Over the last few months, we covered the CySEC-regulated investment firm MCA INTELIFUNDS LTD, which offers broker services under the trading name FXORO. Besides the CySEC-regulated mutation, they ran an offshore mutation licensed by the FSA Seychelles that has also offered its services to EEA residents. Upon our reports, the offshore domain has been changed, and no new registrations are currently possible. However, existing EEA clients can continue to work with the offshore broker. And we have received a threat of legal action.

Key data

| Trading name | FXORO |

| Domains | www.fxoro.com (CySEC) https://orofintech.com (FSA Seychelles) |

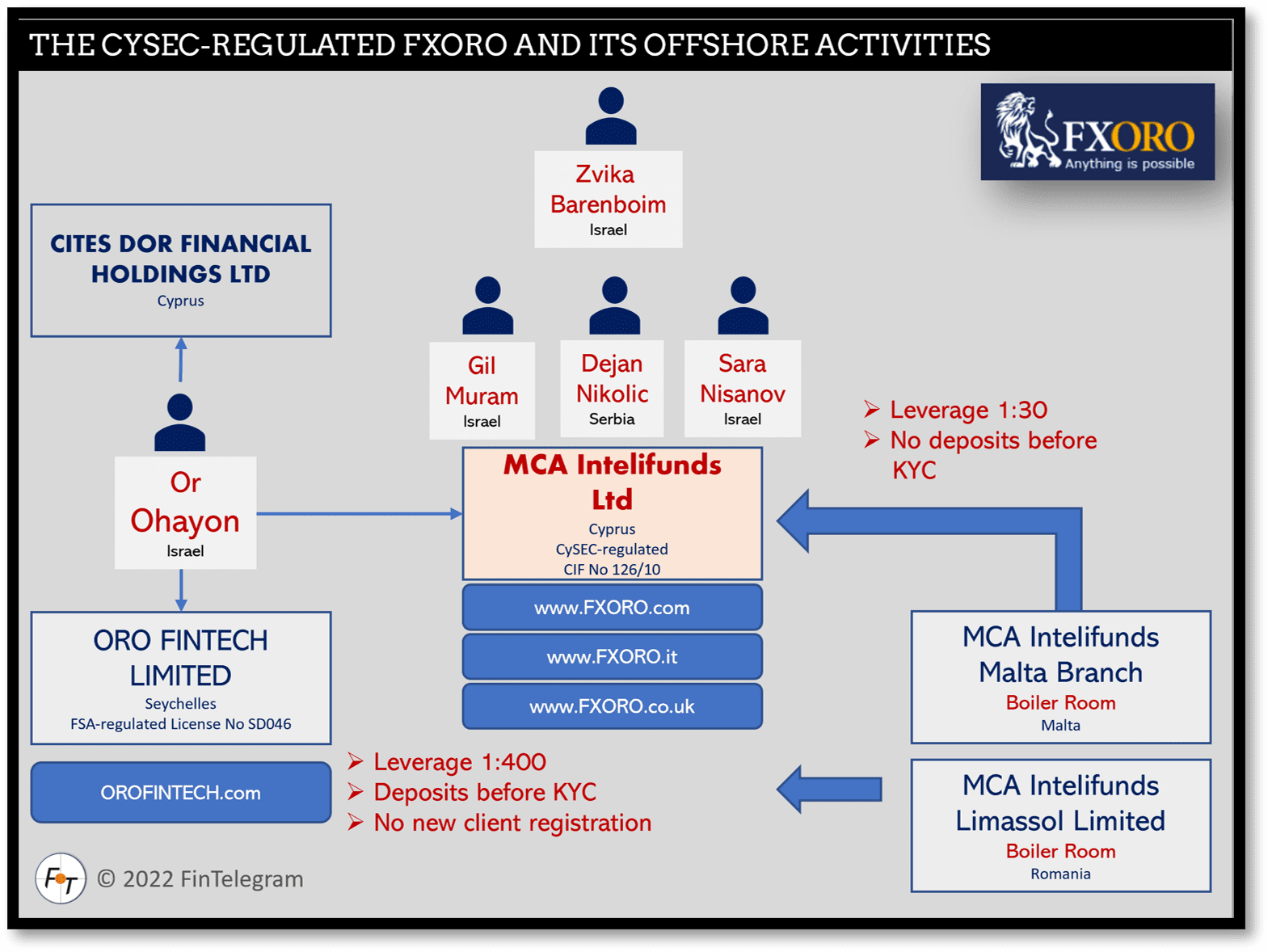

| Legal entities | MCA INTELIFUNDS LTD, regulated by Cyprus Securities and Exchange Commission (CySEC) as a Cyprus Investment Firm (CIF) with Licence No. 126/10 ORO FINTECH LTD, regulated by the Financial Services Authority Seychelles (FSA) as a Securities Dealer with Licence No. SD046 MCA Intelifunds Limassol Limited (Romania) MCA Intelifunds Malta Branch (Malta) Cites Dor Financial Holdings Ltd (Cyprus) |

| Related individuals | Or Ohayon, Israel Zvika Barenboim, Israel Cristina Dana Ohayon, Israel Gil Muram, Israel Dejan Nikolic, Serbia Sara Nisanov Christos Evripidou Andriani Zeniou |

| Jurisdictions | Cyprus Seychelles |

| Contact | +357.25.20.5555 (CySEC) +442031290670 (offshore) |

| Regulators | CySEC, FSA Seychelles |

| Payment processors | GlobePay, Trustly, Jeton Nuvei (SEPA via SENTENIAL) Skrill, NETELLER, Sofort |

The Updated Narrative

Allegedly, the Israeli Zvika Barenboim (pictured right) would be one of the beneficial owners of FXORO. In 2020, Calcalista reported that Barenboim would be interested to acquire the Financial Division of Playtech, including the CySEC-regulated broker Safecap Investments Ltd d/b/a Markets.com.

Sometime after our last report in March 2022, FXORO changed the domain (https://orofintech.com) of the offshore broker. In our review on October 167, 2022, it was no longer possible (for us) to re-register. However, we could access our existing EEA accounts with the offshore broker and make deposits.

