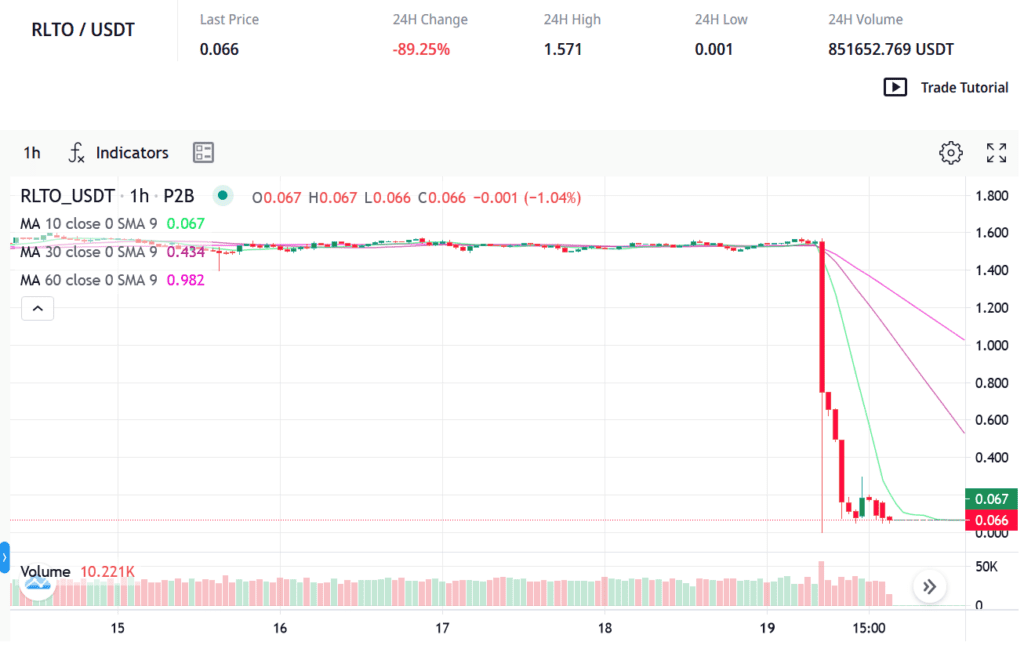

Investors of the REAL-TOK real estate crypto token are currently navigating through a tumultuous period that starkly contrasts with the initial optimism surrounding its launch. Initially pegged at €1 during its Initial Coin Offering (ICO), REAL-TOK debuted on the Lithuanian crypto exchange P2B in early December 2023. By February 18, its value appeared promising, peaking at around USDT 1.6 (€1.47). Yet, the following day marked the onset of a dramatic downturn, with the token’s value nosediving by over 95%. This seems to be the beginning of the end of the REAL-TOK scheme!

