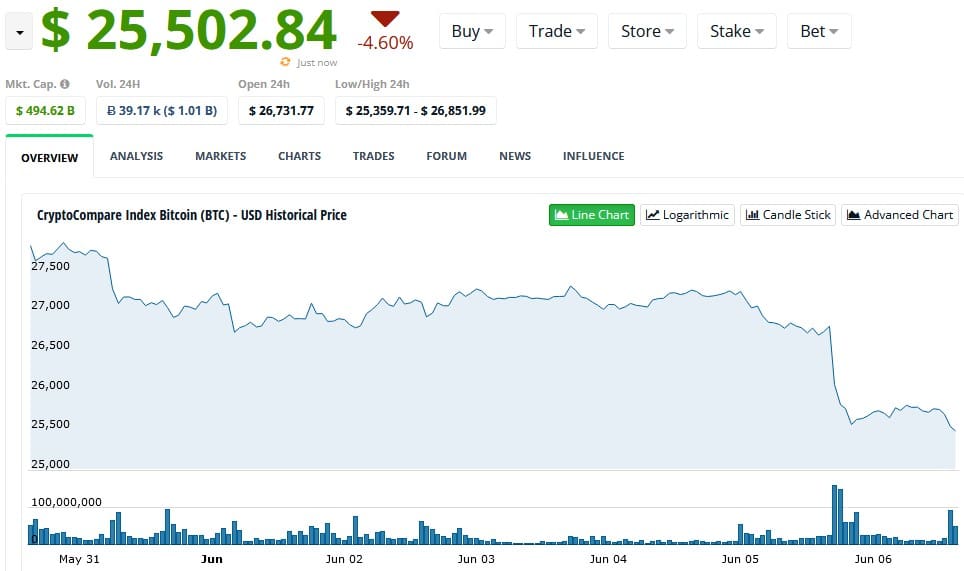

On Tuesday, cryptocurrency prices dived because of U.S. SEC filed lawsuits against the leading crypto exchanges Binance and Coinbase. Within hours of the Binance lawsuit announcement on Monday, Bitcoin (BTC) plunged from $27,200 to below $26,000. However, the Coinbase lawsuit announcement on Tuesday did not cause another plunge. The SEC accused Coinbase and Binance of operating as an unregistered broker and exchange, seeking permanent restrictions and injunctions.

The SEC’s complaint included a list of 13 crypto assets on Coinbase that could be categorized as crypto asset securities. Among these assets, Solana (SOL) and Polygon’s MATIC token, both popular coins, experienced respective declines of over 3% and 5% on Tuesday.

On Monday, the SEC announced charges against Binance, the world’s largest crypto exchange, and its co-founder, Changpeng Zhao (CZ). The complaint against Binance caused cryptocurrency prices to drop.

The SEC’s blow to Binance and Coinbase was not unexpected. The U.S. regulator warned Coinbase a few weeks ago, hinting at a possible lawsuit. In a reaction, the Binance CEO spoke of irresponsible actions by the regulator and pointed out that regulation via enforcement actions would also jeopardize leading U.S. positions in the international financial market.