We have been following the activities of the CySEC-regulated Cypriot Investment Firm (CIF) BDSwiss and have reported extensively on their offshore onboarding. We have been threatened several times by their Compliance and Legal Departments for doing so. In fact, we have perfectly documented the offshore onboarding approach for EU and UK residents at BDSwiss. In our review today, we were advised on the website that secondarily no new brokers can be accepted via the CySEC approved domain. Existing customers are promised a deposit bonus via email.

Latest review update

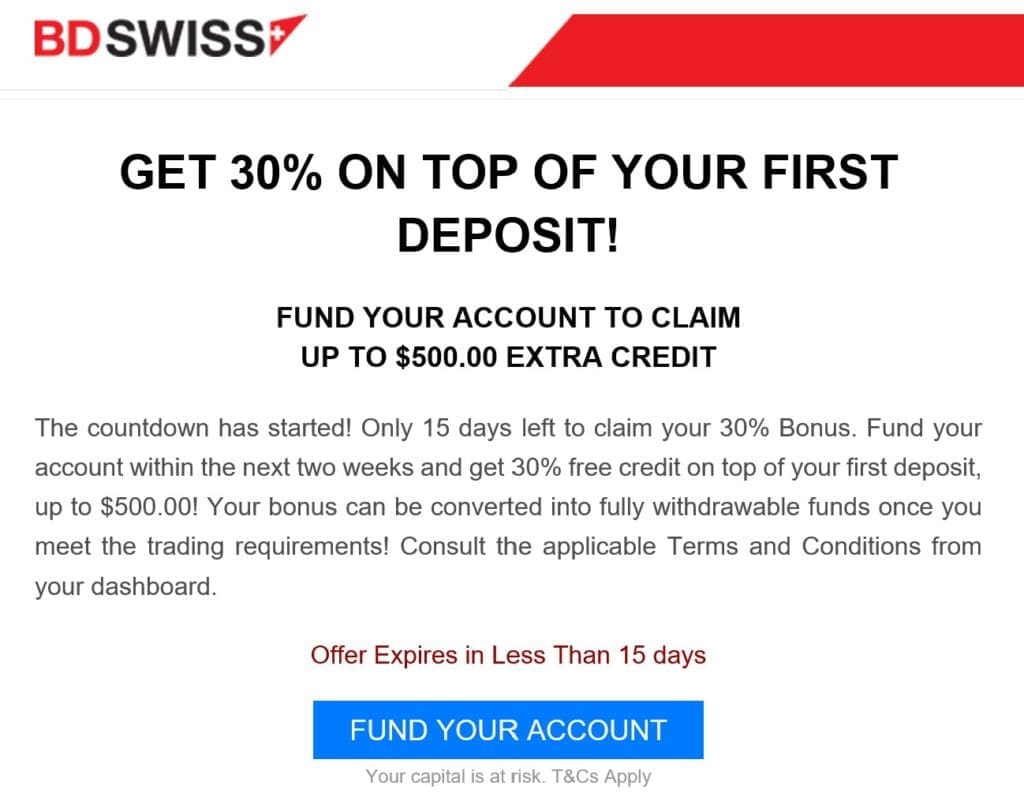

Today we received an email from the FSC Mauritius regulated offshore broker BDS Markets (www.bdsmarkets.com) promising a 30% bonus on the first deposit (picture left).

We have registered as EU residents but never even started our KYC process, uploaded any ID and address proofs, or even confirmed our phone number. Nevertheless, we could have theoretically made unlimited deposits via PayPal or bank wire. The violations of UK and EU compliance rules, which we have already criticized several times, have not changed.