In our previous reviews of the FXORO offshore mutation, we would have been able to make pre-KYC deposits of more than €25,000 with SEPA bank transfers possible without KYC, i.e., without confirming our ID or address. As an EEA resident in our new review on 17 October 2022, we still could have made pre-KYC deposits via Nuvei SEPA. So nothing changed here.

While the offshore mutation of FXORO does not apply an ESMA or CySEC-compliant onboarding, the CySEC-regulated FXORO adheres to the compliance regulations.

The broker’s call center is located in Bucharest, Romania, at MCA Intelifunds Limassol Limited (OpenCorporates). Given the LinkedIn connections and employees, FXORO (LinkedIn profile) seems to be an Israeli-Romanian venture with its registered headquarters in Limassol, Cyprus.

Preliminary Conclusion

It looks like the FXORO broker is sort of facing out its offshore activities, at least for EEA residents. That’s good news in the first place.

The FXORO offshore mutation is neither compliant with the CySEC regulations nor the ESMA compliance framework. The very same people run both FXORO mutations: Or Ohayon, Gil Muram, Dejan Nikolic, and Sara Nisanov are still registered as directors. The FXORO offshore mutation offer violated regulatory rules in the EEA jurisdictions.

Offering super-risky high leverage of 1:400 and non-compliant onboarding are two important reasons for CySEC-regulated investment firms to establish offshore mutations. With the offshore mutations, the CySEC investment firms are making money and producing many victims. Victims in the EU!

No protection

EU and UK clients of offshore brokers are not eligible for Investor Compensation Schemes or Financial Ombudsman assistance. Legal action in Seychelles is virtually impossible for consumers. In a high-risk investment area, this increases your risk considerably once again. This increases the probability of loss to almost 100%.