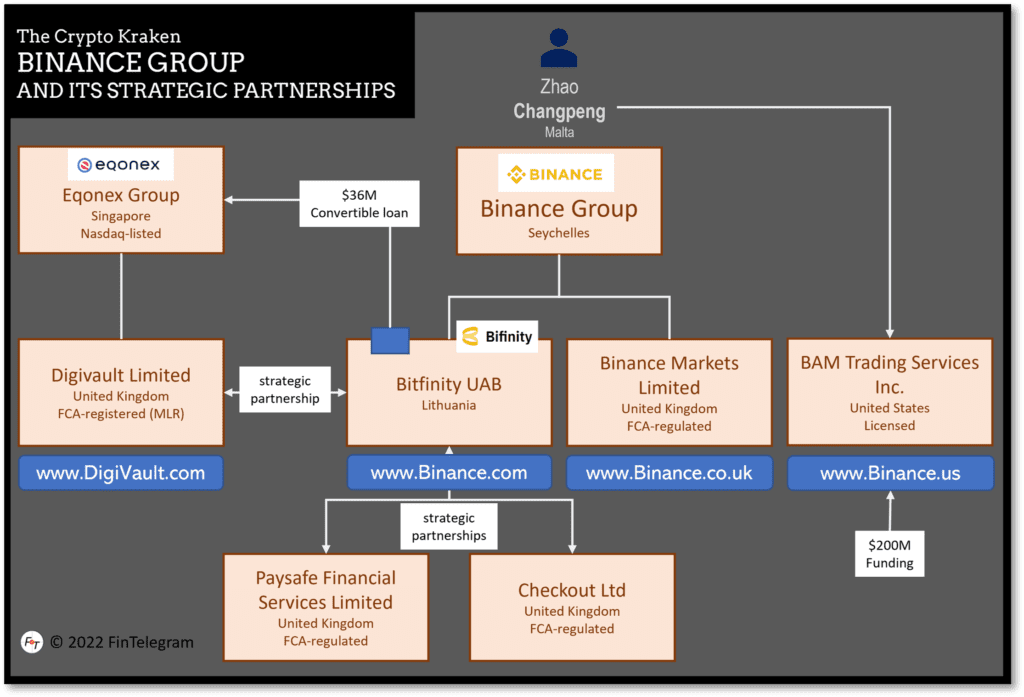

In March 2022, the Nasdaq-listed crypto exchange operator EQONEX Limited entered into a strategic partnership with the world’s leading crypto exchange operator Binance and became a related company controlled by Binance people. Amid the crypto winter and collapsing share prices, EQONEX became a notice from Nasdaq. On 26 July 2022, the company announced that it Nasdaq informed them that their share price is not in compliance with the Nasdaq Rules.

The Nasdaq Challenge

Nasdaq informed EQONEX that it does not comply with the minimum bid price requirement of US$1.00 per share outlined in Nasdaq Rules for continued listing on Nasdaq.

Based on the closing bid price of the Company’s listed securities for the last 30 consecutive business days from June 7, 2022, to July 20, 2022, the Company no longer meets the minimum bid price requirement set forth in Listing Rule 5550(a)(2). The Notice is only a notification of deficiency, not of imminent delisting, and has no current effect on the listing or trading of the Company’s securities on the Nasdaq Capital Market.

The Company has been provided 180 calendar days, or until January 17, 2023, to regain compliance with Nasdaq Listing Rule. To regain compliance, the Company’s common shares must have a closing bid price of at least US$1.00 for a minimum of 10 consecutive business days.

The New Management

With the partnership agreement, EQONEX became a sort of Binance subsidiary and appointed Binance people as executives: Jonathan Farnell was appointed CEO, Almira Cemmell Chief Corporate Affairs Officer, and Daniel Ling was appointed CFO.

Under the terms of the strategic partnership, Bifinity retained the right to nominate key appointments, including the CEO and two new Board members. Before joining EQONEX in March 2022, Jonathan Farnell served as Head of Binance UK and CEO of Bifinity. Helen Hai, President of Bifinity, has also been appointed to the EQONEX board. Daniel Ling served as the Strategy Director for Bifinity before becoming EQONEX‘s CFO.

Regulatory Worries

The UK Financial Conduct Authority (FCA) said that it would be concerned about the announcement made by the Eqonex Group and the Binance Group. The FCA said it did not have powers to assess the fitness and propriety of the new beneficial owners or the change in control before the transaction was completed. However, the regulator previously published its concerns about Binance. The Binance Group includes Binance Markets Limited. The FCA regulates Binance Markets Limited with reference number 688849 for a limited set of activities.

EQONEX Limited is the parent company of Digivault Limited, one of the cryptoasset businesses registered by the FCA under the Money Laundering Regulations (MLRs) with the reference number 927958. As a result of the transaction mentioned above, the Binance Group may have become beneficial owners of Digivault.

Binance US

BAM Trading Services Inc. d/b/a Binance.US, the US branch of the Binance Group raised over $200 million in its first external funding round in April this year, just before the markets took a nosedive. The company was valued at $4.5 billion at the time. Binance.US CEO Brian Shroder recently said that the company is “in the strongest position possible to not only successfully weather this downturn but also emerge as the leading crypto platform in the U.S.“

Binance.US is tied to Binance through its founder, Changpeng Zhao, and its licensing agreements with Binance Group that cover its core technology and naming rights.