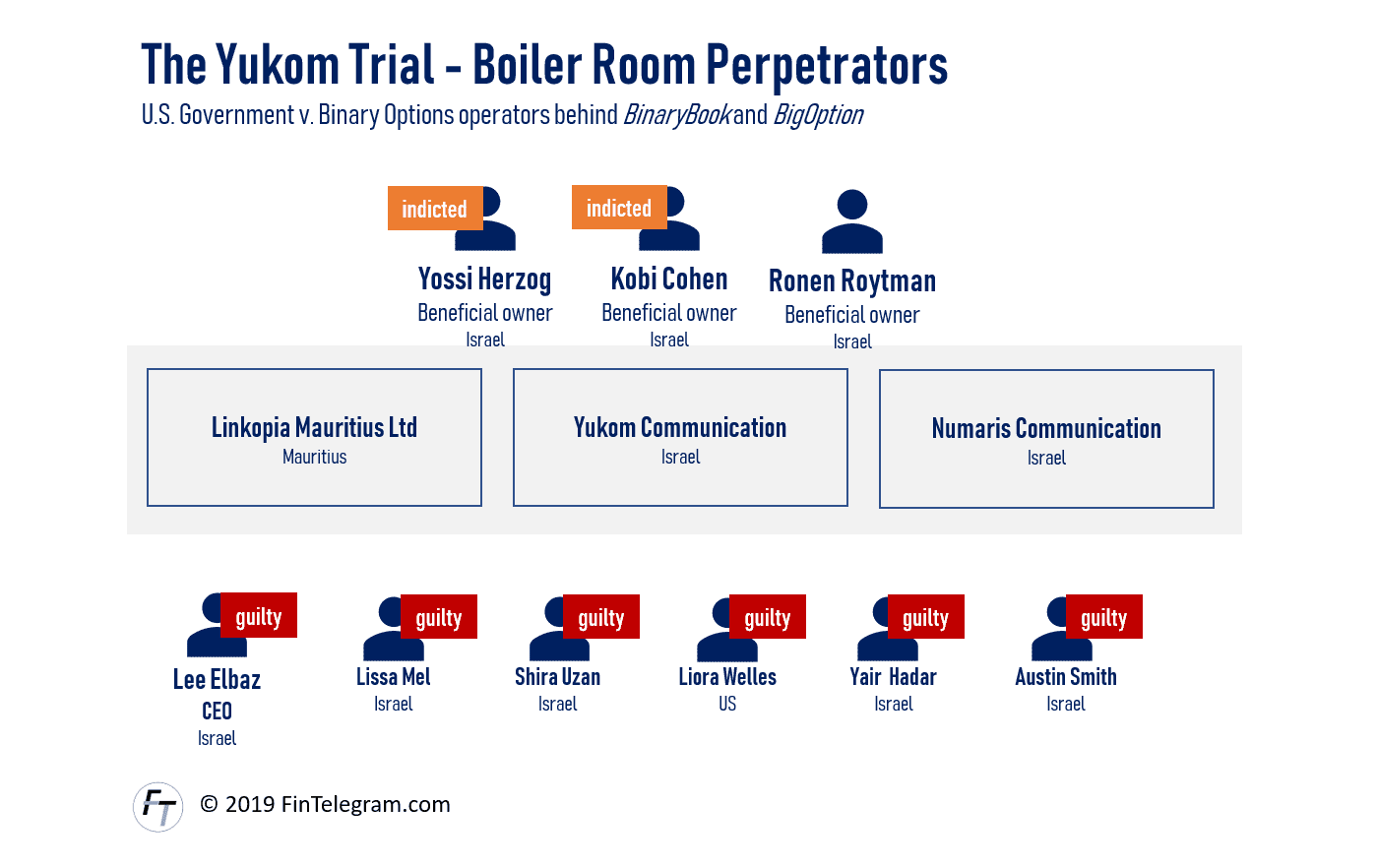

As expected, the Yukom case involving binary options fraud with BinaryBook and BigOption, which is being indicted in the United States, is developing into a worldwide precedent. After five former employees of the Yukom Communications and Numaris Communication boiler rooms had already pleaded guilty to the fraud, former CEO Lee Elbaz was found guilty by a U.S. jury at the beginning of August 2019. Her sentencing is scheduled for December 9, 2019.

More arrests in Hungary

A few days ago, two other binary options perpetrators have been arrested. One of them, a 28-year-old French-Israeli citizen was charged with being part of the Yukom scheme. Another man, a 44-year old U.S. citizen, was arrested on charges of binary options fraud. Allegedly, he defrauded U.S. client-victims with a total

Restituation payment plans

On September 12, 2019, the U.S. prosecutors submitted the first proposal for restitution payments by the individual culprits to the competent court. At the same time, the prosecutors asked the court for more time to work out the actual amount of damages and to establish a corresponding restitution payment plan.

According to the prosecutors, the damage to the alleged 75,000 customer victims of the Yukom schemes would exceed $140 million. This is also the sum of money stolen by the Yukom attackers around Lee Elbaz and the beneficial owners Yossi Herzog and Kobi Cohen.

Postponed sentencing

Most recently, the sentence for Lissa Mel was set at one year in prison and two years on supervised release. In addition, Mel must make a payment of more than $288,000.

Most recently, Shira Uzan had asked the court to adjourn the sentencing which was scheduled for September 20, 2019. Uzan, who pleaded guilty in a plea agreement with the U.S. prosecutors and testified against her former boss Lee Elbaz, needs more time to establish her sentencing memorandum.

CFTC complaint and the Potemkin Village

Parallel to the indictment, the U.S. Commodity Futures Trading Commission (CFTC) filed a lawsuit against the beneficial owners of Yukom, Yossi Herzog and Kobi Cohen, as well as the former CEO Lee Elbaz. In this lawsuit, the U.S. regulator provides a detailed explanation that no real trading in binary options actually took place. This trade would have been faked to the customer victims. In fact, the alleged trade was only a Potemkin Village (read the FinTelegram report).

According to the CFTC complaint, the Yukom scheme and its perpetrators misappropriated a significant percentage of those customer funds by utilizing various manipulative or deceptive devices, including so-called “bonuses” and “risk-free” trades, to prevent customers from withdrawing funds; and by artificially manipulating the results of binary options trades to force customer losses and ultimately prevent customers from withdrawing funds.