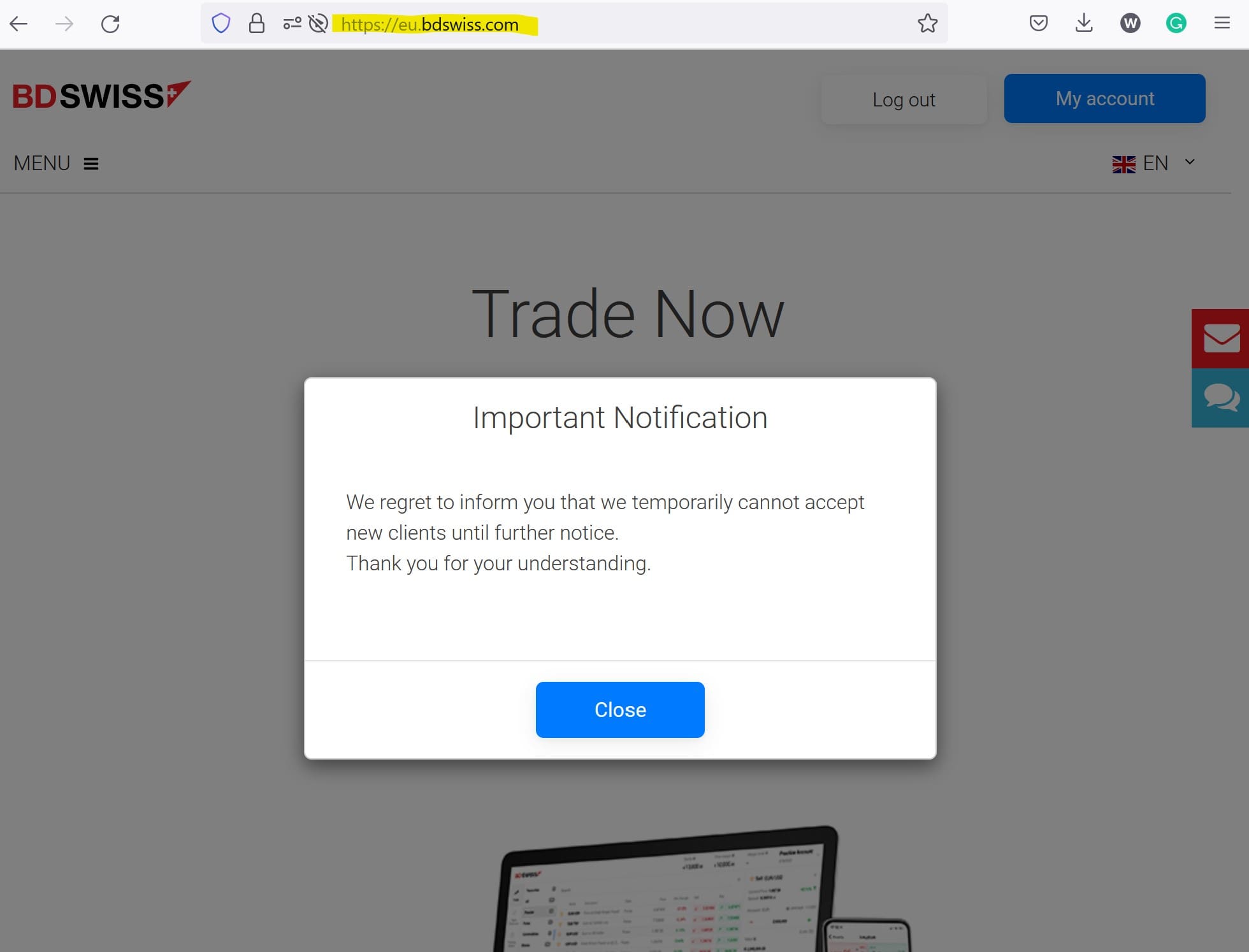

What has changed, however, is that on the website with the CySEC-approved domain https://eu.bdswiss.com there was a notice that temporarily no new customers can be accepted (screenshot on top). Maybe CySEC is actually finally checking?

Key data

| Trading names | BDSwiss Swiss Markets BDS Trading |

| Domains | eu.bdswiss.com (CySEC approved) eu.swissmarkets.com (CySEC approved); eu.investments.bdswiss.com (CySEC approved); eu.bdstrading.com (CySEC approved) www.bdswiss.com (offshore) swissmarkets.com (offshore) |

| Legal entities | Duronga Holding Limited (Cyprus) BDSwiss Holding Ltd (CySEC) BDSwiss GmbH (CySEC agent) BDSwiss UK Limited (UK) BDS Markets (Mauritius) BDS Ltd (Seychelles) BDS Swiss Markets Global Services Ltd (Cyprus) BDS Swiss AG (Switzerland) BDSwiss LLC (USA) |

| Related individuals | Alexander-Wilhelm Oelfke (LinkedIn) Jan Malkus Catalina Pantea |

| Jurisdictions | Cyprus, Mauritius, Seychelles |

| Regulators | CySEC for BDSwiss Holding Ltd license number 199/13 FSC Mauritius for BDS Markets with license No. C116016172, FSA Seychelles for BDS Ltd with license number SD047 |

| Payment options | Bank wire, credit and debit card PayPal, Trustpay, eps, Skrill Cryptocurrencies |

