More and more traditional investors, and especially institutional investors, want to diversify into crypto assets without getting involved in crypto exchanges or OTC themselves. They invest in exchange-traded securities that have a direct crypto connection. In the U.S., the market leader is Grayscale Investments with several crypto-related products, and in Europe, Germany’s ETC Group is one of the market leaders. Trading in crypto-related products exploded in early 2021.

The New York-based Grayscale Bitcoin Trust(ticker: GBTC) of Barry Silbert tracks the price of BTC. It has posted an average daily turnover of almost $1bn in the first two weeks of 2021, amounting to more than nine times the average in 2020. Its assets under management have boomed to $23bn from $2bn at the start of 2020.

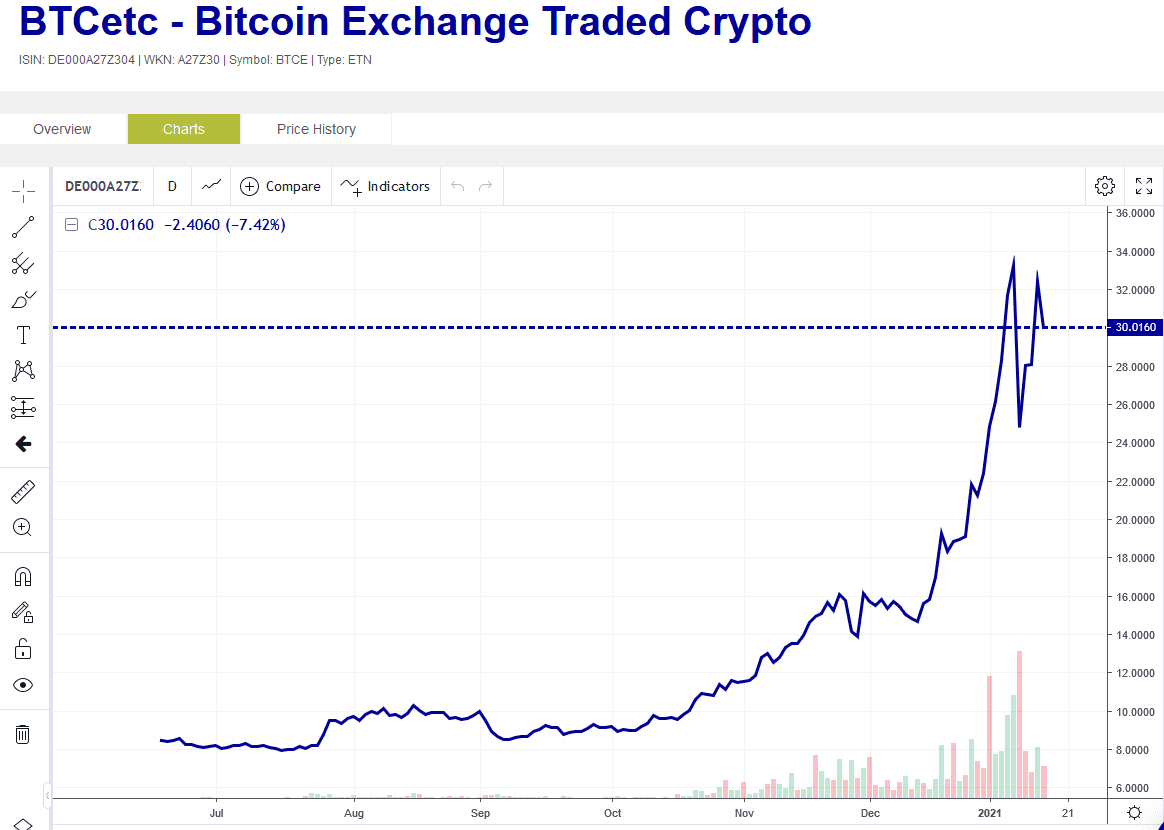

The BTCetc (ticker: BTCE) of the German ETC Issuance GmbH (a/k/a ETC Group) has recorded average daily trading amounting to €57m in the first 11 days of January 2021. Up from the €15.5m daily average in December 2020. BTCetc (www.btc-etc.com) is an exchange-traded cryptocurrency that, like GBTC, tracks the price of BTC and trades on Deutsche Boerse XETRA. As of 15 Jan 2020, BTCE recorded total holdings of BTC 12,485. 4 (AUM in BTC) worth more than $483.5 Mio.

Bradley Duke, co-founder and chief executive of ETC Group, said he thought institutional investors were starting to buy the cryptocurrency as a “safe haven.” ETC Group listed similar exchange-traded notes denominated in dollars, sterling, and Swiss francs on SIX, the Swiss exchange. More products would be launched “in the next few weeks” based on other cryptocurrencies and a basket of cryptos, Bradley Duke said.

The sharp rise in trading in crypto-related securities suggests that investors are increasingly looking to gain exposure to crypto on traditional markets rather than buying the cryptos themselves or trading on crypto exchanges.