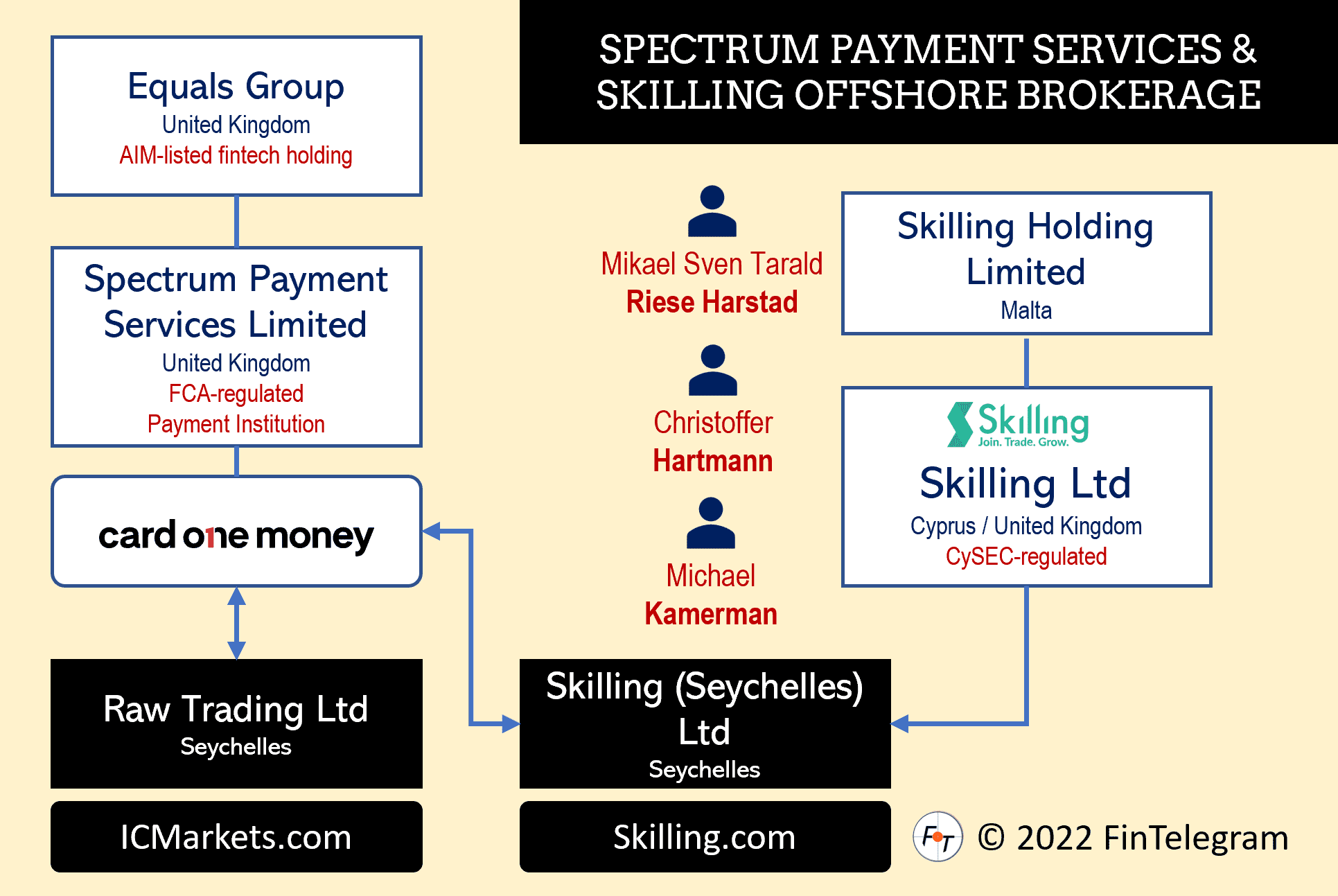

Skilling Ltd, a Cyprus Investment Firm (CIF) regulated by CySEC, is doing business as Skilling. The broker scheme also offers offshore onboarding to EEA residents outside of ESMA and CySEC rules. This is done through Skilling (Seychelles) Ltd, with whom clients then enter into a Client Agreement. More than 70% of the website visitors are from Sweden. EEA consumers should be cautious with offshore Skilling as any investor compensation scheme or ombudsman does not protect them.

