Question: Is it conceivable that the hype of the FinTech startups over the last 10 years is not linked to the hype of the Broker Scams? Where do the incredible “new” payment traffic volumes with which these FinTech startups impress their investors come from? Only naive people can believe that these payment volumes come exclusively from reputable sources. OK, naive people can have that guess. Supervisory authorities, on the other hand, are obliged to be suspicious. That is their task. Where do the volumes and growth rates of WireCard, Payvision, MoneyNetInt or

It is no secret to insiders that the growth rates of most FinTech startups in the area of payment transactions originate from the so-called high-risk business. So from the porn business, gambling and scams. While porn and gambling are morally frowned upon but not cheated, scams are designed for cheating. The U.S. FBI has estimated that binary options alone can steal up to $10 billion a year from retail investors.

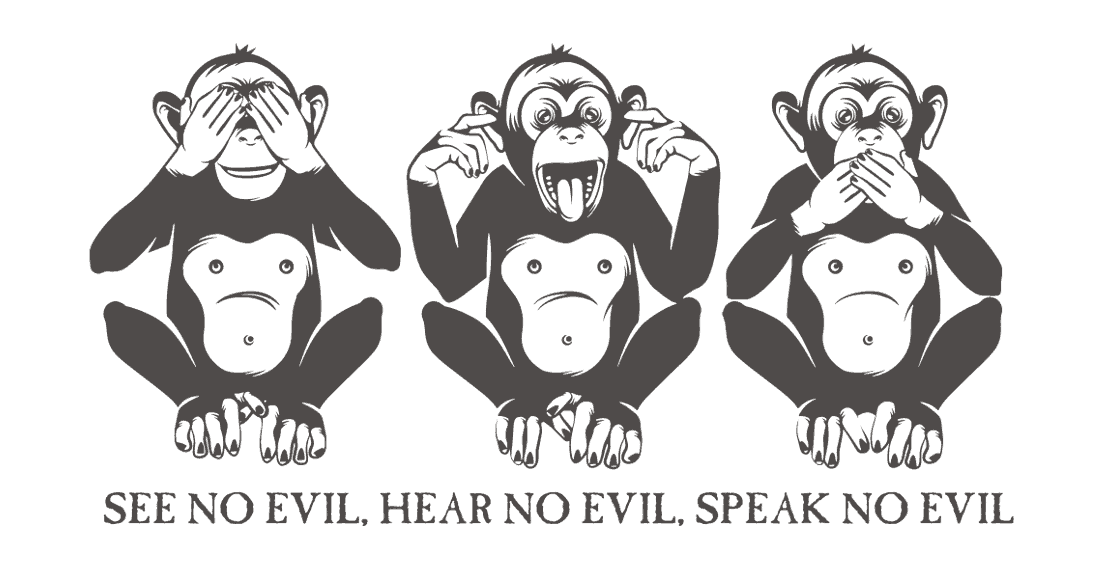

The damage to retail investors is the payment volume for participating FinTech companies. In the high-risk business, high commissions are collected from the Payment Services Providers (PSP). This can be up to 20%. On the other hand, the PSPs also generously neglect proper KYC and AML audits and let their “merchants” operate via offshore companies. They apply the “3-wise-monkey strategy” – hear nothing, see nothing and ask nothing! Let it happen.

‘Growth Wonder Fintech” Series starts Nov 11, 2019! Stay tuned!