The gigantic Chinese PlusToken crypto scheme has kept the crypto markets massively busy in the last two years. PlusToken with $5.7B raised from some 800,000 members is said to have been a driving force behind manipulations in the crypto markets. In a Chinese law enforcement action, 27 key individuals involved in the PlusToken crypto scheme have been arrested. Several Chinese news outlets reported that another 82 members of the scheme have been arrested.

In August 2019, Chinese police officials confirmed to The Block that six suspects associated with PlusToken had been arrested, but the main suspects were still on the run at the time. The PlusToken crypto scheme, launched in early 2018 caused the first wave of panic among its Chinese and Korean investors in June 2019 when some users reported that they could not withdraw funds from the wallets. The scheme billed these issues as the result of a “hacker attack.”

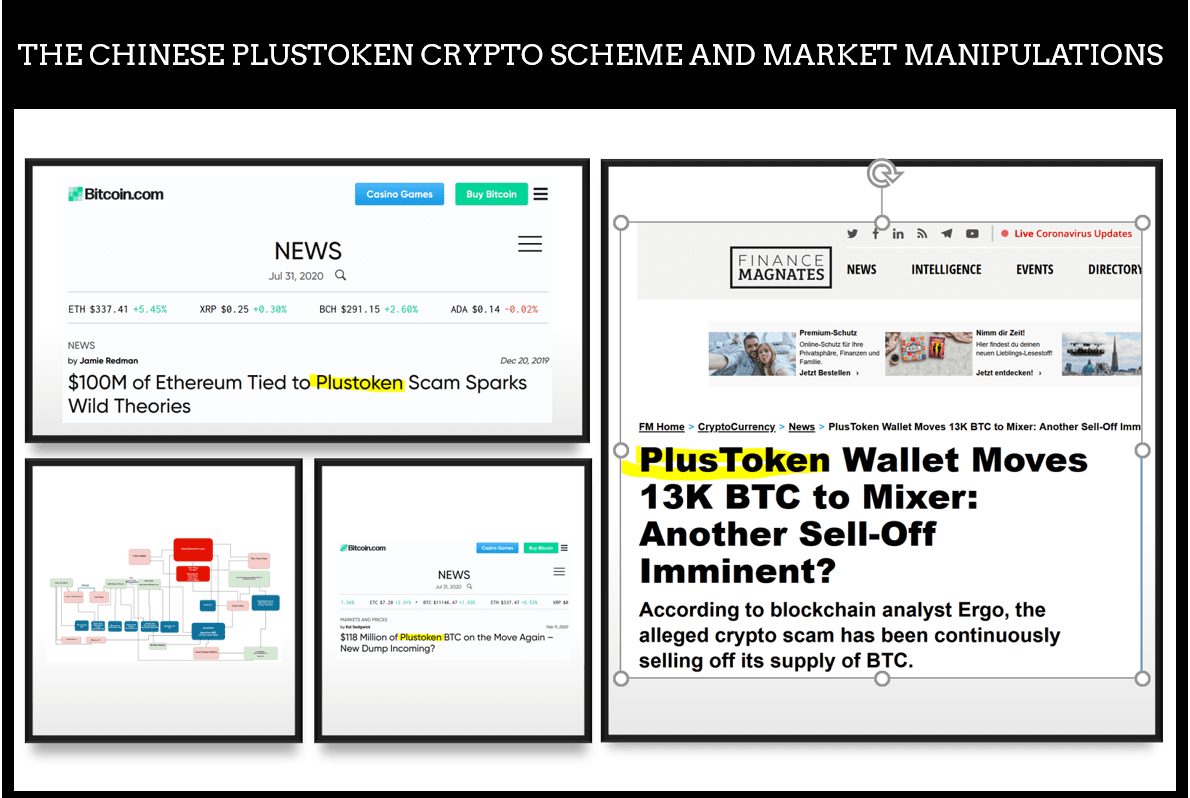

The PlusToken scheme raised some $3 billion from about 800,000 investors. The scheme’s enormous resources have kept the BTC and other cryptocurrencies on the move. Rumors have it that the Plustoken funds have been deliberately used to manipulate the prices of cryptocurrencies. Just last month, nearly 790,000 ETH, worth roughly $188 million at the time, was moved.

In February 2020, a report was published by crypto-trader Jacob Canfield who claimed that the increase in Bitcoin (BTC) to around $13,000 in the summer of 2019 was caused by the PlusToken scheme. This would have invested the stolen customer funds in BTC and manipulated the price up. They would then have sold the BTC and cashed in heavily. This hypothesis cannot be verified. Canfield had initially communicated the report on Twitter. The corresponding tweet has since been deleted but Canfield evidently sticks to his “Plustoken sell-off theory.“

Another journalist, Kai Sedgwick, also reported on the PlusToken‘s “stash of bitcoin on the move.” In their respective articles, both Canfield and Segdwick blame PlusToken for the rise of the BTC to $13k in June 2019 and the subsequent crash. Jamie Redman blamed PlusToken for the unusual price movements at ETH in December 2019. In his article on Bitcoin.com he reported that on December 19, 2020, Plustoken scammers moved 789,525 ETH ($101 million) from one address to another.

The smashing of PlusToken and the arrest of those responsible could therefore be an overall clean-up of the crypto-markets. Regulators such as the U.S. SEC still accuse the crypto markets of being very prone to manipulation and fraud. And so far, they seem to have been right.