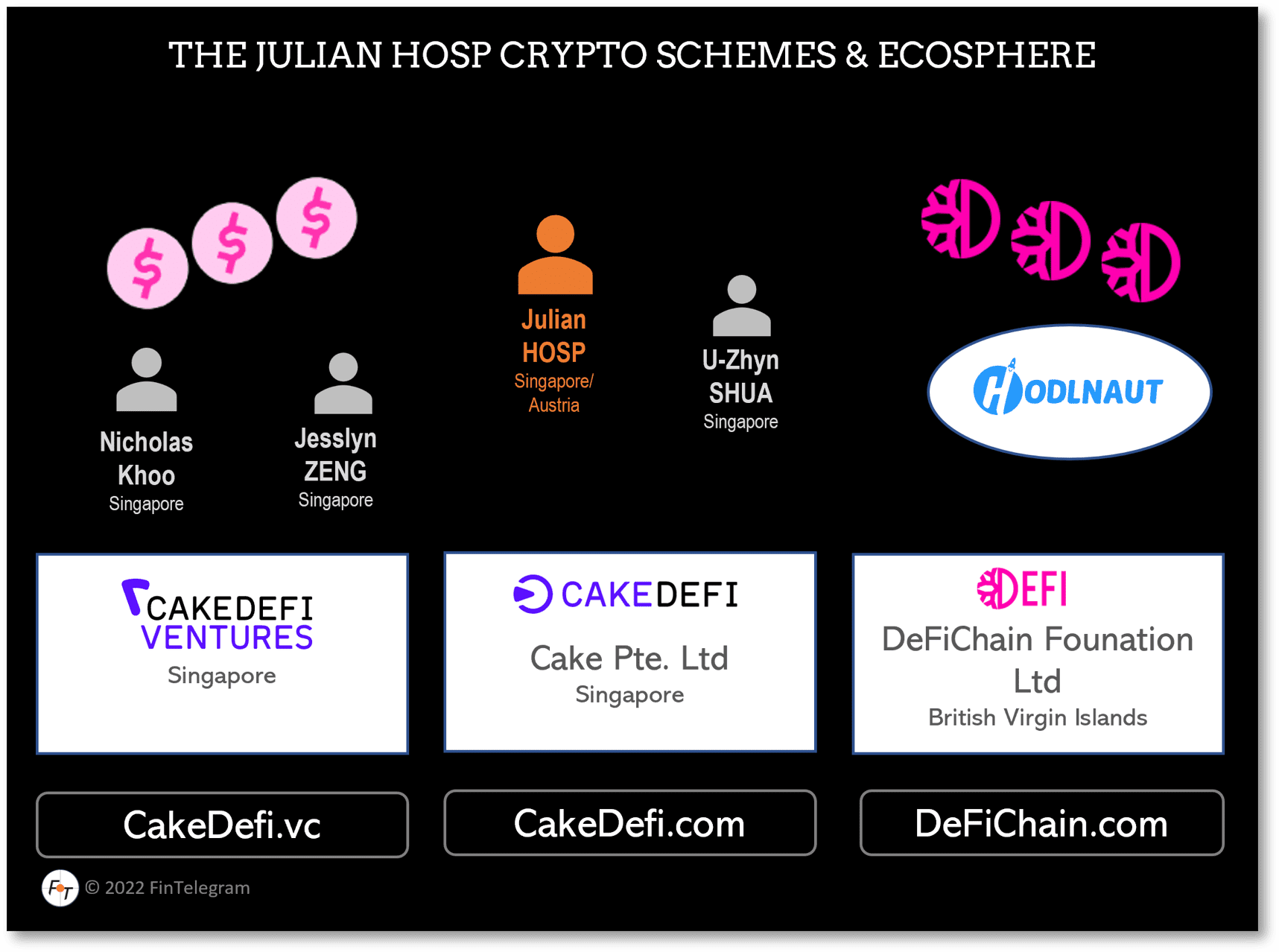

The self-proclaimed crypto guru Julian Hosp is infamous in the global crypto scene. The former manager at MLM scheme Lyoness joined the now collapsed crypto startup TenX in 2016 or 2017 and pulled off an $80 million ICO, but what happened to the money is unknown. Hosp parted ways with the rest of TenX’s founders in a dispute in 2019 and founded Cake DeFi and DeFiChain, which are under fire and regulatory scrutiny. Germany’s BaFin announced an investigation in January 2022. We advise investors to be extremely cautious of Julian Hosp and his unauthorized crypto schemes.

Read the Julian Hosp report here.

