Whistleblower Credits: We would like to thank our whistleblowers for their reports and insights, which help us expose scammers and their payment processors. Together we can make a difference in cyberspace. Together we are an invincible force.

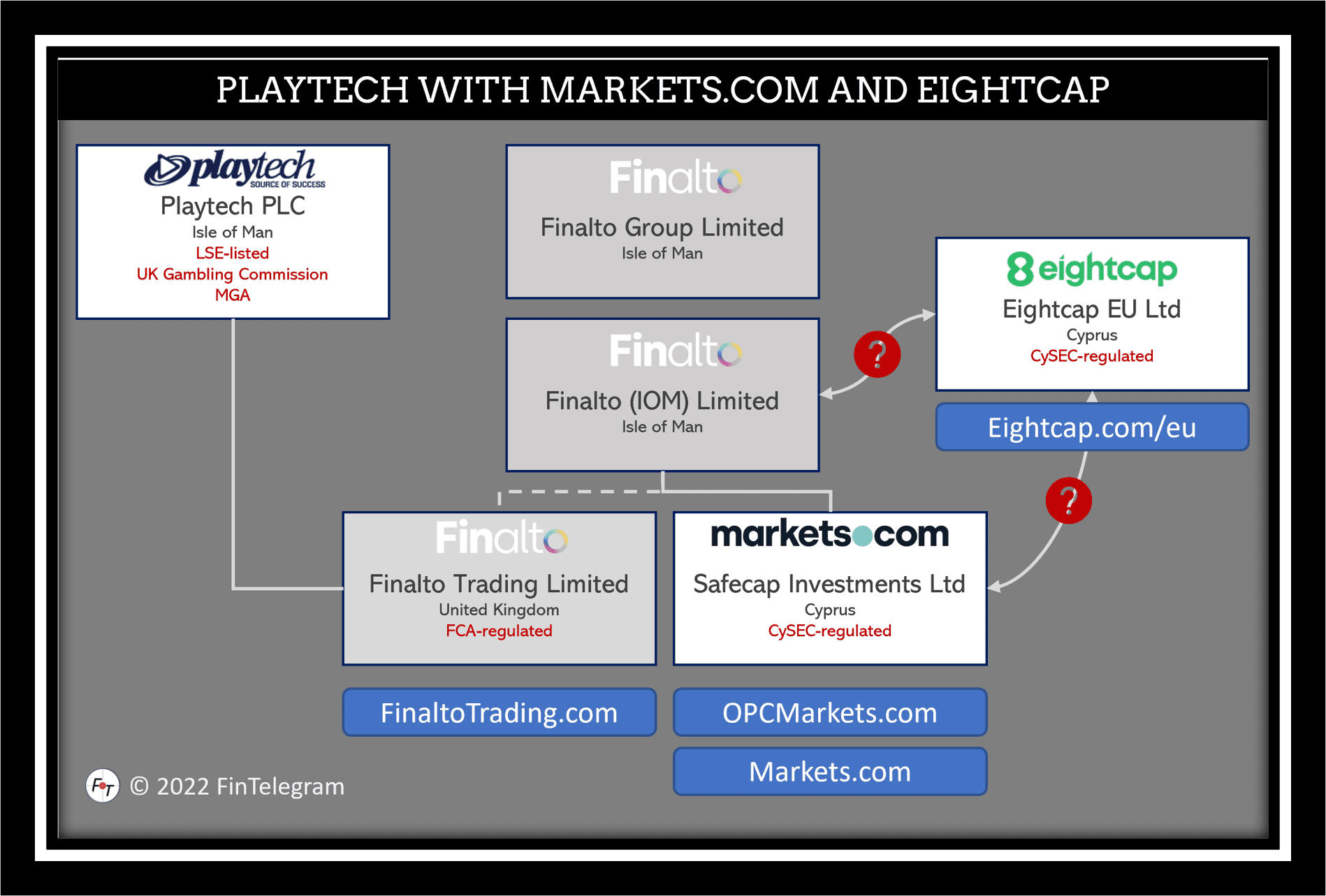

The Israeli entrepreneur Teddy Sagi founded Playtech plc in 1999. It has over 7,000 employees and is listed on the main market of the London Stock Exchange. The company is a technology provider for the gambling and financial trading industries. Playtech owns the CySEC-regulated investment firm Safecap Investments Ltd d/b/a Markets.com via Finalto (IOM) Limited. The latter holds the intellectual property rights and marketing and technology contracts of Playtech‘s financial division, sold for $250 million to Gopher Investments!

Key data

| Trading name | Playtech |

| Business | Technology provider for gambling and online trading Operator of gambling and trading platforms |

| Domain | www.playtech.com www.finalto.com www.markets.com |

| Legal entity | Playtech plc, Isle of Man |

| Related legal entities | Finalto (IOM) Limited, Isle of Man Finalto Trading Limited, UK Safecap Investments Limited, Cyprus |

| Regulators | UK Gambling Commission Malta Gaming Authority (MGA) FCA for Finalto Trading CySEC for Markets.com FSCA for Markets.com |

| Related individuals | Teddy Sagi, founder Mor Weizer, CEO Andrew Smith, CFO |

Short narrative

In November 2018, founder Teddy Sagi sold his remaining shares in Playtech. According to Forbes, his net worth is estimated at $5.7 billion.

Since early 2021, Playtech has been in talks to divest its Financial Division with Finalto Group and Safecap Investments. In Sept 2021, Playtech announced that it sold Finalto for $250 million to its shareholder Gopher Investments, an affiliate of TT Bond Partners. The transaction should be have been completed in H1 2022. Playtech recorded an excellent 2021 revenue of €1.21 billion, 12% up compared to €1.07 billion in 2020. Playtech itself has been involved in a takeover battle over the last couple of months

Insiders from Cyprus have told us that there are interesting connections between Finalto and Safecap Investments with Eightcap a/k/a 8Cap. Both are CySEC-regulated investment firms. Eightcap (formerly R Capital Solutions) sold the MXTrade broker in 2015 to the notorious Lau Scheme, a vast, now vanished, scam network that is also based in Cyprus but operated through offshore companies.

Share information

We would like to know more about the connections between Safecap Investments, Eightcap, and the Lau Scheme. There may or may not be connections between the Playtech Group and Eightcap. In any case, for the completion of our Cypriot puzzle, we would be very grateful for the information. Please share information with FinTelegram via our whistleblower system, Whistle42.