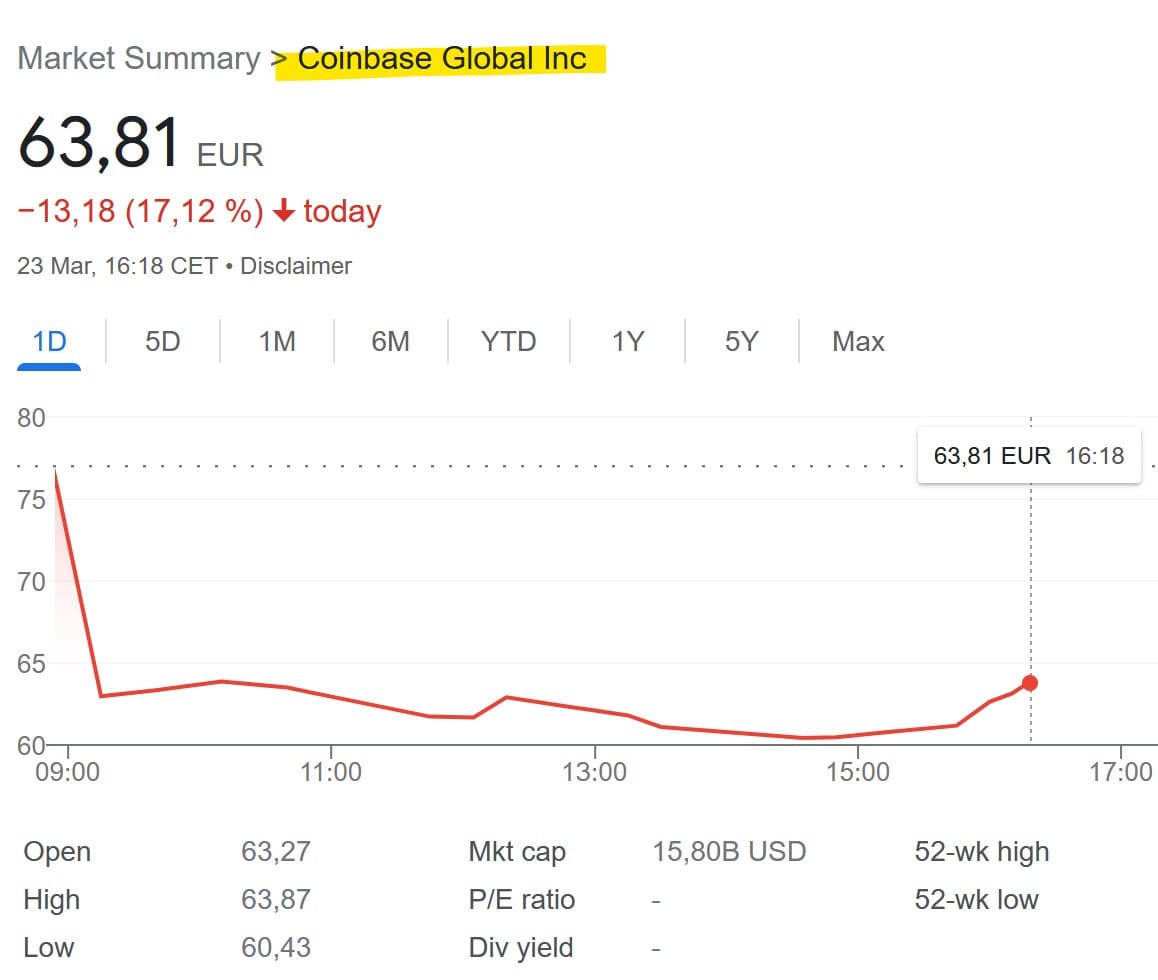

The announcement of an enforcement action by the U.S. Securities and Exchange Commission (SEC) against Coinbase today sent the stock price down by nearly 20% at the start of trading. Coinbase management had tried to explain and reassure on Twitter. However, that didn’t help for the time being. The possible qualification of certain assets and offerings as securities could actually shatter the Coinbase business and revenue model (report here).

Despite the bad news, the bitcoin price is unimpressed and was back just above $28,000 at the time of this report. Ether is also slightly up, although there is a risk that U.S. authorities will classify it as a security due to the staking (proof of stake) of the Ethereum blockchain. In this, regulators and prosecutors see an investment service subject to regulation.

Coinbase is at risk of the SEC classifying some listed cryptocurrencies as securities. This would require the issuers to have a corresponding SEC registration, which they do not have. If staking is indeed classified as an investment service, ether would also be a security. Trading on Coinbase would then no longer be possible. Ether trading accounted for 25% of trading volumes on Coinbase in 2022 and generated 22% of trading revenue.