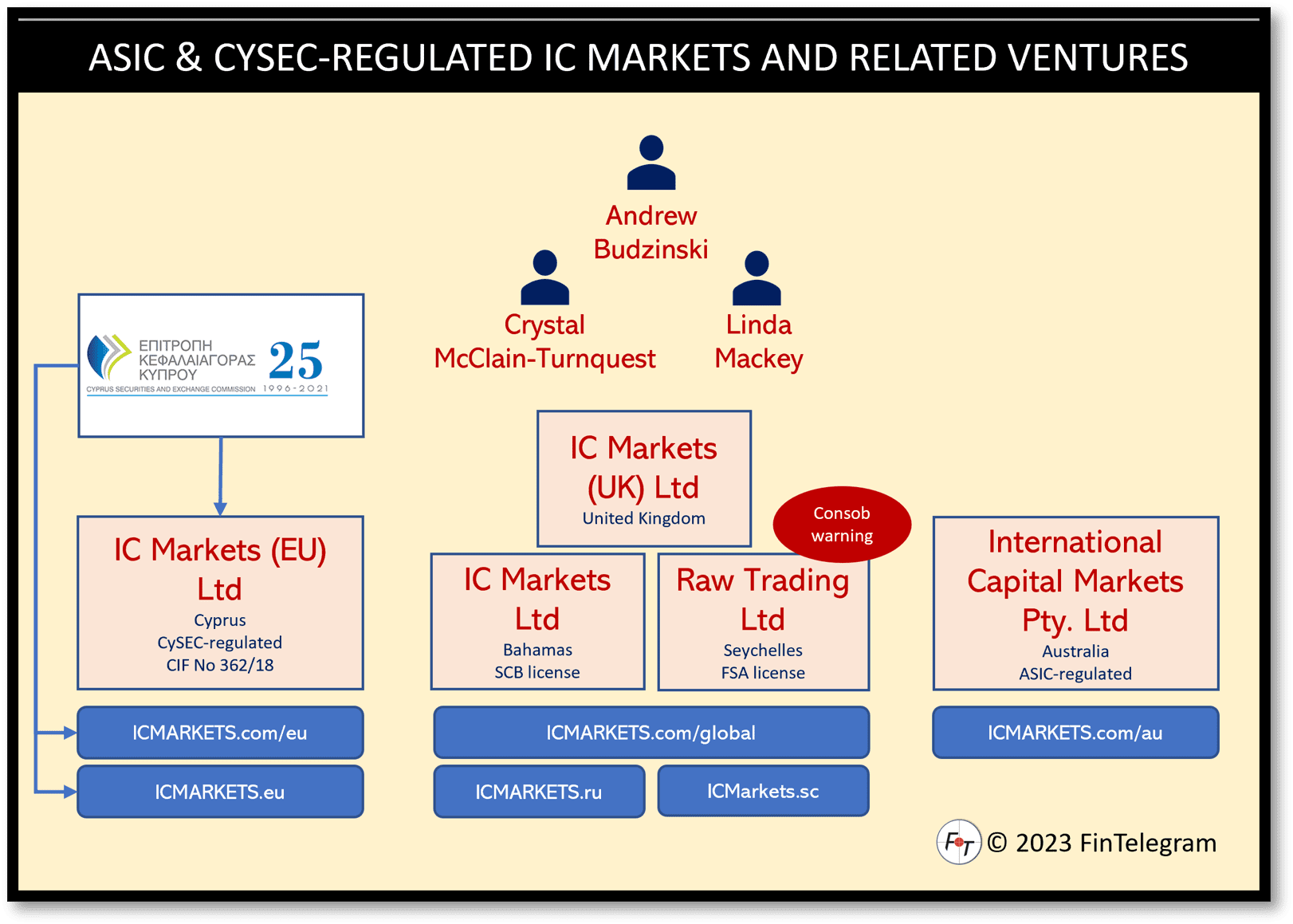

IC Markets claims to be the world’s largest forex broker in terms of trading volume. As of March 2022, IC Markets has a trading volume of $1.11 trillion with more than 185,000 clients listed on its website. Daily FX trades with a volume of $29 billion are reportedly processed. IC Markets works with regulated entities in Cyprus and Australia and also has offshore regulated entities in the Seychelles and the Bahamas. With a 4.9-star rating, the broker is one of the best in class. Here is an update.

