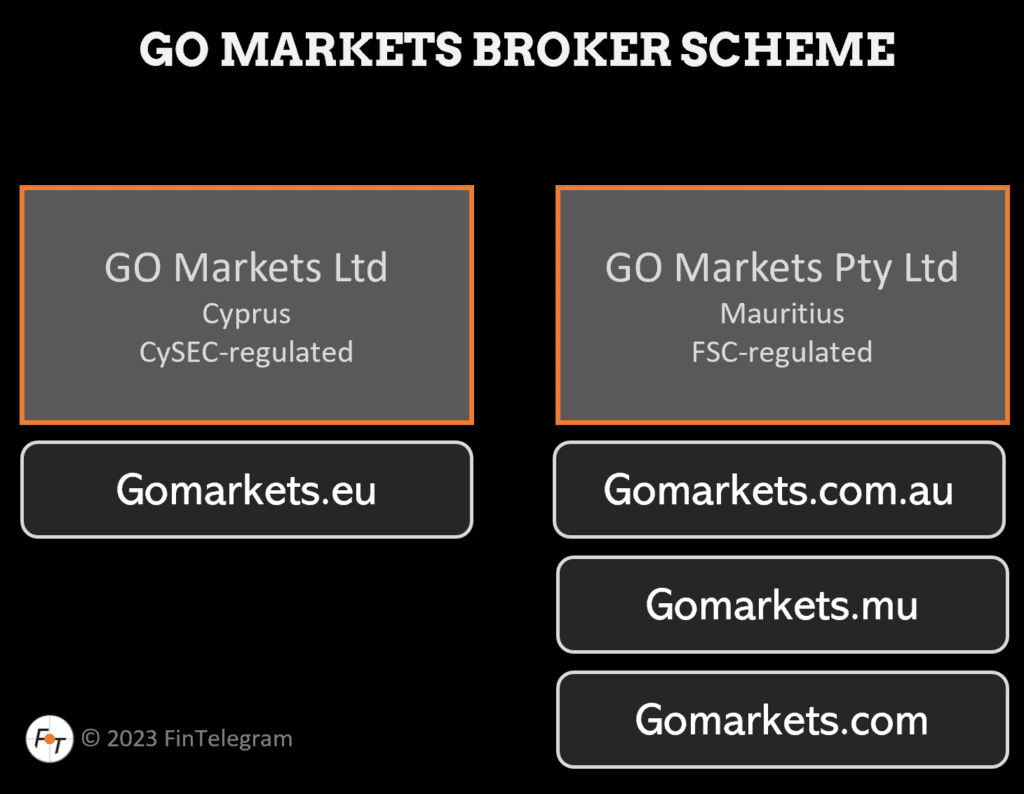

GO Markets is an Australian multi-asset broker regulated by CySEC in Cyprus. Besides, as is common with many CySEC-registered brokers, the broker scheme operates an offshore mutation regulated by the FSC Mauritius. This allows the strict ESMA and CySEC regulations to be bypassed, higher leverage can be offered, and pre-KYC deposits can be accepted. GO Markets offers a leverage of up to 1:500 and accepts clients from the EEA area without any problems. Here is our initial review.

Key Data

| Trading name | GO Markets |

| Activity | Multi-asset broker |

| Domains | gomarkets.eu gomarkets.com Gomarkets.mu Gomarkets.com.au |

| Social media | |

| Legal entity | GO Markets Ltd (Cyprus) GO Markets Pty Ltd (Mauritius) |

| Jurisdictions | Cyprus, Australia, Mauritius |

| Authorization | CySEC with license no FSC Mauritius with license no GB19024896 |

| Contact | +357 25023910 (Cyprus) +230 5869 0074 (Mauritius) support.mu@gomarkets.com |

| Leverage | up to 1:30 (CySEC) up to 1:500 (FSC Mauritius) |

| Payment options | Bank wire |

| Payment processors | Mauritius Commercial Bank Ltd Equals Money UK Limited (prev. Spectrum Payment Services Limited) |

| Related individuals | Ioannis Koutelakis (LinkedIn) Maria Polydorou (LinkedIn) Soyeb Rangwala (LinkedIn) Preetam Canhye (LinkedIn) Daniel Vary (LinkedIn) Khim Khor (LinkedIn) Klavs Valters (LinkedIn) |

Short Narrative

It should first be noted that GO Markets, as an Australian broker, does not appear to hold an ASIC license. The Australian domain GOmarkets.com.au links to the page of the offshore mutation (GOmarkets.com). Australian retail traders are solicited through the FSC-regulated entity.

