2022 was for sure a difficult year for the BDSwiss scheme. For a few months in Q2 and Q3 2022, the CySEC-regulated German BDSwiss has not been accepting new clients. In March 2022, German BaFin launched investigations against the offshore broker BDS Markets. In May 2022, the FCA banned BDSwiss from the UK due to its offshore activities. The CySEC-approved domains BDSwiss.com and EU.BDSwiss.com have been terminated, and Viverno seems to be a new brand. Here is an update.

Short Update

Initially, the offshore onboarding was done via BDSwiss.com. Following BaFin, FCA actions, and FinTelegram reports, offshore onboarding via this domain has been discontinued. This domain is now redirected to the CySEC-approved EU.BDSwiss.com. But this has also been discontinued. The offshore activities are now carried out via Global.BDSwiss.com, but no clients from the EEA or ESMA jurisdictions are accepted.

EU clients are no longer serviced through the website EU.SwissMarkets.com. So it looks like the BDSwiss brand is being scaled back or discontinued in ESMA jurisdictions. Maybe it was too much negative news. Late in 2022, Viverno launched as a new brand.

Key Data

| Trading names | BDSwiss Swiss Markets BDS Trading |

| Domains | https://viverno.com (CySEC approved) eu.swissmarkets.com (CySEC approved); eu.investments.bdswiss.com (CySEC approved); eu.bdstrading.com (CySEC approved) global.bdswiss.com (offshore) |

| Legal entities | Duronga Holdings Limited (Cyprus) Vastani Services Ltd (Cyprus), Vastani GmbH (Germany) BDSwiss Holding Ltd (Cyprus/CySEC) BDSwiss GmbH (Germany/CySEC agent) BDSwiss UK Limited (UK) BDS Markets (Mauritius) BDS Ltd (Seychelles) BDS Swiss Markets Global Services Ltd (Cyprus) BDS Swiss AG (Switzerland) BDSwiss LLC (USA) |

| Related individuals | Jan Eric Malkus (LinkedIn) Dennis Uitz (Germany) Alexander-Wilhelm Oelfke (LinkedIn) Konstantin Oelfke (manager) Karl Hunger (director) Ivan Vasylchenko (director) |

| Jurisdictions | Cyprus, Mauritius, Seychelles, Germany, United Kingdom |

| Regulators | CySEC for BDSwiss Holding Ltd license number 199/13 FSC Mauritius for BDS Markets with license No. C116016172, FSA Seychelles for BDS Ltd with license number SD047 |

| Payment options | Bank wire, credit and debit card PayPal, Trustpay, eps, Skrill Cryptocurrencies |

| Payment processors | VIA Payments UAB |

| Warnings | FCA, BaFin |

The BDSwiss Group

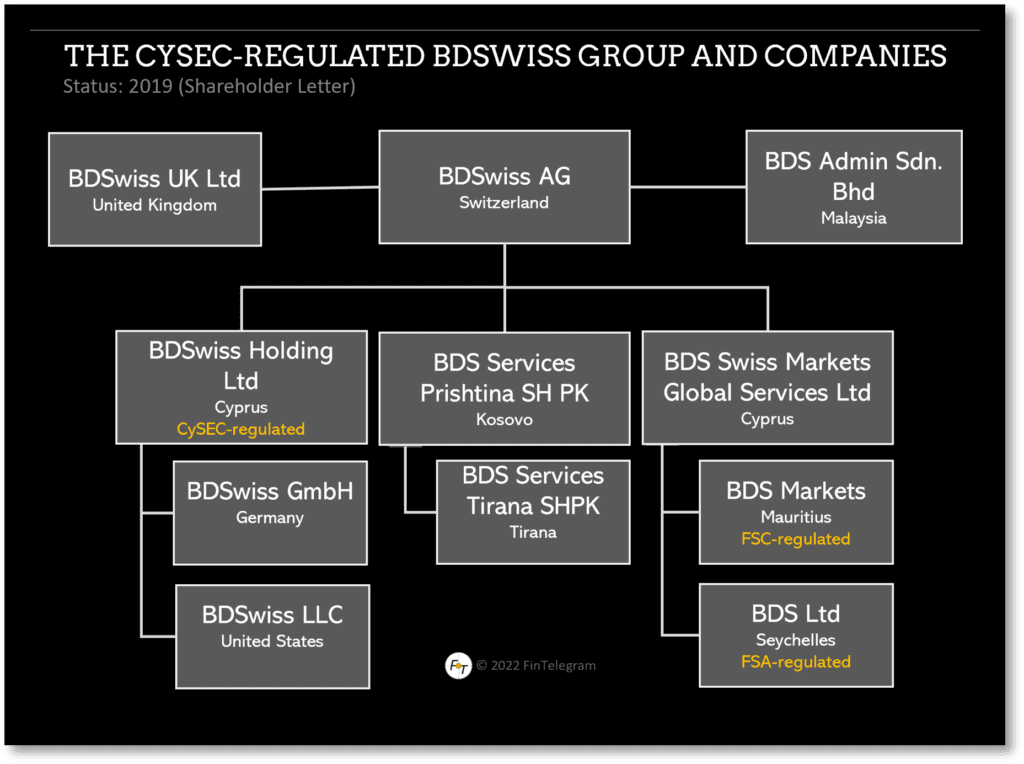

BDSwiss is a financial venture established by the German entrepreneur and investor Jan Eric Malkus (pictured left), who initially acted as CEO and is its current Chairman. Malkus is a rather public person, maintains a personal website to inform about his investments and projects (www.janmalkus.com), and runs the consulting and investment venture Vastani (www.vastani.de) in Germany and Cyprus. German Vastani GmbH is also behind the GermanBlueChip Pool (www.germanbluechip.com), established through BDSwiss and its co-founder and former CEO, Jan Malkus.

Via the Swiss-based holding BDSwiss AG and the Cyprus-based Duronga Holding Limited, Malkus controls the BDSwiss Group. He holds more than 70% of BDSwiss AG, Switzerland, through his Cyprus-based Duronga Holding Limited. In addition, he still has more than 10% directly in this Swiss holding company. Alexander-Wilhelm Oelfke, a Berlin-based entrepreneur, is the acting CEO of the BDSwiss Group.

Jan Eric Malkus is a close partner of the well-known and disputed German entrepreneur Dennis Uitz (www.dennisuitz.com). The latter apparently claims to third parties that he would also be one of the beneficial owners of BDSwiss.

According to the FCA, the BDSwiss Group’s offshore brokers did not comply with the FCA’s restrictions on the marketing and sale of CFDs to retail consumers. The FCA identified severe concerns with the sales and marketing practices of the BDSwiss Group, including the use of misleading financial promotions, which made unrealistic claims about the likely returns. Many investors were attracted to the firm via social media promotions.

Share information

If you have any information about BDSwiss, please share it with us through our whistleblower system, Whistle42.