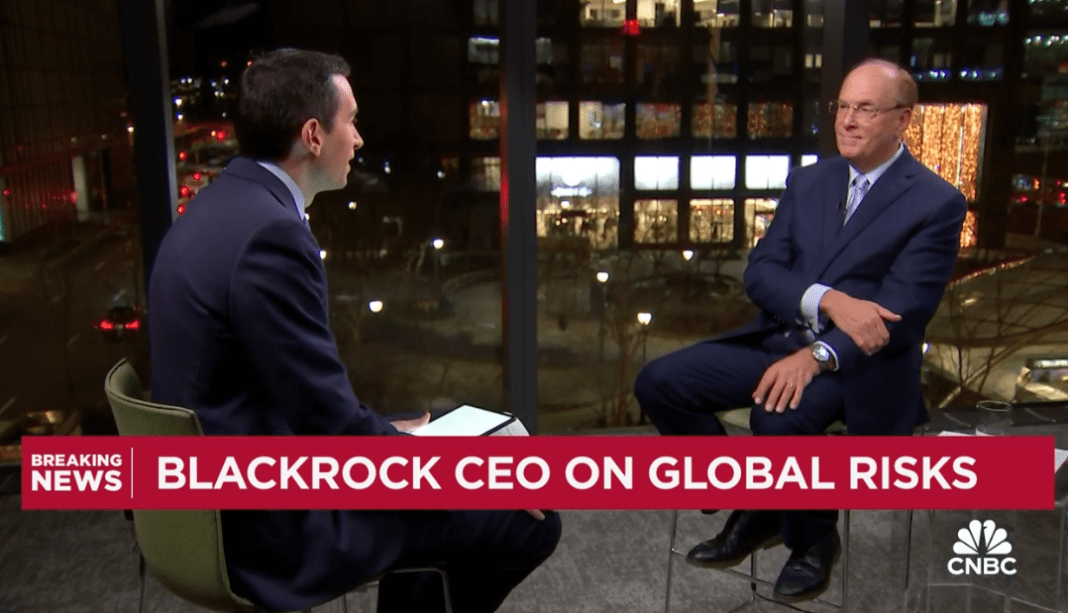

Larry Fink, the CEO of BlackRock, the world’s largest asset manager, recently shared his insights on CNBC’s “Squawk Box” about the future of finance, emphasizing the role of Exchange-Traded Funds (ETFs) and tokenization. Fink considers ETFs as just the first step in what he calls a “technological revolution in the financial markets,” with tokenization being the pivotal next phase.

The Rise of ETFs and Beyond

ETFs, particularly those tied to Bitcoin, represent a significant breakthrough after a prolonged struggle with the U.S. Securities and Exchange Commission (SEC). Fink views these ETFs as more than just a means to give investors exposure to emerging and volatile asset classes like cryptocurrencies. They are a precursor to a broader movement towards the tokenization of various financial assets.

Tokenization: The Next Frontier

Tokenization, the process of converting rights to an asset into a digital token on a blockchain, is gaining traction among financial institutions. Fink highlighted that while institutions remain cautious about cryptocurrencies, they are keenly interested in the underlying blockchain technology. Real-world assets like gold are already being tokenized, offering more information and data to investors about their holdings.

Ethereum ETFs and the Path to Tokenization

While the focus has been on Bitcoin ETFs, the financial world is also anticipating the SEC’s decision on Ether ETFs, slated for May. Fink sees an Ether ETF as valuable but believes it’s only a stepping stone towards the ultimate goal of tokenizing various financial assets.

Blockchain Technology in Upgrading Systems

Fink’s vision extends beyond cryptocurrencies like Bitcoin and Ether. He is particularly interested in how blockchain technology can be used to upgrade existing financial systems. This technology, according to Fink, has the potential to eliminate corruption by ensuring immediate and transparent recording of transactions on a general ledger.

BlackRock’s Stance on Crypto and Blockchain

Though BlackRock has shown increasing interest in Bitcoin, offering exposure to its clients, Fink’s comments suggest a broader focus on the crypto world. He underlined the potential for blockchain to revolutionize financial markets, not just through cryptocurrencies but through the tokenization of a wide array of assets.

Fink’s remarks reflect a growing interest in the intersection of traditional finance and emerging technologies like blockchain. The move towards ETFs and the potential for widespread tokenization of assets could mark a significant shift in how financial markets operate, offering more transparency and efficiency.