Key data

| Brands | Cake DeFi, Cake DeFi Ventures DeFiChain Julian Hosp |

| Business activities | Decentraliced crypto lender and crypto exchange Venture Capital |

| Domain | https://cakedefi.com https://cakedefi.vc https://defichain.com www.julianhosp.com |

| Legal entity | Cake Pte. Ltd, Singapore DeFiChain Foundation, BVI (prev related to TenX and Lyoness) |

| Related individual | Julian Hosp (LinkedIn) U-Zyn Chua (LinkedIn) Nicholas Khoo (LinkedIn) Jesslyn Zeng (LinkedIn) |

| Cryptocurrency | DFI |

| Jurisdiction | Singapore British Virgin Islands |

| Authorization | No |

| Warnings | BaFin |

A Short Narrative

Allegedly, Cake DeFi manages over $1 billion in customer assets through liquidity mining, staking and lending. Recently, Cake DeFi announced on Twitter that it would have more than one million customers. Sounds impressive at first glance but the crypto scheme OneCoin also had millions of customers before it collapsed. We are not saying that Cake Defi is a scam scheme like OneCoin but we are saying that the number of customers says nothing about a scheme’ seriousness and trustworthyness.

The two unregulated and unlicensed crypto financial platforms Cake DeFi and DeFiChain rely heavily on the DUSD stablecoin and tokenized assets. There are currently significant issues with both crypto asset classes.

The Securities trading question: DeFiChain offers the trading of “tokenized shares” such as Apple Inc., Tesla Inc., Amazon.com Inc. and GameStop Corp. The tokenized stocks would be collateralized by cryptocurrencies. Apart from the fact that this is, in our opinion, unregulated securities trading, there are other problems with this offer. The tokenized share priced have been decoupling from the price of the underlying stock. But the example of Apple shows: on the open market, AAPL is currently traded for a good 135 US dollars, but the version at DeFiChain under the name Apple Tokenized Stock Defichain (DAAPL) only comes to a price of around 100 US dollars.

The DUSD is theoretically pegged to the US-$ and should therefore have a stable value of $1 per token. Hence the name Stable Coin. In fact, the DUSD used (issued?) by DeFiChain is far below the $1 value and was quoted below $0.7 at times.

DeFiChain has also issued its own token – the DFI – which is traded on its own decentralized exchange but also on other centralized crypto exchanges like Bittrex or KuCoin. Currently (21 Aug 2022) DFI has a market cap of around $422 million. Also with DFI, due to DeFiChain’s business model, the question arises whether the token does not qualify as a security.

The Cake DeFi Ventures

In March 2022, Cake DeFi has launched a corporate venture arm with $100 million in capital with the goal to invest in startups across Web3, the metaverse, the NFT space, gaming, esports and fintech spaces that will benefit its core business.

The USDS Question

Due to the lack of transparency of the entire group of companies of Julian Hosp and it is not possible to answer the question whether and how they are connected with the DUSD. That is a significant governance problem!

On Twitter, Julian Hosp denies that he has control over the DUSD stablecoin however, numerous other pieces of information as well as a blog post of DeFiChain suggest that indeed Hosp and his crypto ventures have control and/or influence over DUSD. However, he said, the DefiChain would work on a solution to re-peg the DUSD at $1.

The Hodlneut Question

Another question being discussed in the scene is the connection of Julian Hosp and/or his entities to the collapsed crypto lender Hodlneut which is also based in Singapore.

FinTelegram reported recently that Hodlnaut filed bankruptcy proceedings in Sinpagur in early Aug 2022. Lastly, media has reported that prosecutors have also opened investigations into Hodlnaut. Most recently, Hosp also hinted at a closeness to Hodlneut on Twitter. As always, however, everything about Hosp is completely non-transparent and, above all, every critical question is dismissed with apodictic marketing statements on Twitter.

Conclusion and warning

We advise all investors to be extremely careful with Julian Hosp and his crypto schemes. He is a marketing genius in the first place. However, it should first be noted that neither Cake DeFi nor DeFiChain are regulated by any financial market supervision authority. In light of the tokenized shares, DeFiChain‘s activities must most likely qualify as securities activities. These may not be offered without regulatory approval.

It is furthermore feared that the controversial “stablecoin” DUSD could collapse like Terra-Luna before and that this could have lethal effects on Cake DeFi and DeFiChain. Again, due to lack of available information, lack of transparency and regulation, it is difficult to make correct statements. This alone is reason for an urgent warning.

Ultimately, information is lacking as to whether and, if so, how the crypto lender Cake DeFin was or is connected to the collapsed Hodlnaut or other collapsed crypto schemes.

Share Information

If you have any information about Julian Hosp, Cake DeFi, DeFiChain and their activities, please share it with us through our whistleblower system Whistle42.