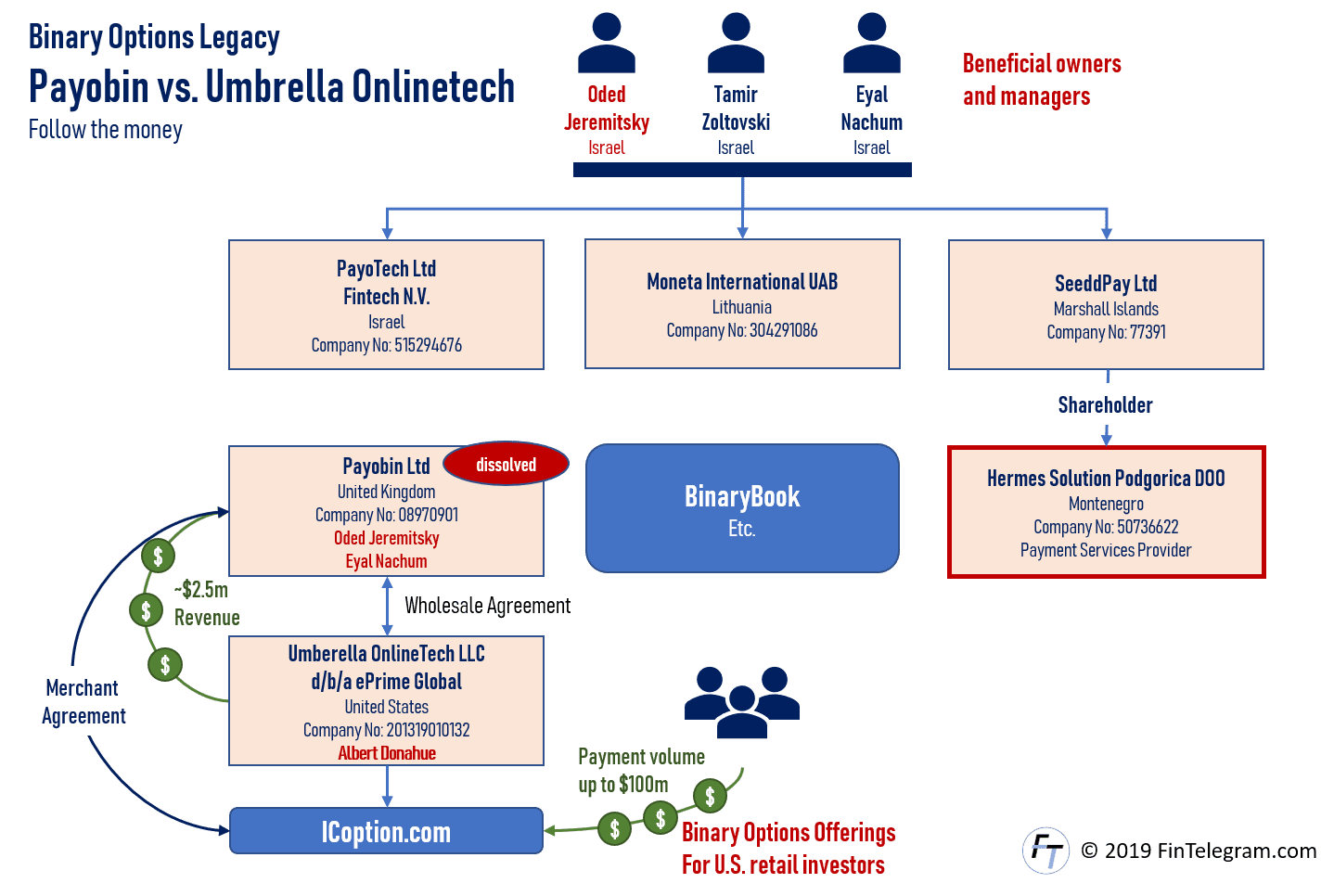

A while ago FinTelegram reported about the lawsuit of Pay o bin Ltd (Payobin Ltd) against the US company Umbrella Onlinetech LLC. The complaint was filed by PayoBin Ltd, registered in the UK, in the U.S. in September 2016. At that time, however, according to UK Companies House, Payobin Ltd no longer existed at all.

Timeline and Playbook

Originally the director of the UK-registered Payobin Ltd was Oded Jeremitsky, who founded the company in April 2014. Already in October 2015, Oded Jeremitksy applied for the company’s voluntary strike-off which went effective in November 2015. Following the struck-off the company was dissolved in February 2016. According to the UK Companies House, no balance sheets or financial statements were ever filed for 2014 or 2015 as required by the UK laws and Companies House rules.

According to the rules of the Companies Act 2006, One must conclude from this that Payobin Ltd did not make business, right? No filing, no records, no statements, no nothing. Well, maybe not. Let’s have a look or two.

