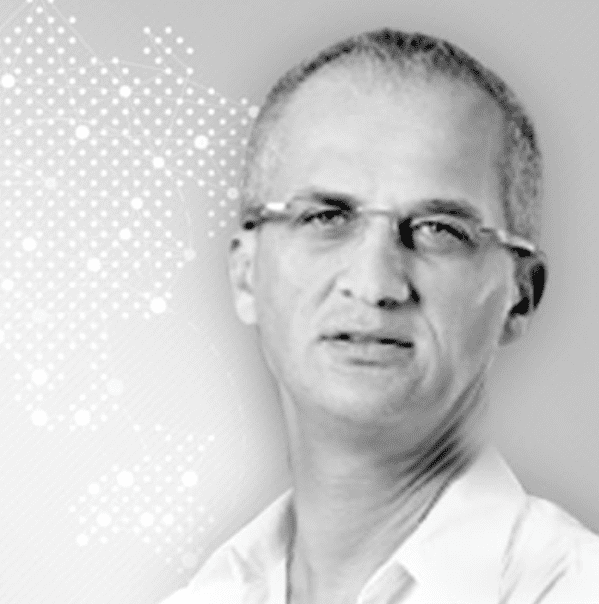

Moshe HOGEG was called Israel’s hype startup master by various media such as Bloomberg. He is famous for being able to attract prominent investors to his projects. His investors include Mexican billionaire and telecom entrepreneur Carlos SLIM or Oscar winner Leonardo DiCaprio.

In 2012 HOGEG and the Kazhak entrepreneur Kenges RAKISHEV established the VC fund SINGULARITEAM in Israel. It labeled itself as a “super angel investor” focused on new and disruptive technologies with a focus on Israeli tech startups. The VC raised $152 million across three funds mainly from Asian investors eager to tap into the startup nation Israel. Forex used not to be the investment niche for HOGEG and SINGULARITEAM. Hence, the 2014-move to acquire the domain invest.com and enter the Forex space caught everyone’s attention. It took SINGULARITEAM and IDC another 2 years to raise USD 20 Million and launch its website in May 2016.

In 2014, we experienced the climax of the predominantly fraudulent binary options industry that had its headquarters in Israel. According to the Times of Israel, several thousand people worked in this rip-off industry, cheating investors from around the world out of billions. Nine out of ten illegally operated binary options platforms were powered by Israeli companies and people.

The Binary Option Deal with AnyOption

The significance of the transaction between INVEST.COM and AnyOption for the crypto industry can hardly be overestimated. Boiler rooms, affiliate systems, and illegal trading practices thus moved into the crypto scene. Hundreds of thousands of potential retail investors were introduced to cryptocurrencies and many of them became ICO’s victims.

In June 2017, IDC acquired binary options provider AnyOption and its affiliated network of companies. The binary options business was merged into Invest.com with allegedly 3 million binary option retail investors. AnyOption was co-founded in 2008 by the Israeli Shy DATIKA who also ran the company as CEO at the time of the merger. He was one of the most knowledgeable people in the binary options industry as he has been part of it since its very beginning.

Although AnyOption and Invest.com announced in the course of the merger that they would terminate the binary options business, the 3 million customers remained as well as the boiler rooms and the trading software. The company planned to focus on other products in the area of FOREX trading and cryptocurrencies. Nevertheless, the boiler rooms continued to focus on the acquisition of customer funds.

The termination of the binary options business of AnyOption was in line with the general exodus of the binary options industry after supervisory authorities in the different countries had started to crack down on the industry’s fraudulent activities. AnyOption was one of the big shots in the binary options industry on a worldwide basis. It had a vast history of warnings from regulators. In December 2009, Argentinian regulators ordered the company behind AnyOption to stop soliciting customers in Argentina. In December 2011, the Italian regulator issued a warning about the company for operating without authorization.

The Next Step – STOX

SINGULARITEAM was also behind the startup Israeli STOX. Established in 2014, STOX was referred to as “the next big thing in retail trading” and was positioned as an online stock brokerage allowing traders to see other people’s stock portfolios and even copy their trades. It presented itself as a sort of copycat of the Israeli eToro.

Sometime in 2017, the startup entered the crypto-space and started to bill itself as a “blockchain prediction markets platform”. STOX became another building block to market the ICO’s and cryptocurrencies with the illicit methods of the binary options industry.

