Fraser Perring, one of the short-sellers behind Viceroy Research, revealed in 2022 that SBB‘s annual report was not coherent. He accused SBB and its CEO, Ilija Batljan, of misleading and defrauding investors (reports here). On Monday, S&P Global Ratings downgraded Stockholm-based SBB, one of Europe’s most indebted real-estate developers, to junk status. On Twitter, Perring said that the downgrade brings Barljan to the verge of bankruptcy:

As a result of the downgrade, SBB‘s shares plummeted by over 15% on Monday and have declined by more than 85% since reaching a peak in late 2021.

S&P cited SBB’s significant amount of short-term debt, approximately $1.4 billion, which is set to mature within the next 12 months. Although the company is actively exploring new funding sources, such as raising capital from shareholders, its liquidity position is a cause for concern, according to S&P.

The credit rating agency lowered SBB‘s credit rating from BBB- to BB+ and assigned it a negative outlook, indicating the possibility of further downgrades. In Wall Street terminology, BBB- and below are categorized as speculative grade or junk status.

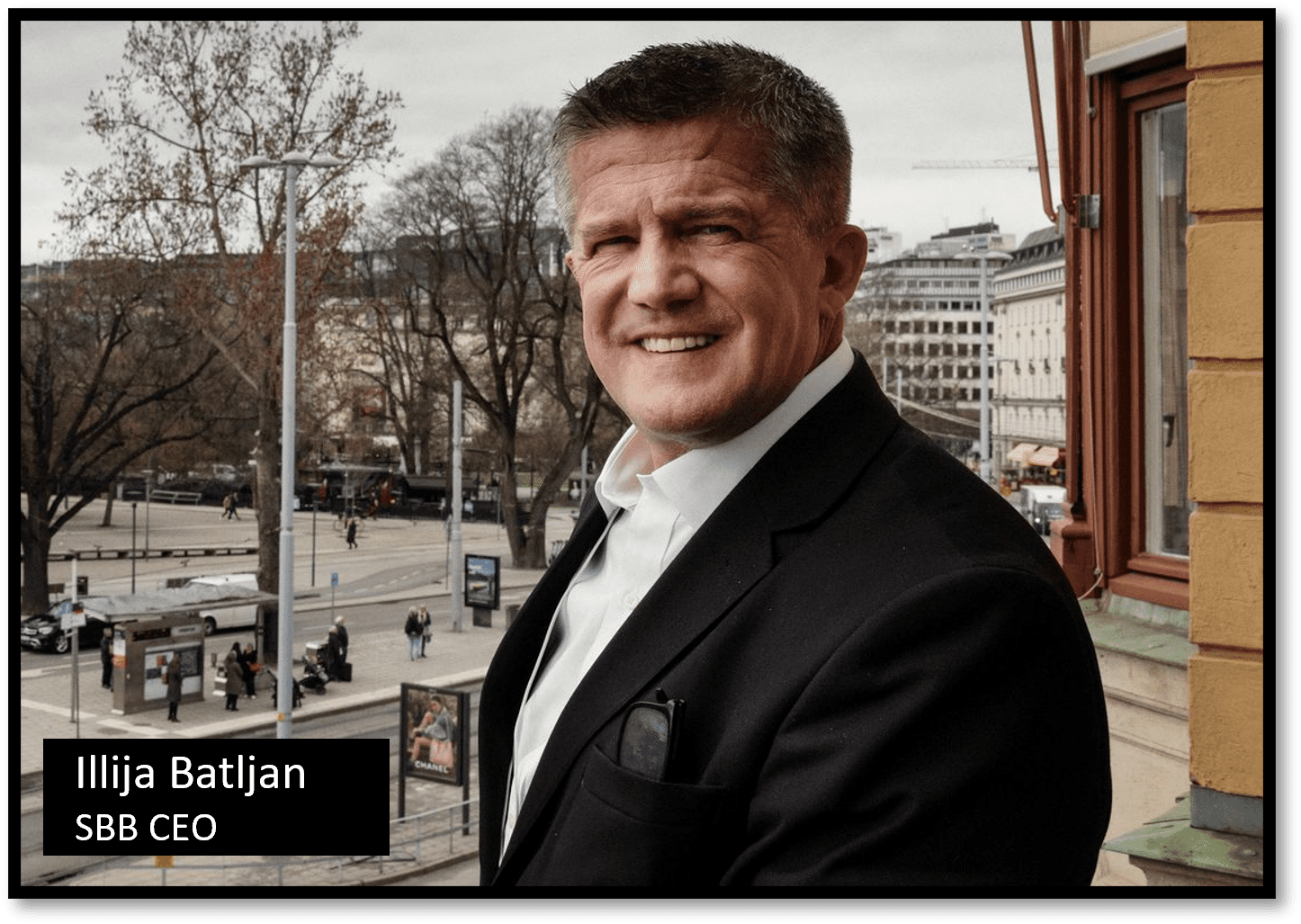

Under the leadership of its charismatic founder, Ilija Batljan, SBB embarked on an expansion strategy fueled by debt at exceptionally low-interest rates. S&P noted that approximately 85% of SBB‘s debt exposure is at fixed or hedged interest rates. However, more than 40% of the debt will mature within the next two years, placing significant pressure on the company’s financial resources. Moreover, obtaining new debt has become considerably more expensive in the current market environment.

Today, the well-deserved karma for @ilija_batljan is served cold. The man falsely labelled @viceroyresearch criminals, fraudsters, market manipulators. He paid private investigators to misuse our data & repeatedly lied to investors about us. If only he’d listened to us Feb 2022.

Fraser Perring on Twitter

Viceroy Research also uncovered the irregularities of the German Wirecard, which were later confirmed by the Financial Times. Wirecard went bankrupt in 2020 for the reasons uncovered by Perring. The CEO at the time, Markus Braun, is currently facing a trial to defend himself against allegations of fraud.