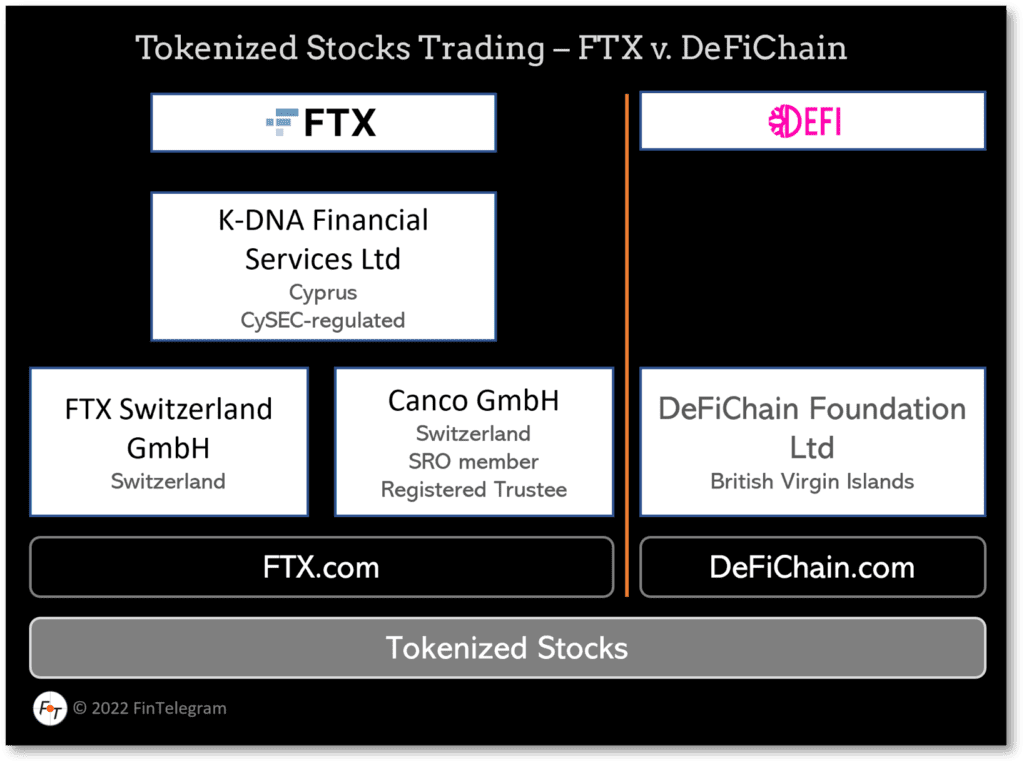

Trading tokenized shares are currently all the rage on crypto exchanges. The aim is to indirectly offer customers trading with traditionally listed shares such as Apple, Microsoft, or Tesla without the intermediation of brokers and low fees. We think tokenized shares also qualify as securities and require a license. While FTX trades tokenized shares through its CySEC-regulated subsidiary K-DNA Financial Services Ltd and other regulated entities, Julian Hosp‘s DeFiChain operates without regulatory permission. Here’s a quick comparison.

The Tokenized Stocks Offerings

| FTX | DiFiChain/DeFiChain DEX | |

| Business activity | Centralized crypto exchange | Decentralized crypto exchange |

| Legal entities | K-DNA Financial Services Ltd (CY) Canco GmbH (CH) FTX Switzerland GmbH (CH) | DiFiChain Foundation Ltd (BVI) |

| Regulators | CySEC, FINMA, BaFin | none |

| Jurisdictions | Cyprus, Switzerland, Germany | British Virgin Islands |

| Tokens are backed by shares custodied by FTX Switzerland and can be redeemed for the underlying shares | Tokens tokenized stocks will be collateralized by cryptocurrencies | |

| Offerings | Tokenized stocks Futures on tokenized stocks | dTokens a/k/a Tokenized stocks |

| More information | Tokenized Stocks | Decentralized Stock Tokens |

| Controlling individuals | Sam Bankman-Fried | Julian Hosp U-Zyn Chua |

Short Narrative

Even a first look at the comparison between FTX and DeFiChain shows a glaring difference regarding regulation. While FTX works with over its CySEC-regulated K-DNA Financial Services via its Swiss FTX Switzerland via the Swiss trust company and SRO member Canco (link) to map the trading of security tokens, there is ZERO regulation at DeFiChain, which is operated via an offshore entity in the British Virgin Islands.

This complete absence of regulatory supervision and/or permissions cannot be solely attributed to DeFiChain being organized as a decentralized exchange while FTX is a centralized one.

While FTX says it actually buys the shares of the companies in question via its Swiss entity and holds them as assets for their tokens, the DeFiChain dToken seems to be designed as a kind of crypto-backed derivative or synthetic security.

In addition, the FTX offer is explained in much more detail than that of DeFiChain, which leaves many question marks.

According to DeFiChain, they do not regard its dTokens as securities because they would not represent ownership, voting rights, dividends, or other benefits available to stockholders. This doubt that regulators see it this way.

Conclusion & Warning

Trading cryptos and tokenized assets are extremely risky regardless of the provider. In this respect, you should not choose a non-regulated crypto provider under any circumstances and thus significantly increase the risk.

We recently issued an investor warning against Julian Hosp and his crypto schemes Cake DeFi and DeFiChain. After comparing the regulatory mapping of the business models between FTX and DeFiChain, we reiterate this warning.

Share Information & Opinion

If you have any information about FTX, DiFiChain, and their activities or want to share your opinion or experience, please use our whistleblower system, Whistle42.