Update

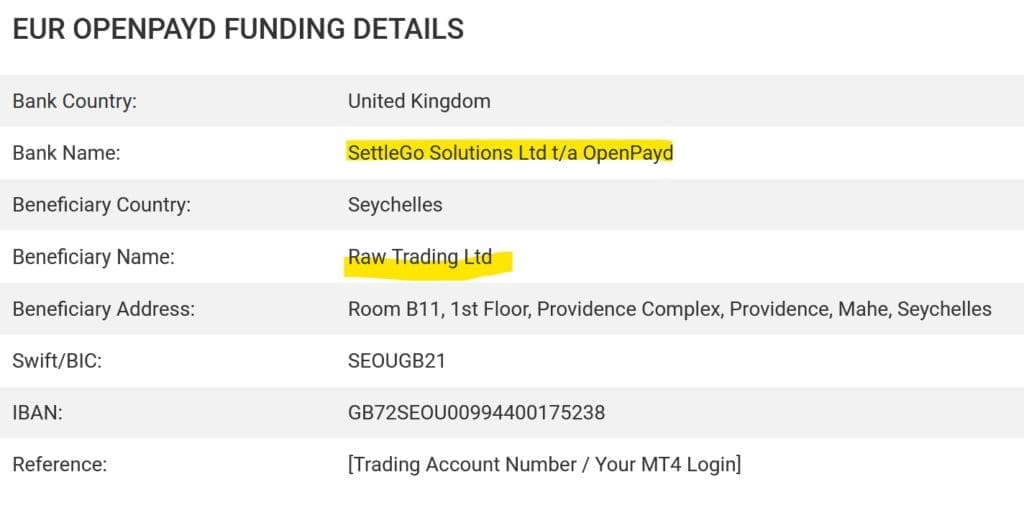

New compared to our January 2022 review is that IC Markets has integrated OpenPayd‘s payment options and open banking technology. This means that SettleGo Solutions Ltd and Clear Bank are also available as payment options for bank transfers. In addition, deposits can also be made via Klarna (Sofort), Neteller, Skrill or via the USDT Stablecoin.

Also new are the directors of IC Markets (UK) Ltd where IC Markets founder Andrew Budzinski has retired as an officer. In November 2022, Edward Anderson, Rodney Martenstyn, Mark Payne and Andrew Rapp were registered as directors.

Key Data

| Brand | IC Markets |

| Domains | www.icmarkets.eu, www.icmarkets.com/global (offshore) www.icmarkets.com/intl (offshore) www.icmarkets.sc www.icmarkets.ru www.icmarketsgroup.com |

| Legal entities | Raw Trading Ltd (Seychelles) IC Markets (EU) Ltd (Cyprus) IC Markets (UK) Ltd (UK) IKBK Holdings Ltd (Cyprus) IC Markets Ltd (Bahamas) International Capital Markets Pty Ltd (Australia) |

| Related individuals | Andrew Budzinski (LinkedIn) Linda Mackey (LinkedIn) Crystal McClain-Turnquest (LinkedIn) Edward Anderson Rodney Martenstyn Mark Payne Andrew Rapp |

| Regulatory regimes | IC Markets (EU) Ltd with CySEC license no 362/18 Raw Trading Ltd with FSA Seychelles license no SD018 IC Markets Ltd Securities Commission of the Bahamas, license no SIA-F212 International Capital Markets Pty Ltd with ASIC license no 335692 |

| Leverage | Up to 1:500 |

| Payment processors | SettleGo Solutions Ltd (OpenPayd), JPMorgan Clear Bank, Citibank N.A. Neteller, Skrill, Rapid Transfer Sofort (Klarna) |

| Warnings | Consob, UK FCA I, UK FCA II |

IC Markets Narrative

Andrew Budzinski is the beneficial owner and founder of IC Markets, registered and regulated in Australia and Cyprus. He is also listed as a representative in IC Markets Ltd‘s offshore entity in the Bahamas. There Linda Mackey is registered as CEO, and Crystal McClain-Turnquest is the Compliance Officer.

According to Wikipedia, Andrew Budzinski is Australia’s 69th richest person and referred to IC Markets as “one of Australia’s most remarkable financial success stories in recent years.”

Complianc Check

The offshore mutation of IC Markets Global (www.icmarkets.com/global and www.icmarkets.com/intl) operated by Raw Teading Ltd in Seychelles and IC Markets Ltd in Bahamas, respectively, accepts clients from EEA countries and other regulatory regimes. Even from regimes where the broker would only be allowed to acquire clients through an existing regulated entity.

The offshore entity offers a maximum leverage of up to 1:500 and thus violates the regulatory requirements in the EEA countries.

The offshore mutation of IC Markets also accepts pre-KYC deposits (“complete later – fund now”) in theoretically unlimited amounts. This is also a violation of regulatory requirements in most jurisdictions.

You understand that you are applying for an account with Raw Trading Ltd trading as “IC MARKETS GLOBAL”, which is authorised and regulated by the Financial Services Authority of Seychelles.

IC Markets Global Onboarding

In October 2020, the Italian Consob blocked the websites of IC Markets for Italian consumers due to continuous violations of the regulatory provisions. In the same month, FC Inter Milan terminated the sleeve sponsorship contract with IC Markets because the broker allegedly failed to fulfill its contractual obligations. IC Markets has filed a ‘wrongful termination lawsuit’ against the club seeking reimbursement for the money they invested. Read our report here.

Share information

Please let us know if you have any information about the IC Markets group.