The lawsuit of a struck-off company

An remarkable point in the US court case is that Payobin Ltd filed the lawsuit against Umbrella Onlinetech LLC in September 2016 according to US court documents (2:16-cv-06978). At this point in time the company was already dissolved. In February 2017 Eyal Nachum submitted a declaration on the behalf of the Plaintiff (Payobin Ltd). In the declaration, he labels himself the CEO of Payobin Ltd and does not mention to the Court that the company he claims to be the CEO of was dissolved a year ago already.

The legal basis of the complaint was an agreement between Payobin Ltd and Umbrella OnlineTech LLC. The agreement was signed on behalf of Payobin Ltd by Oded Jeremitsky, the registered director, on 23 December 2014.

How can a deleted company file lawsuits? Eyal Nachum and Oded Jeremitsky and their lawyers will certainly have good answers to this question.

According to sections 1004 and 1005 of the Companies Act 2006 Oded Jeremitsky was actually not allowed to file for the company’s voluntary strike-off because of the business and the ongoing court case with Umbrella

Illegal broker schemes and the millions

Another inter

At this point, it should be noted that Umbrella

Pursuant to the agreement, Umbrella agreed to process payments for Payobin’s (!) clients and to transfer the money – including Payobin’s commissions – to Payobin which then transferred these payments – less its commissions – to its clients. According to the court files, Payobin actually held the merachant agreements with the operator of those illegal broker schemes like ICoption or BinaryBook. Evidently, Payobin was the principal in this relationship.

The revenues, cash flows, and tax question

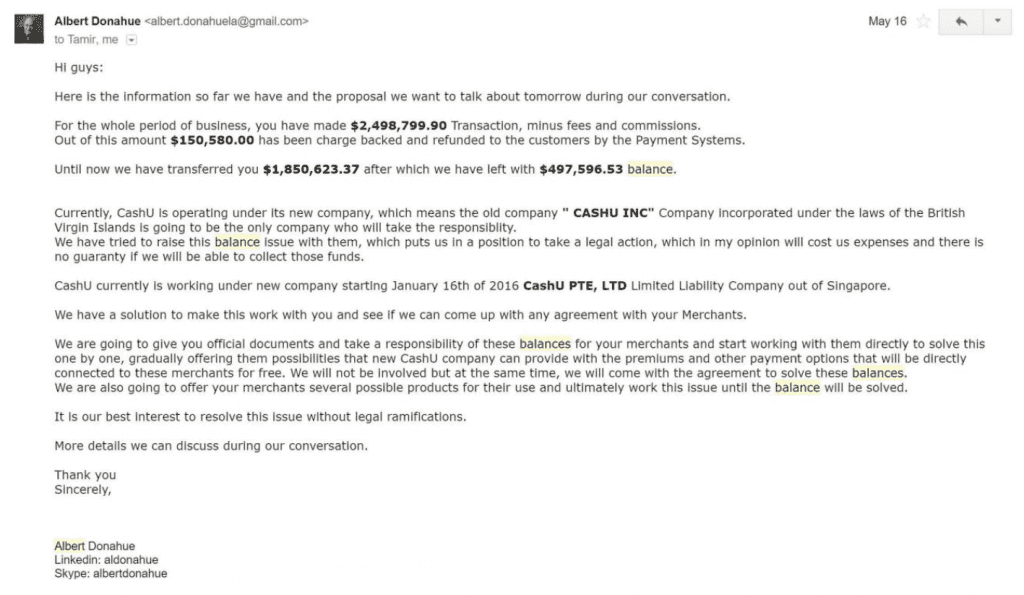

Umbrella OnlineTech actually paid $1.85 million of this amount to Payobin Ltd. The rest has just been argued in the US court. These facts are easy to prove as the respective evidence has been attached to the Payobin Ltd court complaint.

The question here is: where were these millions taxed? It’s just one contract and we talk about millions here. How can a company whose termination has already been initiated in October 2015 continue to do business and receive millions? Were these millions taxed in the UK or Israel? As Eyal Nachum presents himself in his brief as CEO of Payobin Ltd, he is also responsible to the authorities for answering this question.

Irrelevant questions?

These questions and the processing are by no means irrelevant. To date, authorities in the US and Europe are looking for hundreds of millions stolen from retail investors via illegal binary options platforms. In this respect, any forensic analysis must follow the flow of money. The Payobin network undoubtedly plays an important role here.

These questions are also not to be ignored against the background of the ongoing legal proceedings around BinaryBook and BigOption around Lee Elbaz and Yukom. We know that Payobin has also worked as a payment service provider for these schemes. WSB Investment, the operator of BinaryBook and BigOption was a Payobin merchant. Furthermore, BinaryBook as a client of Hermes Solution, the Montenegrine venture of the Payobin people. What role did Umbrella Onlinetech LLC and its payment solution ePrime Global play?