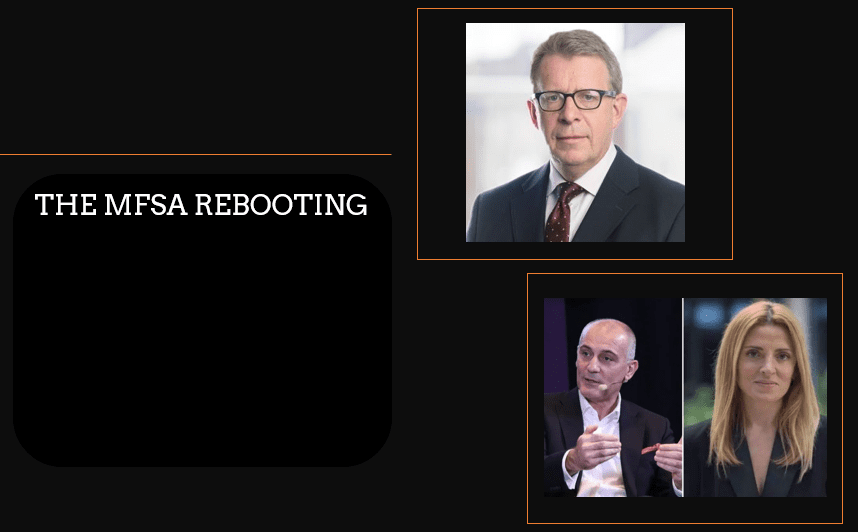

The Times of Malta reported that the Irish lawyer Joseph Gavin (LinkedIn) had been appointed CEO of the Malta Financial Services Authority (MFSA). The former general counsel with the Central Bank of Ireland will start his job in September. Former CEO Joseph Cuschieri had to resign in November after it was revealed that he had flown to Las Vegas with casino owner Yorgen Fenech in 2018, with Fenech footing the bill. Cuschieri’s close confident Christopher P. Buttigieg has been acting CEO since. What is certain is that it can hardly get any worse. We can hope that the MFSA will finally become a real regulator under its new CEO.

According to his LinkedIn profile, Joseph Gavin has more than 30 years of financial services experience in Ireland, Europe, and the United States. He has been consulting clients on a broad range of regulatory and compliance issues. Currently, he is the Head of Financial Services with ByrneWallace LLP, one of Ireland’s largest full-service law firms with a team of close to 300 professionals, which includes 43 experienced partners.

On 25 June, the Financial Action Task Force (FATF) placed Malta on its greylist grey list of untrustworthy jurisdictions during a secret vote. The country now faces increased monitoring and has to improve its anti-money laundering and funding of terrorism framework (ALM/CFT). Malta joined the list with 19 other countries that the FATF deemed to have “strategic deficiencies.” Countries like Zimbabwe, Syria, Panama, Myanmar, or Albania.

The previous leadership of the MFSA under Josef Cuschieri, Edwina Licari, and Christoper Buttigieg probably disgraded the regulator in recent years by not acting properly in the fight against money-laundering, cybercrime, or scams. How could they? The MFSA establishment, it turned out, loved to mingle with representatives of regulated entities. The evident compliance issues and systemic conflicts of interest MFSA had may have contributed to Malta being placed on the greylist. Rightfully placed there!

With Cyprus’ CySEC, the MFSA is probably currently among the two worst EU regulators. But Cyprus and its CySEC are under the protection of Israel and thus untouchable for FATF or Moneyval.

We are curious to see if the beleaguered MFSA will succeed in rebooting under its new CEO Joseph Gavin. We wish him all the best!