As the REAL-TOK website has announced for months, the €1.2B Initial Coin Offering of the RLTO real estate token was launched on July 1, 2023. This is probably the biggest ICO so far in the last 2 years. Organized by the Vienna-based REALTO Group led by the Austrian real estate investors Peter Kilian, Lukas-Koch Hochmuth, and Thomas Wagenhofer, the token sale is expected to raise no less than €1.2 billion. One RLTO will be sold at a nominal €1, with VIP users getting a 10% discount.

Key Data

| ICO branding | REAL-TOK |

| Domain | https://real-tok.io |

| Token symbol | RLTO (ERC20) |

| Issuer | REALTO Group |

| Related entities | Metropolis Group REALTO Immobilien GmbH REALTO Investments Kft Stromboli Projektentwicklunsgs GmbH |

| Blockchain | Ethereum |

| ICO Volume | 1,200,000,000 |

| ICO token price | €1 (discounts available) |

| Token supply | 2,000,000,000 |

| Related individuals | Peter Kilian Thomas Wagenhofer Skender Fani Lukas Koch-Hochmuth Markus Pistracher Enver Muelduer |

| Related entities | Chorherrnstift Klosterneuburg |

| Regulatory authorization | Not explained |

| Compliance rating | Red |

The New Whitepaper

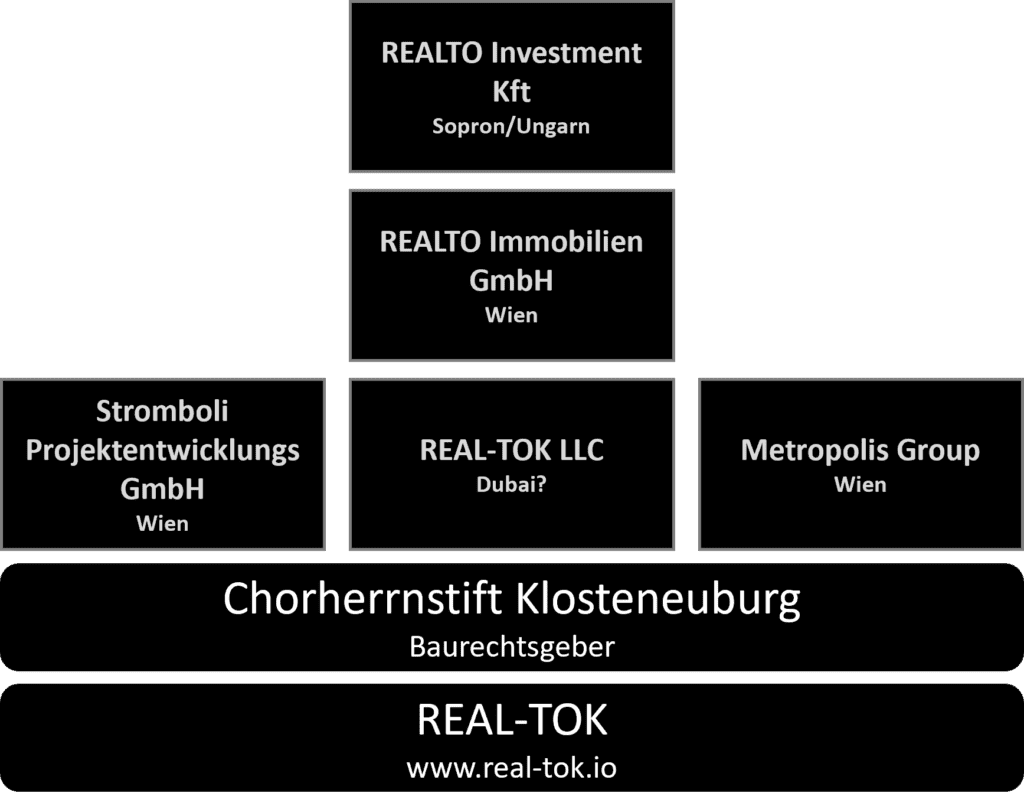

We have carefully studied the revised whitepaper (link to whitepaper). In it, we did not find any further details about the issuer. Allegedly there is a REAL-TOK LLC, but we did not find it. Details about this LLC are missing. However, the whitepaper also mentions the participating companies and groups:

If you click “About us” on the REAL-TOK website, you will be redirected to the website of REALTO Immobilien. There as an operator, the Vienna-based REALTO Immobilien GmbH is stated. Lukas Koch-Hochmuth is registered as the company’s director and a minority shareholder. The company’s main shareholder is REALTO Investment KFT, a company registered in Sopron, Hungary.

