In the last few hours, Evripidis Oskis, Reputation Officer, and Haris Constantinou, Legal & Compliance officer of CySEC-regulated BDSwiss Holding Ltd, complained about the latest FinTelegram review about their offshore activities. Especially the headline concerning “continues its illegal offshore onboarding activities” would be false. At least in the “present tense,” argues the Legal & Compliance Offer. The FCA banned the BDSwiss Group in 2021. On March 1, 2022, the German BaFin launched an investigation saying that BDS Markets has no permission to offer ist regulated services in Germany. A short update!

Read all reviews on BDSwiss Group here.

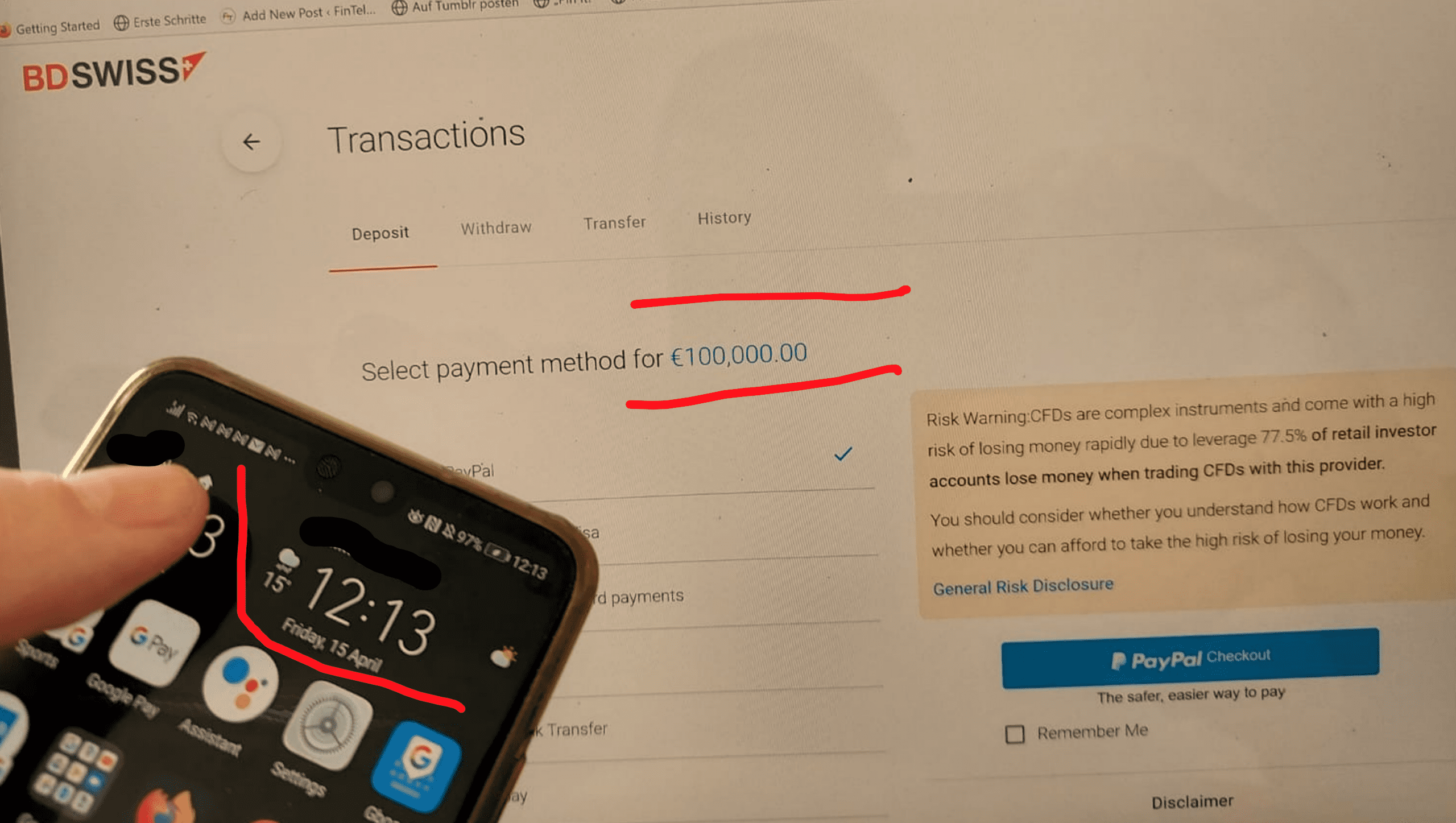

We take complaints very seriously. After receiving the complaint, we conducted another review today (April 15, 2022), our fourth review within a few months. Here are the results:

- All accounts we have created as EU residents at the offshore broker BDSwiss Markets (Mauritius) are still working.

- With our unverified accounts (EU and Non-EU) theoretically unlimited pre-verification deposits via PayPal, bank transfer and other methods were still possible.

- On April 15, 2022 we were able to register as a Serbian resident at BDSwiss without any problems. We also received a confirmation email to that effect.

- Since our last review, however, the access for residents of EU countries has been removed. When exactly this blocking took place is beyond our knowledge.

Conclusion

In conclusion, at the review on April 15, 2022, we can also confirm that onboarding for residents of some European countries is still possible at the offshore broker BDSwiss Markets (Mauritius). Furthermore, pre-verification deposits are possible with theoretically unlimited amounts. This is not compatible with the rules of the European regulators in the ESMA regime or the UK FCA and most other regulatory regimes. We can, however, confirm that BDSwiss Group at his time (“present tense”) no longer enables the offshore onboarding of EU residents.

The semantic angle

A service is labeled “illegal” if the offer violates the law, right? Offering regulated financial services without authorization typically violates financial laws and is therefore illegal. Any different opinion here?

Another BDSwiss criticism was that we noticed that this circumvention of regulatory rules from FCA, ESMA, or CySEC would be systematic. We were asked to provide evidence for this claim. We think that the fact that several regulators have described BDSwiss‘ approach as incompatible over a longer period of time speaks for itself.

The FCA says it has determined that BDSwiss Group acquired 99% of its UK customers through offshore entities, which had no authorization to provide regulated services in the UK. According to FCA, the regulator found “sales and marketing practices of the BDSwiss Group, including the use of misleading financial promotions which made unrealistic claims about the likely returns.” Thus, we may rightfully label BDSwiss activities as illegal and systematic.

At the latest after the FCA ban, BDSwiss should have revised its practices. Blocking residents of certain countries using known algorithms is the easiest thing in the world. Furthermore, the modification of the onboarding process in a way that allows pre-verification deposits proves the systematic approach. It is well known that FCA or CySEC-regulated investment firms have such an onboarding process, including CySEC-regulated BDSwiss.

Compliance Officer

Until recently, according to the information on LinkedIn, Katalina Michael was the Chief Compliance Officer of BDSwiss. She apparently left in April 2022. Haris Constantinou seems to be the advocate running Constantinou Legal (https://constantinoulegal.com).

We find it interesting that the complaint was officially made through the Legal & Compliance Officer of the CySEC-regulated BDSwiss Holding Ltd. Shouldn’t he rather be busy preventing the members of the BDSwiss Group from violating compliance rules?

It is thus transparently stated that BDSwiss Markets (Mauritius) also falls under the responsibility of the Compliance Department of the CySEC-regulated entity.