The Binary Option Machine Works on Crypto

With the integration of AnyOptions and its binary options scheme, INVEST.COM was prepared to address retail investors with cryptocurrencies and tokens, i.e. with ICOs. It may or may not be a coincidence that all ICOs connected with HOGEG were launched during or after the merger with AnyOptions. In total, these ICO’s raised some $350 Million within just a few months.

HOGEG was one of the early investors of the Israeli crypto-startup BANCOR which, in summer 2017, raised more than USD 150 million for a decentralized asset trading and clearing blockchain via its ICO. BANCOR applied the so-called “foundation model” developed by the Swiss law firm MME in Switzerland. The ICO was supported by HOGEG and his Invest.com. HOGEG consequently used BANCOR to promote his STOX project.

In fact, in early August 2017, STOX conducted its ICO and raised some 143,000 ethers (ETH) from investors. That was some USD 40 Mio back then. Where the money has remained, one really knows. It is said that HOGEG has already sold his STOX tokens (STX). Hogeg used the boiler rooms and Floyd MAYWEATHER to promote his STOX project.

SIRIN LABS

In December 2017 Moshe HOGEG did another Token Sale with SIRIN LABS raising again more than 157 Mio USD. This time HOGEG used the football star Leo MESSI to promote the Token Sale.

Sirin Labs is to deliver its heavily promoted Blockchain smartphone Finney soon.

Cooperation between Bittrex and Invest.com

In July 2018, Bittrex, a US-based cryptocurrency exchange platform, and Invest.com announced that they are set to launch a new EU-focused crypto trading platform. Invest.com was presented as a Fintech located in London.

The Collapse

Now the Israeli crypto empire of Moshe HOGEG seems to be facing serious difficulties. Allegedly, his IDC lacks the money to pay the creditors and its operation. Just recently, HOHEG resigned from his post as CEO of the company on November 15, 2018. On November 23, a Tel Aviv court appointed a temporary liquidator for IDC to wind it up. In a court petition, AnyOption founder Shy DATIKA along with 16 other AnyOption shareholders claimed that

- HOGEG did not pay them the compensation agreed upon for the merger;

- they are also shareholders in IDC and Moshe HOGEG as its director systematically robbed the company’s assets and profits and drove it into insolvency;

- IDC carried out two successful ICOs which netted tens of millions of dollars for IDC but HOGEG has unlawfully taken money for his own use;

The judge at the Tel Aviv court initiated liquidation proceedings following HOGEG’s failure to attend a relevant court hearing. Details on the court decision can be found in The Times of Israel.

The situation doesn’t seem to be much better with STOX. The company just recently denied rumors of its own insolvency. As a matter of fact, however, the CEO Yossi PERETZ departed a few weeks ago and important business partners terminated their relationships. The employees in Israel have been dismissed and the offices closed. Allegedly they want to move to Europe – Bulgaria or Ukraine would probably be a good tip. This would mean the end of this evil transformation and the death of STOX.

The Sad Legacy

That said, it’s evident that Moshe HOGEG and his network of companies have been responsible for the transition of the binary options schemes and their illicit methods into the crypto world.

The questionable merit of Moshe HOGEG is that he introduced the fraudulent methods and hard selling practices of binary options into the crypto scene. Regardless of their quality and legality, ICO’s were brutally sold through Boiler Rooms and affiliate systems. In an event organized by TRAFFIC LORDS, HOGEG called on the affiliates present to push customers for ICOs and crypto exchanges. In return, they would receive high commissions.

The Israeli crypto scene around Moshe HOGEG has to be blamed for the irrational ICO hype and a good part of the bad reputation of the scene gained with investors and regulators. The transition of the illegal binary options into the crypto industry has shaken the trust of the authorities and regulators in the crypto scene and will again result in ripped-off investors.

It is hard to see how technical innovations are damaged by bad actors. It’s shameful how Israeli authorities are watching and the proud startup nation degenerated into a gigantic boiler room and a rip-off nation.

ESMA ruled a ban on marketing binary option in late 2017 and BaFin just sent out an announcement that it would ban all marketing activities of binary options platforms early in 2019. Actually, it is too late. The binary options people have long ago moved into the crypto space and the regulators did not even recognize.