The regulatory situation

There is no information about the regulatory situation in the whitepaper. It is stated that the RLTO token would be audited and regulated by Dubai’s financial and legal authorities. The whitepaper does not provide any evidence for this. Incidentally, Dubai regulation would not be of much use in other regions.

There is probably no permission from any EEA regulator to sell RLTO to the public. The RLTO issues evidently try to circumvent the required regulatory permission by constructing a so-called utility token. The RLTO is described in the whitepaper as a utility token used for the acquisition of new real estate and the payment of brokerage fees. In addition, token holders also participate in the growing value of the REAL-TOK real estate portfolio.

Well, that’s a bit of a contradiction. If a token

- can be used to acquire real estate and pay brokers, and,

- participates in the growing value of the real estate portfolio,

- it is not a utility token but a means of payment or a security token.

The RLTO is to be offered to “prospective homeowners,” according to the whitepaper. These are apparently to purchase the RLTO from the REAL-TOK Group in advance and use it to purchase apartments from the token issues. To make the use of RLTO as a purchase currency palatable to potential apartment owners, they will receive a discount on the apartment in the amount of 2% when purchasing with RLTO. Get it?

There is no mention in the whitepaper of the legal advisors or the auditors involved. There is also no legal opinion in this regard. The financial market regulators will have to take a look and decide for themselves. However, they will do so quickly, as the crowdsale has already begun.

Get-Richt-Quickly

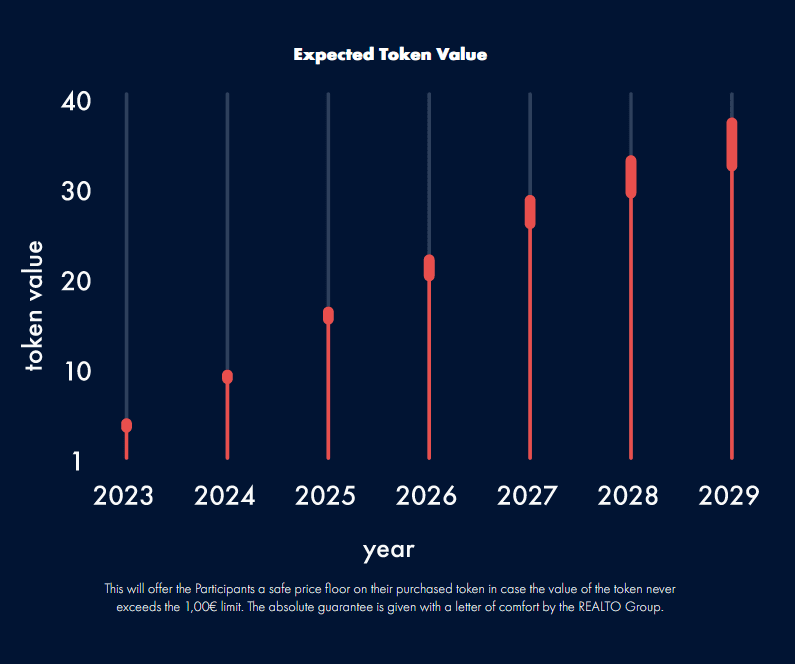

Investors are promised nothing less than rapid wealth via the increase in value of RLTO tokens on the website. As late as 2023, the value of RLTO is expected to multiply, and by 2024, the value is expected to reach €10. The token is apparently also to be listed on the CEX crypto exchange:

REALTO Group also offers to buy back the RLTO token at €1 after seven years. However, after seven years, i.e. in 2030, the RLTO token should already be worth around €40, according to the presentation on the website. Why, then the right of resale around €1?

The Monastery And The Usurer

The whitepaper states that the portfolio behind the RLTO Token is preferably real estate located on the properties of an Austrian monastery, the Chorherrnstift Klosterneuburg. According to our information, the RLTO crowdsale was not coordinated with the monastery.

Also participating in the RLTO ICO is the Turkish-Kurdish money lender Enver Muelduer through his Stromboli Projektentwicklungs GmbH. Also participating is the Metropolis Group around the Austrian lawyer and soccer player agent Skender Fani.

Preliminary conclusion

After registering at the REAL-TOK website, one must upload a copy of an ID and a confirmation of address for the KYC check. There is no problem registering as an EEA resident. When registering, one gets an error message, but essentially it works.

So much for a first review from us. We would strongly advise investors against investing given the operators’ unclear, regulatory situation and missing legal information in the whitepaper.

Share Information

If you have any information about REAL-TOK, its publishers, and its facilitators, please let us know through our whistleblower system, Whistle42.