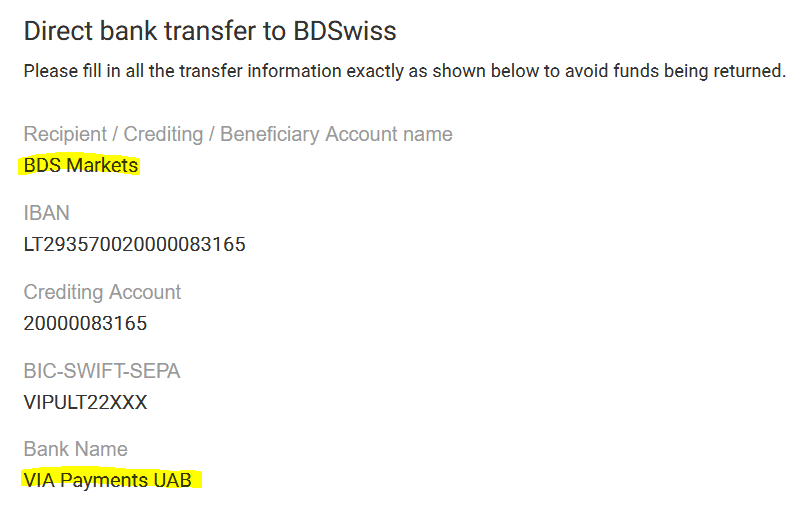

| Payment processors | VIA Payments UAB |

| Warnings | FCA, BaFin |

The narrative

Alexander-Wilhelm Oelfke (pictured left), a Berlin-based entrepreneur, is the controlling person of the BDSwiss Group. He is registered as a director with the CySEC-regulated entity as well as with the entities in Germany and Seychelles. In this respect, it is fair to say that this group is centrally controlled.

The BDSwiss Group has apparently designed its company and website structure to systematically circumvent European regulatory requirements. According to the website, the offshore broker Swiss Markets (https://swissmarkets.com) is operated by the Cypriot BDS Swiss Markets Global Services Ltd, which also acts as a payment processor for BDS Markets in Mauritius.

According to the FCA, the BDSwiss Group‘s offshore brokers did not comply with the FCA’s restrictions on the marketing and sale of CFDs to retail consumers. The FCA identified serious concerns with the sales and marketing practices of the BDSwiss Group, including the use of misleading financial promotions which made unrealistic claims about the likely returns. Many investors were attracted to the firm via social media promotions.

Non-compliant offshore onboarding

In our review on April 11, 2022, the CySEC-approved domains were redirected to the websites of the offshore brokers. This means that the onboarding of new clients from Europe is done exclusively offshore.

In our review, we could have made unlimited deposits even before verifying our email and identity. This is not a problem, especially with cryptocurrencies. For bank transfers, the offshore entity BDS Markets uses an account with VIA Payments in Lithuania (screenshot left).

This offshore onboarding without proper KYC/AML procedures violates financial laws, anti-money laundering requirements, and regulatory requirements.

Conclusion

By using offshore onboarding, the BDSwiss Group, as well as other CySEC CIFs, circumvent and violate ESMA and CySEC regulatory requirements. Neither the onboarding procedure (without proper KYC/AML) nor the offered leverage levels comply with regulatory requirements in UK and EU. This offshore onboarding is done willfully and knowingly. The payment options are designed for European customers with SEPA transfers and accounts in the UK or EU.

Clients of offshore entities are not entitled to investor compensation schemes or other regulatory intervention measures. They are also not entitled to assistance from Financial Ombudsman institutions.

Share information

If you have any information about BDSwiss, please share it with us through our whistleblower system, Whistle42.