In our review on January 31, 2023, we registered as an EEA resident with the GO Markets offshore mutation (GOmarkets.com) without any problems. The EEA countries, Australia, and most other jurisdictions worldwide are included in the drop-down menu. Even an interactive address database for street and postal codes in EEA cities is implemented, suggesting that Australians and EEA clients are target groups.

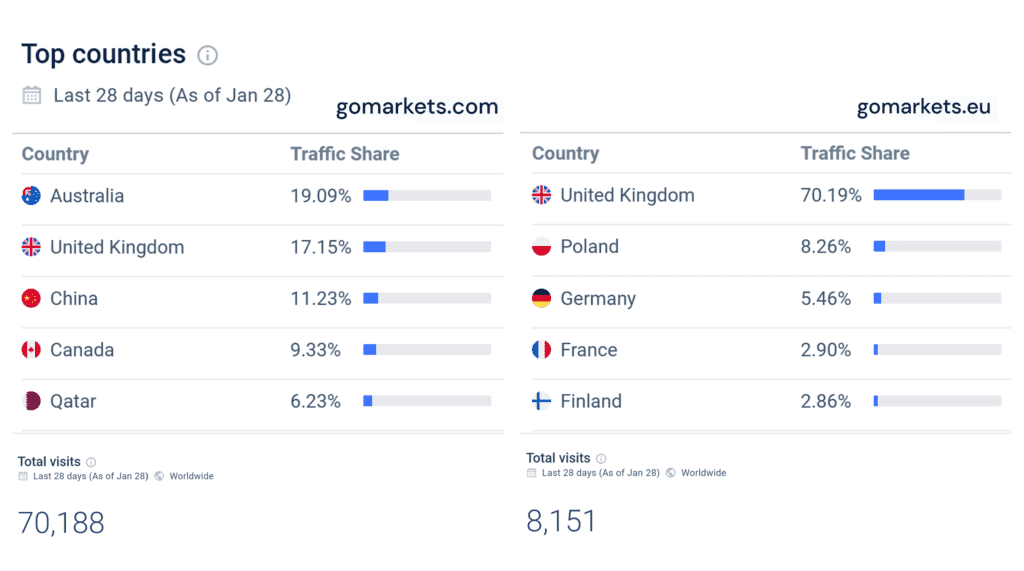

The offshore Mutation has almost nine times as many visitors (around 70,000) as the CySEC-regulated broker’s website in the last 28 days before January 28, 2023. Of these, just under 19% came from Australia and around 17% from the United Kingdom, where FSC-regulated GO Markets does not have permission to operate.

Regulatory Violations

Even before the KYC check with identity and address verification, we could have theoretically made unlimited deposits to the offshore entity GO Markets Pty Ltd bank accounts via bank wire. This offshore entity maintains bank accounts with Mauritius Commercial Bank Ltd and Equals Money UK Limited (formerly Spectrum Payment Services). This approach of theoretically unlimited pre-KYC deposits violates the regulatory framework of ESMA and CySEC.

By registering with the offshore mutation, EEA customers also have an account with a standard leverage of 1:100 which can be increased to 1:500. Retail brokers in ESMA’s regulatory regimes are allowed to offer retail clients a maximum of 1:30 leverage. In this respect, GO Markets also violates the regulatory provisions.

Preliminary conclusion

We generally advise retail traders not to work with offshore brokers, even if they are not a scam, especially in high-risk segments like CFD, forex, or crypto. As a client of an offshore broker, EEA residents are also not entitled to investor compensation schemes or financial aid from Financial Ombudsman Services.

This also applies to offshore brokers that have a regulated affiliate in the EEA, such as GO Markets. We have numerous reports of clients registering with offshore mutations of ESMA-regulated schemes and subsequently being denied support by ESMA regulators. Stay away!

Share Information

If you have any information about GO Markets, its operators, and facilitators, please share it with us via our whistleblower system, Whistle42.