The REAL-TOK Scheme Operators

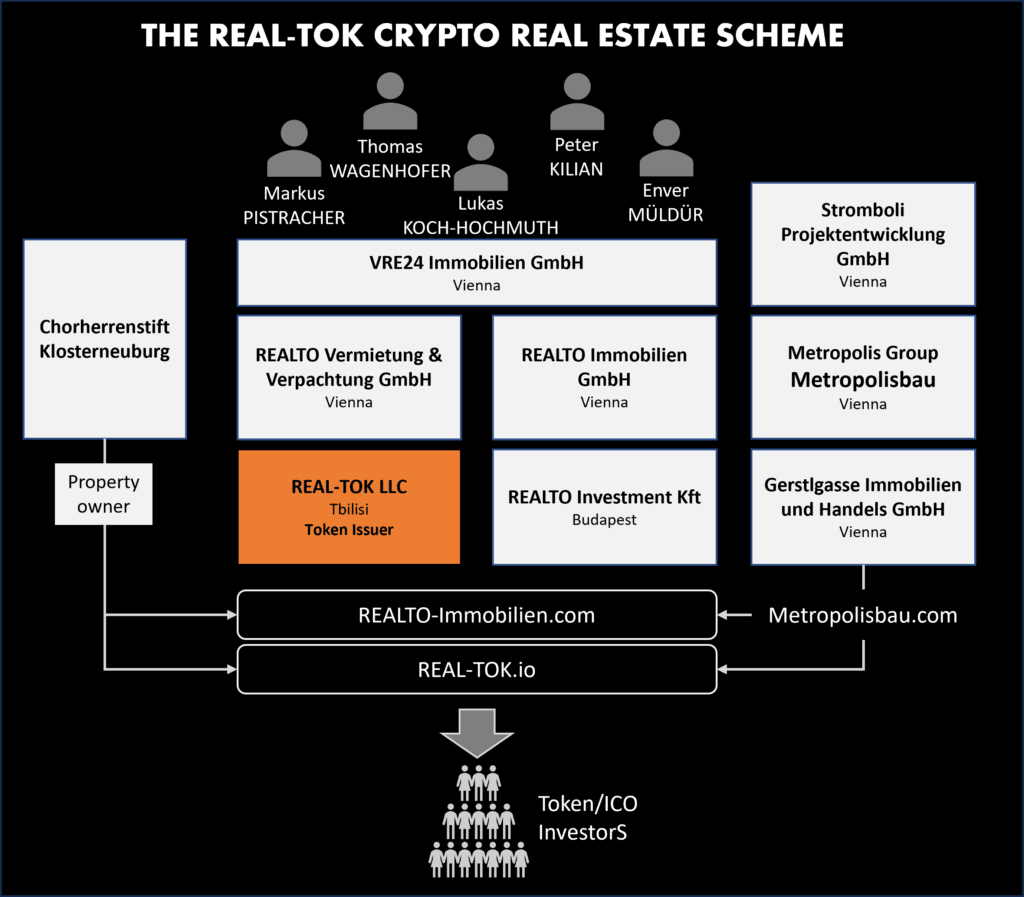

The project, masterminded by Vienna-based real estate figures Peter Kilian, Thomas Wagenhofer, and their consortium, was once heralded as a revolutionary step in real estate investment. With aspirations of amassing up to €1.2 billion and forecasts of a tenfold value surge by the end of 2024, the ambitions were sky-high.

Central to the REAL-TOK endeavor is the Vienna-registered REALTO Group, a real estate developer with connections to the Klosterneuburg monastery. Lukas Koch-Hochmuth, the group’s managing director and shareholder, doubles as REAL-TOK’s Chief Operating Officer. Moreover, the REALTO Group in Vienna is primarily funded by REALTO Investment KFT in Hungary, a venture under the stewardship of Kilian and Wagenhofer, with Kilian being prominently featured as Chief Strategy Officer on the REAL-TOK website.

Despite the ambitious setup, FinCrime Observer, alongside FinTelegram, has persistently flagged REAL-TOK as a potential scam, placing it on our Black Compliance List. Our apprehensions stem from a deep understanding of the scheme’s architects and their track record.

The Price Collapse

Since its listing on P2B, the token’s valuation underwent suspicious manipulation, briefly nearing €1.6. This artificial inflation, clearly observable through the skewed supply and demand dynamics, led to a transient surge in investor confidence. However, the facade crumbled when attempts to liquidate REAL-TOK holdings triggered a precipitous price collapse to USDT 0.086, further deteriorating to 0.066. The REAl-TOK lost over 95% of its value within 24 hours. That is the definition of a collapse.

REAL-TOK, at its core, has always been a nefarious crypto scheme marked by blatant market manipulation and flagrant legal breaches. In anticipation of regulatory scrutiny, the orchestrators set up a nominal entity in Georgia, REAL-TOK LLC.

Regulatory Scrutiny Requested

The looming question is whether there will be an attempt to artificially buoy the token’s value once more. The Austrian Financial Market Authority (FMA) is urged to conduct a thorough investigation into REAL-TOK. Based on criteria like the US Howey Test, REAL-TOK undoubtedly qualifies as a security token, necessitating a capital market prospectus for its offering—a requirement glaringly overlooked. Additionally, the P2B exchange’s listing of REAL-TOK contravenes established financial regulatory mandates.

The abrupt downfall of REAL-TOK has exposed the scheme’s price manipulation mechanisms. It’s high time REAL-TOK investors critically assess how their funds have been utilized. It may already be too late to get the money back!

Report Financial Wrongdoing

If you possess any insider knowledge regarding the REAL-TOK scheme, its operators, or affiliates, we encourage you to reach out through our whistleblowing platform, Whistle42. Stay tuned for continuous updates from FinCrime Observer as we delve deeper into this unraveling saga.