Whistleblower Credits: We would like to thank our whistleblowers for their reports and insights, which help us expose scammers and their payment processors. Together we can make a difference in cyberspace. Together we are an invincible force.

TrioMarkets is a CySEC-regulated broker operated by EDR Financial Ltd. Besides, the TrioMarkets scheme also offers its products through the offshore entity Benor Capital Ltd. However, TrioMarkets offshore broker also accepts EEA clients and offers them the leverage of up to 1:200. In our review, we also found that pre-KYC deposits via bank or crypto were possible in theoretically unlimited amounts. We advise you to stay far away from the TrioMarkets offshore broker. You are not protected!

Key Data

| Trading name | TrioMarkets |

| Business activity | CFD, forex, and crypto broker |

| Domains | www.triomarkets.eu www.triomarkets.com http://edrfinancialltd.com |

| Social media | |

| Legal entities | BENOR Capital Ltd EDR Financial Ltd |

| Related individuals | Andrey Kalashnikov (LinkedIn) Raphael Ghrenassia (LinkedIn) Aleksandra Pidov |

| Jurisdictions | Mauritius, Cyprus |

| Regulators | FSC Mauritius for Benor Capital Ltd CySEC for EDR Financial (license no 268/15) |

| Leverage | up to 1:200 offshore up to 1:30 CySEC |

| Payment options | Bank wire, Credit card, crypto |

| Payment providers | SwissQuote |

Short Narrative

It is a (very) well-known fact in the CySEC scene that the licensed CIFs often operate through offshore entities to circumvent the regulatory requirements of ESMA and CySEC. TrioMarkets is apparently no exception.

TrioMarkets, founded by Raphael Ghrenassia in 2015, could easily prevent EEA clients’ onboarding by algorithmic means. Sure, their website presents a disclaimer to EEA residents but accepts them nevertheless. The scheme operators want to have these clients in their offshore entity. The CySEC-regulated entity exists primarily for marketing. For example, through the CySEC-regulated broker, it would not be allowed to offer leverage of up to 1:200.

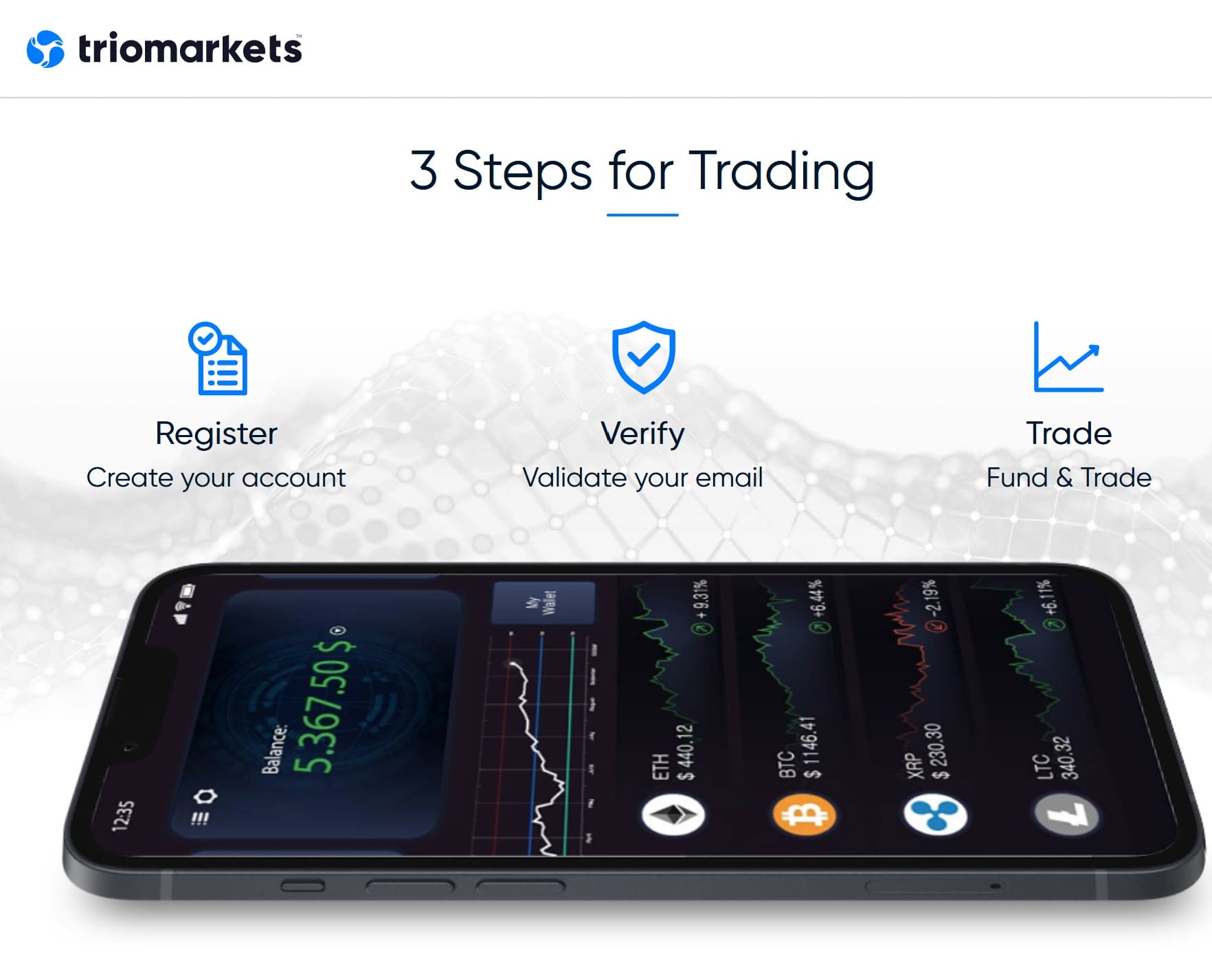

In our review on October 27, 2022, pre-KYC deposits of theoretically unlimited amounts would have been possible via crypto and wire transfer to Benor Capital‘s bank account at SwissQuote. This is also a violation of ESMA and CySEC regulatory requirements. This procedure – deposits after email confirmation – is even advertised on the website.

The offshore approach of Triomarkets violates the regulatory provision in Cyprus and the other regulatory regimes in the EEA.

No Investor Protection

Clients from the EEA region registering through Triomarkets Offshore Broker are not entitled to Investor Compensation Schemes or Financial Ombudsman assistance (for whatever that is worth). As such, all clients should be aware of the risk they are taking. We strongly advise against it.