On 9 March 2022, the EU Parliament has voted overwhelmingly to end the practice of EU countries selling “citizenship by investment” (CBI). It comes in the wake of Russia’s invasion of Ukraine, with many wealthy Russians having received EU passports in exchange for significant investments (and payments to local officials and politicians). Members of the European Parliament in Strasbourg on Wednesday voted 595 for, 12 against and with 74 abstentions to end the so-called ‘golden passport’ schemes.

The Voice of the EU Parliament

The MEPs are calling for an all-out ban on “citizenship by investment” (CBI) a/k/a Golden Passport schemes by 2025 but want significantly increased background checks to come into force immediately. The vote is, however, not binding. It is now up to the European Commission to outline a detailed proposal of how to end the schemes, and then the EU’s national government will have the final say on the matter.

The controversial practice is suspected of facilitating corruption and money laundering. Brussels launched disciplinary proceedings against Cyprus and Malta in 2020 without going further.

“The system of golden passports and visas carries with it inherent risks of tax evasion, corruption, and money laundering,” said Saskia Bricmont, a Green MEP from Belgium. “For too long, oligarchs, criminals, and corrupt politicians have had the ability to buy their way into Europe and launder their cash, image, and identities.“

Parliament stresses that CBI schemes, under which third-country nationals obtain citizenship rights in exchange for money, undermine the essence of EU citizenship. They call the practices in Malta, Bulgaria, and Cyprus “free-riding,” as the selling of EU citizenships was never intended to become a commodity. The EU member states would have accepted applications even when requirements were not met. The governments need to terminate due to the risks they pose.

A very lucrative business

Malta, Cyprus, and Bulgaria are the EU countries that have run the most lucrative golden passport schemes. Selling passports is a highly lucrative business. The Prime Minister of Malta, Robert Abela, prior to being appointed as Prime Minister, was selling passports through his law firm Abela Advocates.

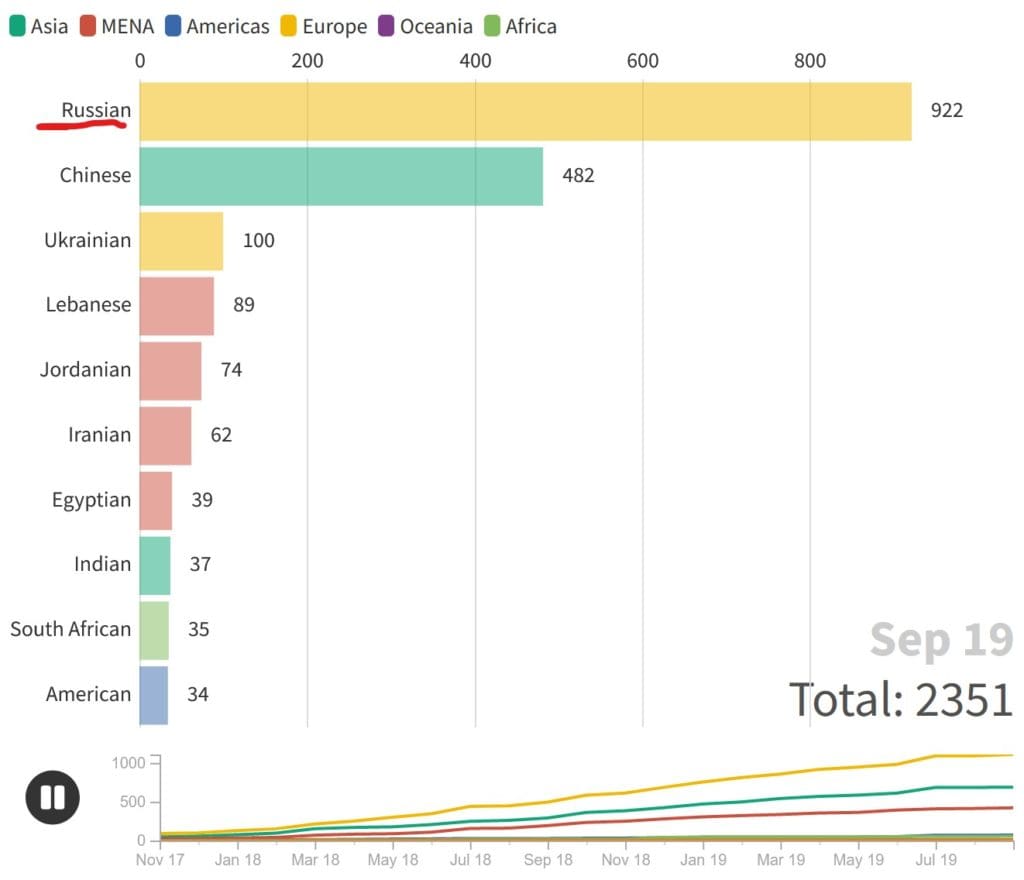

According to The New York Times, more than 6,779 individuals from Russia, Ukraine, China, or Cambodia purchased citizenship in Cyprus between 2007 and 2020. Most of them were Russians; between 2013 and 2019, 922 Russians became Cyprus citizens. They needed to invest at least €2 million. Cyprus terminated its Golden Passport scheme in Oct 2020 after AlJazeera, in its report The Cyprus Papers, exposed the corruption associated with it. Cyprus has raised over €6B billion through the program. Let alone the millions in bribes.

The Golden Passport schemes have been a highly profitable business, especially for the states’ politicians and high officials. High sums of bribes flow in the process, as insiders tell us. Therefore, it is not surprising that the politicians in the countries concerned are resisting the abolition.

New rules for Residence by Investment

Noting the less severe risks posed by ‘residence by investment’ (RBI) schemes, Parliament asks for EU rules to help tackle money laundering, corruption, and tax evasion. These measures have to include

- stringent background checks (also on applicants’ family members and on sources of funds), mandatory checks against EU databases, and vetting procedures in third countries;

- reporting obligations for member states, including a “notification and consultation” scheme to allow other member states to object; and

- requirements for minimum physical residence (for applicants) and active involvement, quality, added value, and contribution to the economy (for their investments).

MEPs lamented the lack of comprehensive security checks and vetting procedures in both schemes, adding that it should not be possible to file successive applications in different member states. Member states should not rely on checks carried out by non-state actors. Parliament called for an EU levy of a meaningful percentage on the investments made – until ‘golden passports’