Disclaimer: the FinTelegram “Headline News” format curates news about financial markets, investors, and investor protection. The “Headline News” articles do not contain extensive research but either provide short updates on relevant subjects, organizations, and individuals or refer to 3rd-party findings and opinions.

Cryptocurrencies are the future, right? At least, that’s what many experts and visionaries like Elon Musk claim. Apparently, North American regulators are now also giving in to the crypto trend, finally approving the first crypto ETFs and facilitating the entry of more institutional investors into crypto. While the U.S. SEC has not yet approved a crypto ETF, the Canadian Ontario Securities Commission (OSC) has approved two Bitcoin ETFs within just a couple of days.

- On Tuesday, Evolve Funds Group Inc (www.evolveetfs.com) has received approval to list its Bitcoin ETF. The new asset will trade under the ticker symbols “EBIT” and “EBIT.U” on the Toronto Stock Exchange (Symbol “EBIT”).

- Last Thursday, the Purpose Bitcoin ETF, established and managed by Purpose Investments Inc. (www.purposeinvest.com), received the OSC approval.

Both ETFs have a management fee of 1%.

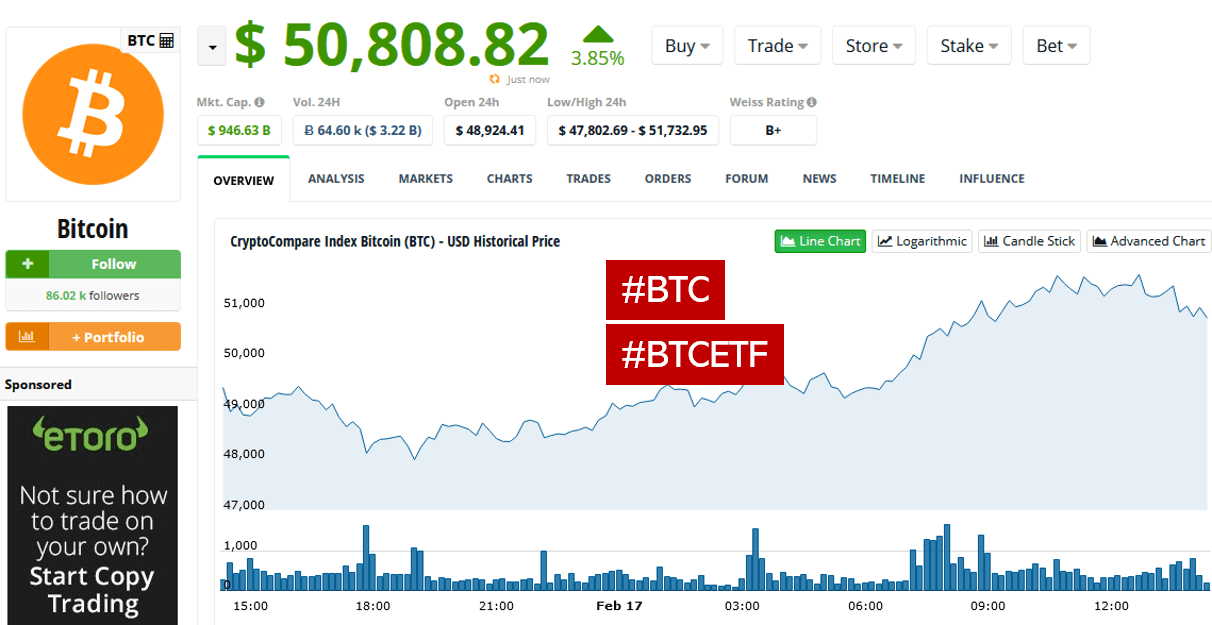

With the two crypto ETFs, even more demand from institutional and retail investors should flow into crypto. The price of BTC has risen to over $50,000 since the Evolve ETS was announced. The question is if and when the U.S. SEC will approve the first crypto ETF. So far, all applications in this regard have been rejected in recent years, citing the vulnerability of crypto markets to manipulation.

Sources: Evolve press release, Purpose Investments announcement