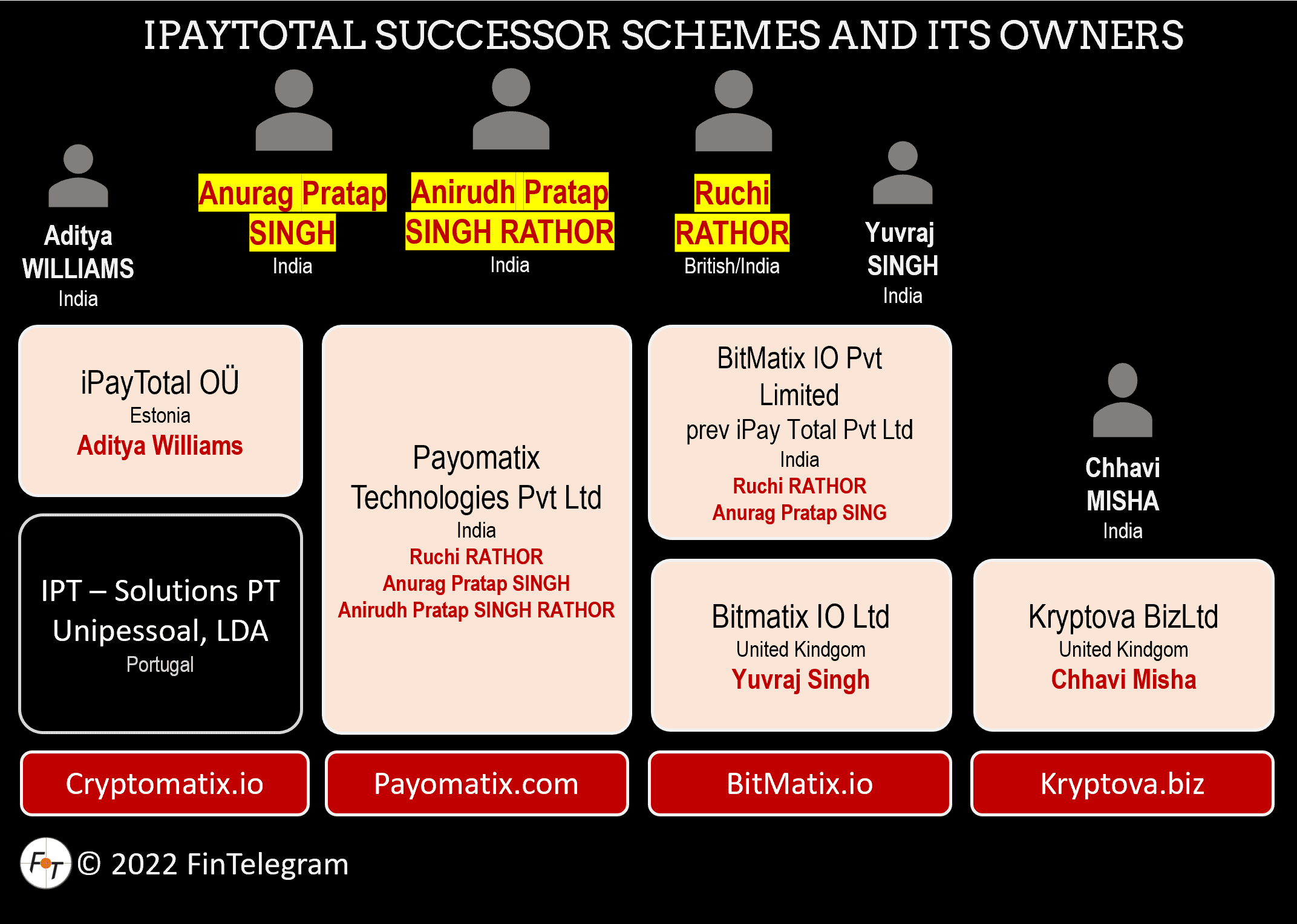

The high-risk processor Payomatix is one of the many payment ventures of the British-Indian Ruchi Rathor, who became sort of famous with the collapse of her iPayTotal scheme. iPayTotal vanished with their merchants’ money. The scheme’s UK entity went into court-ordered insolvency with creditor claims totaling about GBP 1.1M (report here). The successor brand OctaPay vanished after a few months. Nothing about that will be discussed at the Payomatix Founder Investor Networking event in November 2022.

Read our reports on the iPayTotal scheme here.

On LinkedIn, Paymatix is currently offering an Early Bird discount for the Founder Investor Networking Q4 on 16 November 2022. The event will be held at Crowne Plaza, Mayur Vihar, New Delhi.

On her LinkedIn profile, you can see that Ruchi Rathor is a founder or investor in the most notorious high-risk payment processors at the moment, such as OpenUp a/k/a OpenUp.Finance, or Hawex Group. Besides that, we are also aware of her connections with Paypound and NeoBanq. Some of their companies, like OctaPay or iPayTotal, have vanished with their merchants’ money. Dozens of whistleblowers have informed us about Ruchi Rathor‘s illicit practices over the past months.

She makes employees of various companies work with fake social media profiles, pressures merchants with insider knowledge and threatens employees if they want to leave the company.

We recommend all merchants stay away from Ruchi Rathor‘s payment processors. The online rating agency PayRate42 has included all her ventures in its “Black Compliance” list.