Key data

| Trading name | Skilling |

| Domain | https://skilling.com |

| Legal entities | Skilling Ltd (Cyprus) Skilling (Seychelles) Limited Skilling Holding Limited (Malta) |

| Jurisdictions | Cyprus, United Kingdom Seychelles |

| Regulators | CySEC with license no 357/18 FCA FSA Seychelles |

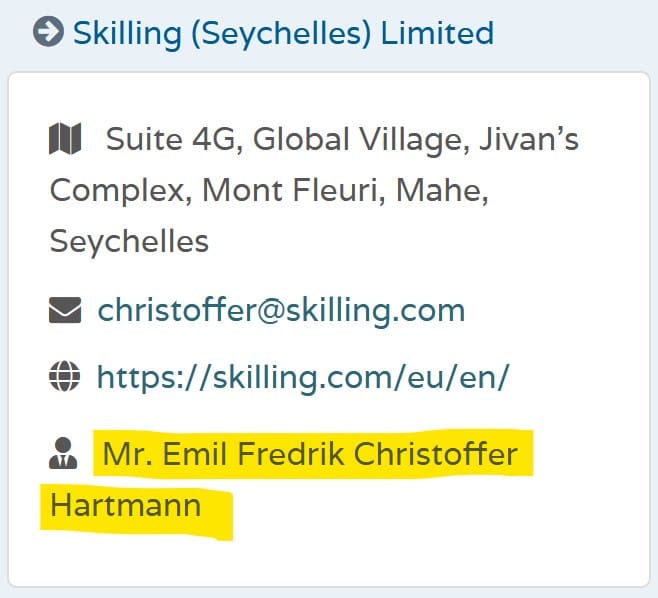

| Related individuals | Mikael Sven Tarald Riese Harstad Michael Kamerman (LinkedIn) Andrew Haigh( LinkedIn) Emil Frederik Christoffer Hartmann (LinkedIn) David Hodge (LinkedIn) Judita Simke (LinkedIn) Fiona Soler (LinkedIn) |

| Payment processors | Spectrum Payment Services, Skrill ConnectPay, NETELLER, Volt, AstroPay, WebMoney, Rapid Transfer |

The Update Narrative

Serving as CEO since Oct 2020 is Michael Kamerman in Marbella, Spain. Christoffer Hartmann, who works in Malta at Optimizer Invest, is also registered as a contact person for Skilling Seychelles. According to his LinkedIn profile, he works there as Head of Legal. Optimizer Invest is one of the shareholders of Skilling Holding Limited in Malta. The group’s CFO, Fiona Soler, is also based in Malta, where she is also a director at Skilling Holding Ltd.

As with most offshore brokers, Skilling allows newly registered clients to make pre-KYC deposits of theoretically unlimited amounts without prior verification of ID and address. In our review of October 18, 2022, we could have theoretically transferred unlimited amounts by bank transfer without a KYC check. The offshore entity Skilling (Seychelles) Ltd has bank accounts with the FCA-regulated Spectrum Payment Services Limited and the Lithuanian ConnectPay.

Via AstroPay, the initial deposit is limited to a maximum of €30,000 without KYC/AML verification. Not bad either?

Regulatory violations

We want to point out that the offshore activities of the CySEC-regulated Skilling Group are unauthorized in the EEA. The offshore entity of the group has no regulatory authorization, and the onboarding process violates the regulatory requirements of ESMA and CySEC. As with most of the CySEC-regulated CIFs, it seems that Skilling established its offshore entity and offshore onboarding to circumvent ESMA and FCA regulations systematically.

Customers of the offshore broker should be aware that they are not entitled to Investor Compensation Schemes or to the assistance of a Financial Ombudsman. Furthermore, disputes arising from the Client Agreement are also subject to the exclusive jurisdiction of the courts in Seychelles. There they can hardly sue as a private person.

Share information

If you have any information about the Skilling Group and its affiliates, we would be grateful if you could share it with us via our whistleblower system, Whistle42.