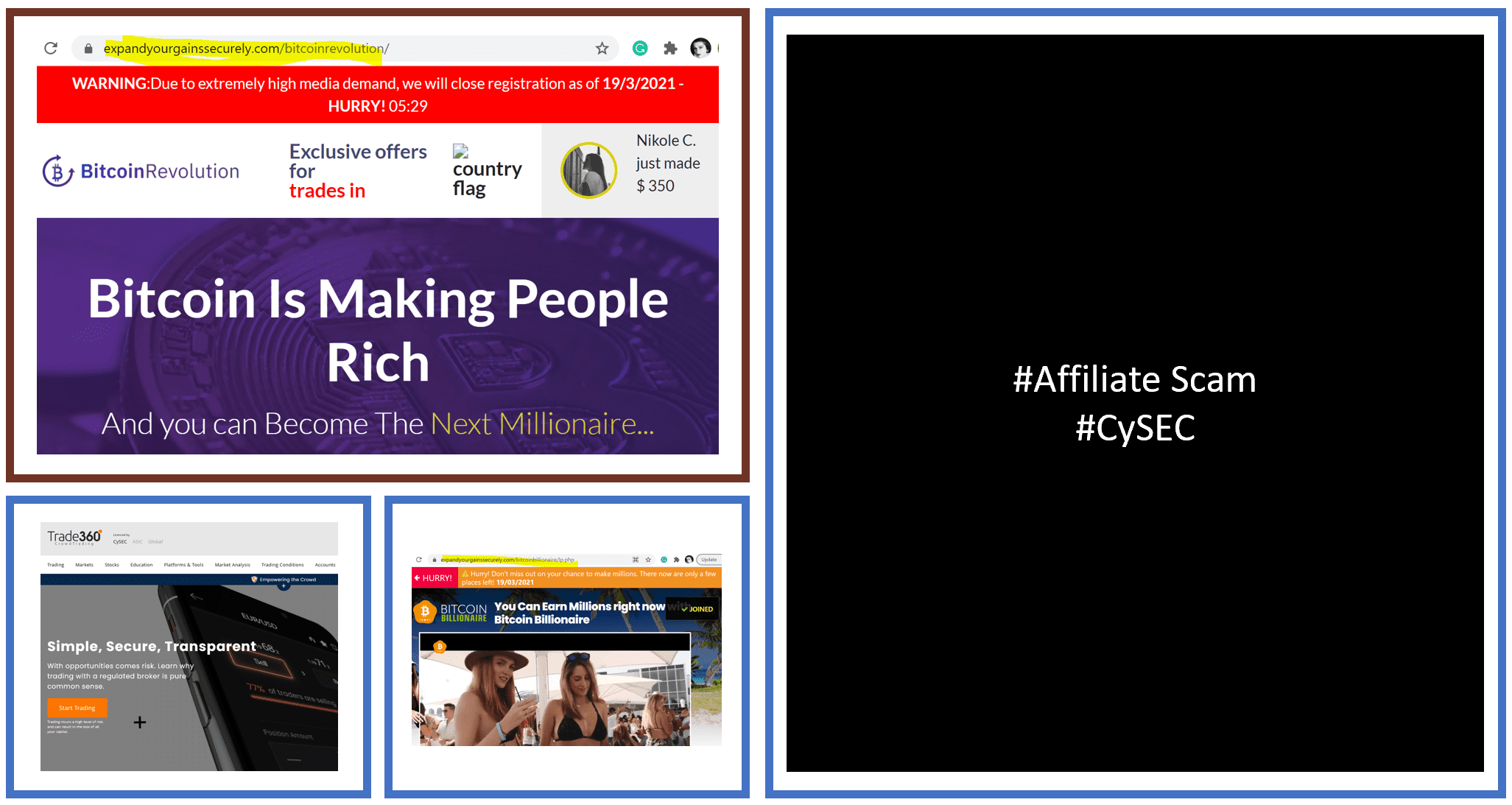

Once registered with one of the many fraudulent affiliate schemes, our research team is served with literally dozens of new scams every day via email, phone, or social media. Currently, cryptocurrencies are used to lure client-victims. These emails introduce crypto investment opportunities. In fact, you are redirected to scams via websites like Bitcoin Billionaire, Bitcoin Revolution, or Bitcoin Era. But also CySEC-registered CIFs use this fraud service. Yesterday and today, we found Trade360, which uses it to get customers to deposit without KYC/AML and false promises.

The Scheme

The process of these fraudulent affiliate schemes is straightforward. Potential victims receive emails promising huge profit opportunities with cryptocurrencies. Anyone who clicks on the link in the email is taken to sites such as Bitcoin Billionaire, Bitcoin Era, or Bitcoin Revolution using domains like www.expandyourgainssecurely.com (today). There you have to register with your name and email.

After the registration, you are immediately redirected to CySEC-regulated brokers’ cashiers such as Trade360 (www.trade360.com). You are supposed to deposit immediately to make the promised fortune. At this point of potential deposit, neither confirmation of emails has been done, let alone KYC/AML. Customers come there because they were promised high profits with cryptocurrencies.

The principals

At Trade360, one enters into business directly with the CySEC-regulated operators’ Crowd Tech Ltd (license number 202/13). You are asked to deposit to their bank accounts and receive emails from their approved domains. Very often, offshore vehicles are used by CYSEC-regulated CIFs for these non-compliant and/or fraudulent actions. Sure, using offshore vehicles or fraudulent affiliates is also a violation of the ESMA and CySEC compliance framework, but at least they try to hide it. Evidently, CySEC does not seem to be bothered by this at all, and thus they play their fraudulent games in plain sight.

Conclusion

CySEC-regulated CIFs chase clients and their funds with false promises and without compliance with regulatory requirements. Affiliate campaigns are deeply integrated into their CMR systems and allow the circumvention of regulatory restrictions. In addition, the data of the deceived and/or cheated victims is misused in this way. These procedures are not exceptions, but the rule for CySEC-regulated entities. It is time for CySEC to do something about it.