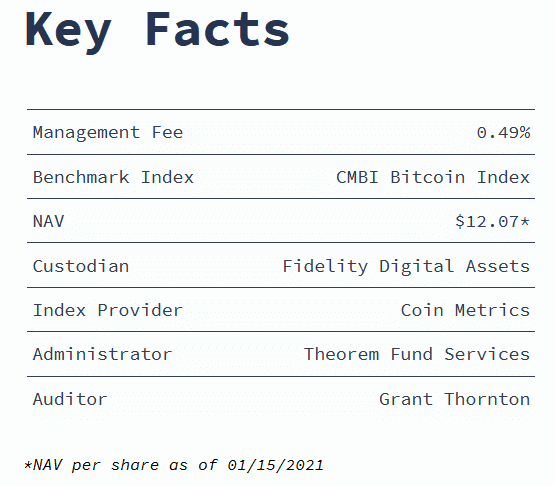

The crypto market is apparently still in vogue in 2021. Despite the almost shocking rise from $20,000 to almost $42,000 within just a few days, crypto’s lead currency, Bitcoin (BTC), is still holding its overbought. Currently, BTC is oscillating around $37,000 and has a market cap of around $680 billion. Etherum (ETH) is also holding at over $1,200 with a market cap of around $140 billion. No surprise that new crypto-related financial instruments are emerging, such as Greg King‘s Osprey Bitcoin Trust (www.ospreyfunds.io), whose shares started to trade on the OTC market in New York a few days ago. This has given competition to Barry Silbert‘s Grayscale Bitcoin Trust and may drive additional demand for BTC.

Like Grayscale Bitcoin Trust (GBTC), the Osprey Bitcoin Trust (OTBC) wants to be listed on the OTCQX in New York. Both OBTC and GBTC invest exclusively in Bitcoin (BTC) to track its performance. This means their shares (units) are very closely linked to the BTC price. Investors can thus invest indirectly in the crypto market by purchasing shares in the trusts without building up crypto know-how and infrastructure themselves. The ETC Group in Germany offers similar crypto-related financial products on a debt basis (report). For example, ETC Group issued a BTC bond, BTCetc (www.btc-etc.com), listed on the German stock exchange that invests exclusively in BTC.

It seems that these hybrid financial instruments are interesting for the broad mass of traditional investors. The trading volume of the GBTC share and the BTCetc bond is currently very high. Crypto-related instruments, in turn, drive additional demand for cryptos into the market. 2021 could turn out to be a good year for crypto.