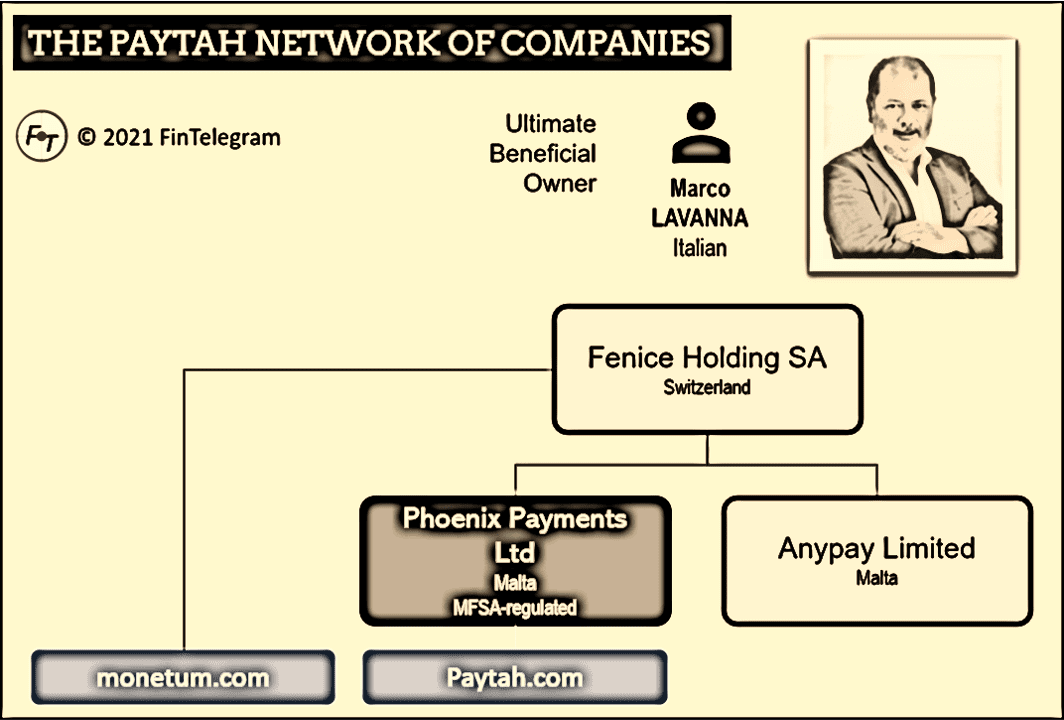

The high-risk payment processor Paytah (www.paytah.com) is operated by Phoenix Payments Ltd, a company registered in Malta and regulated by MFSA. As reported by FinTelegram, PayTah has facilitated vast broker scams, including LincolnFX, RoyalsFX, or CodeFX between 2019 and 2020. Victims of these scams have provided the European Fund Recovery Initiative (EFRI) with the Power of Attorney to recover their funds. Via its Maltese lawyer EFRI has taken actions to recover the victims’ funds from Paytah. Currently, the Maltese connection is chasing after the Paytah people.

Missing filings

The Malta Financial Services Authority (MFSA) has so far not taken any initiative to properly investigate Phoenix Payments (a/k/a Paytah). The company’s main shareholder is the Italian citizen Marco Lavanna (LinkedIn profile), who also owns Anypay Ltd, another company registered in Malta. Public records show that Anypay has failed to file its audited accounts since 2016.

Phoenix Payments has also filed its audited accounts late. Licensed companies in Malta have to file their audited accounts by the end of April. However, Phoenix Payments Ltd only filed its audited accounts for 2019, in November 2020. Companies that file their audited accounts late are usually fined and reprimanded. Interestingly, MFSA seems to have turned a blind eye on Phoenix Payments. The audited accounts were only filed following changes in directorships. This is very telling for a company that has failed to explain its involvement with scams.

Lawsuits

More companies and people are looking for Paytah and have claims against them. The company has recently been sued in Malta courts by Daniela Pesci. Fintelegram will be revealing more about this lawsuit shortly. The Courts will soon announce a date for the first sitting.

MFSA and FIAU don’t care

High officials within MFSA, including Edward Grech and Michelle Mizzi Buontempo, are well informed about this case and have failed to provide any comfort to the victims being represented by EFRI. This regulator has made the headlines for the wrong reasons in recent times. MFSA has been harshly criticized for not acting in well known public cases instead of picking up on small companies for minor infringements to impress Moneyval. Malta may be just a few months away from being greylisted by Moneyval.

With the offices of Paytah being less than 2 minutes walk from the MFSA’s headquarters, one fails to understand how the regulator has so far failed to conduct an onsite visit at Paytah’s offices.

The Maltese Financial Intelligence Analysis Unit (FIAU) has not taken any action against Paytah, as per public records. The FIAU has failed the Moneyval tests and has been highly criticized for failing to act on revelations related to Pilatus Bank, which had its license withdrawn by the European Central Bank. The Maltese press has quoted the FIAU’s Director, Kenneth Farrugia, (picture) that the FIAU is proactive in to fight against fraud. The Assistant Director at FIAU, Alfred Zammit, called a whistleblower a “terrible manager” when testifying at Malta law courts.

Report information

In case you have any useful clues to identify Paytah and his people we would be grateful if you could share them with us.