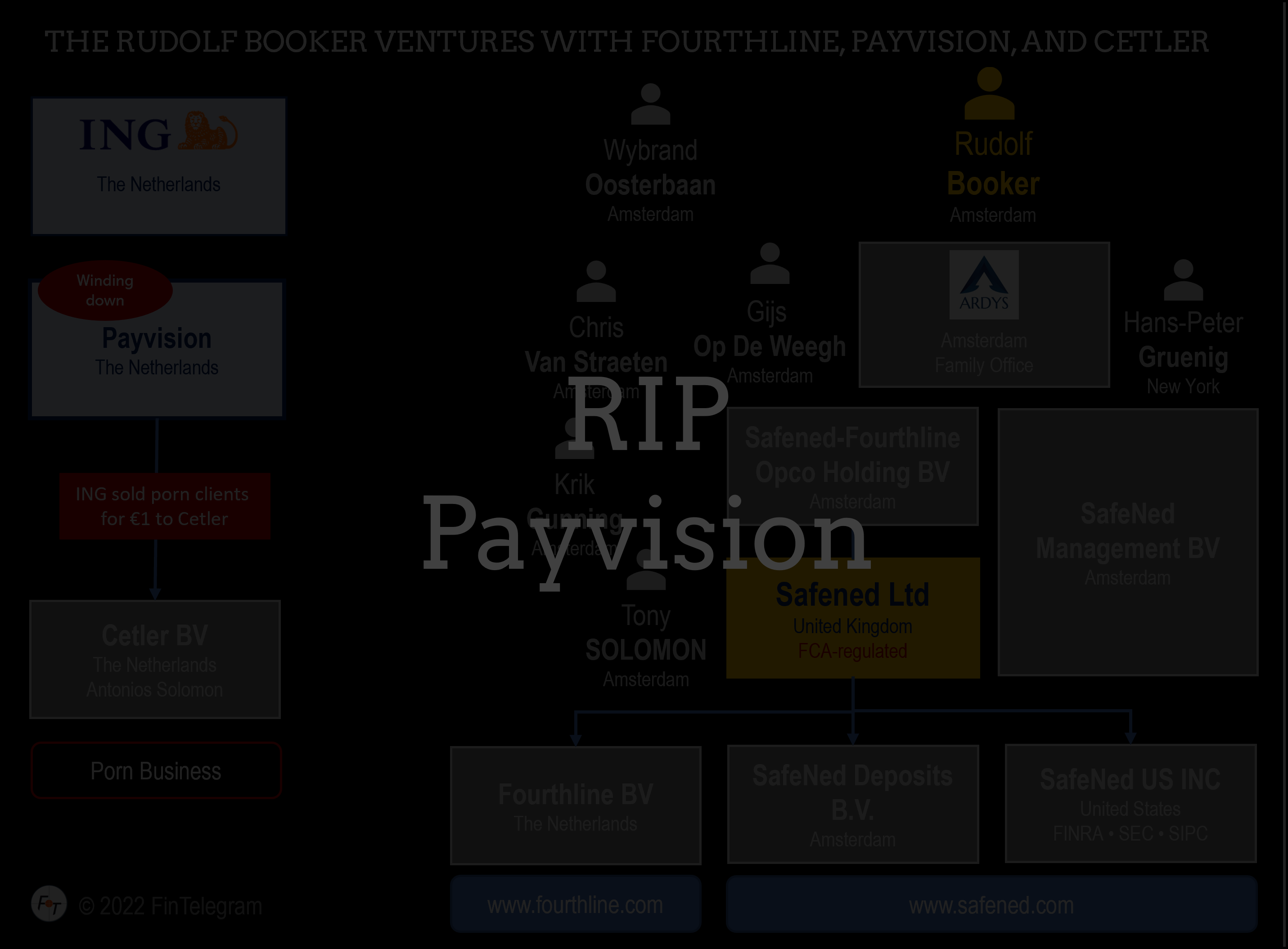

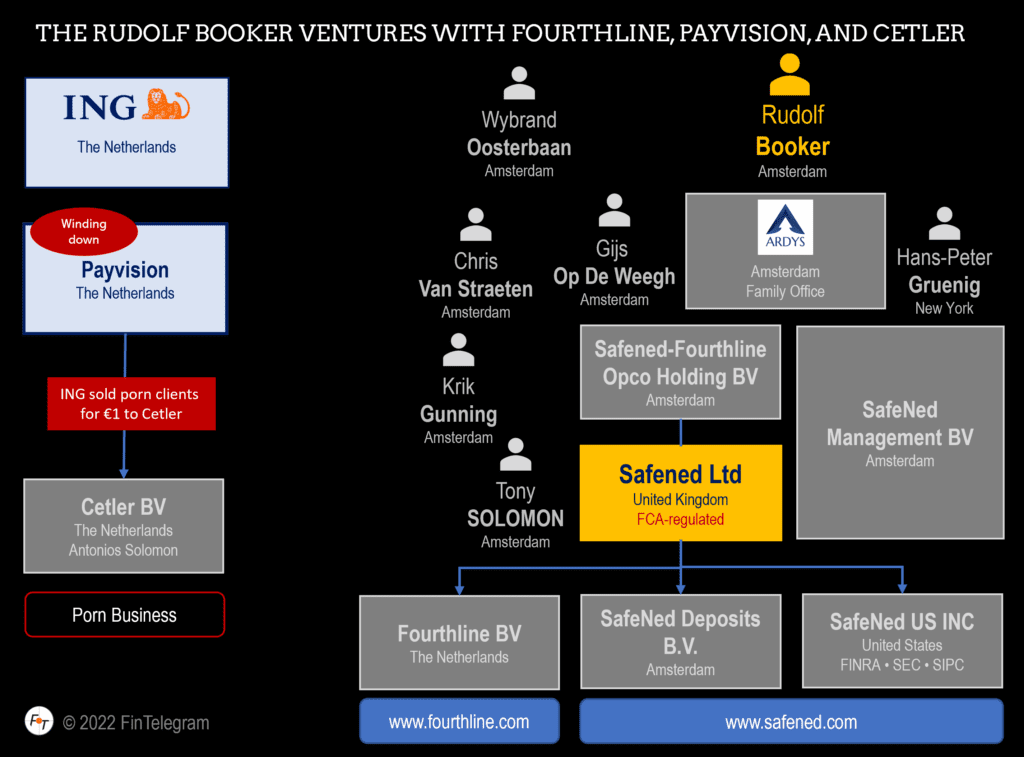

In Germany, the trials against the Veltyco Cybercrime Scheme of Uwe Lenhoff start soon. Uwe Lenhoff and many of the scheme’s shell companies have been Payvision clients. While the now ING subsidiary Payvision is forced to wind down its business, the fintech hub at Tesselschadestraat 12 in Amsterdam is developing fine. Most of the companies registered at the address are controlled by the embattled Payvision founder Rudolf Booker – Safened, Fourthline, and the Ardys family office. Safened is an FCA-authorized Payment Institution, Fourthline is a compliance solution provider for other FinTechs, and Ardys is Booker’s family office.

Key data

| Entity | Jurisdiction | Related individuals |

|---|---|---|

| Safened Ltd (prev. Safened-Fourthline Limited) (www.safened.com) FCA-authorized Payment Institution | United Kingdom | Rudolf Booker Gijs Op De Weegh Christopher”Krik” Gunning, Chris van Straeten Tony Solomon Wybrand Oosterbaan |

| Fourthline BV (prev. SafeNed-Fourthline B.V.) (www.fourthline.com) | Netherlands | Krik Gunning Ralph Post Chris van Straeten Remco Vlemmix |

| SafeNed Deposits B.V. | Netherlands | Krik Gunning Chris van Straeten |

| SafeNed US INC | United States | Chris van Straeten Hans-Peter Gruenig Even Todd Ignall |

| SafeNed-Fourthline Opco Holding B.V. | Netherlands | Krik Gunning, Chris van Straeten |

| Cetler BV (https://cetler.com) | Netherlands | Tony Solomon |

| Ardys Group | Netherlands | Rudolf Booker, Stefanie Keyser Wybrand Oosterbaan Jeroen Vetter |

The Payvision disgrace

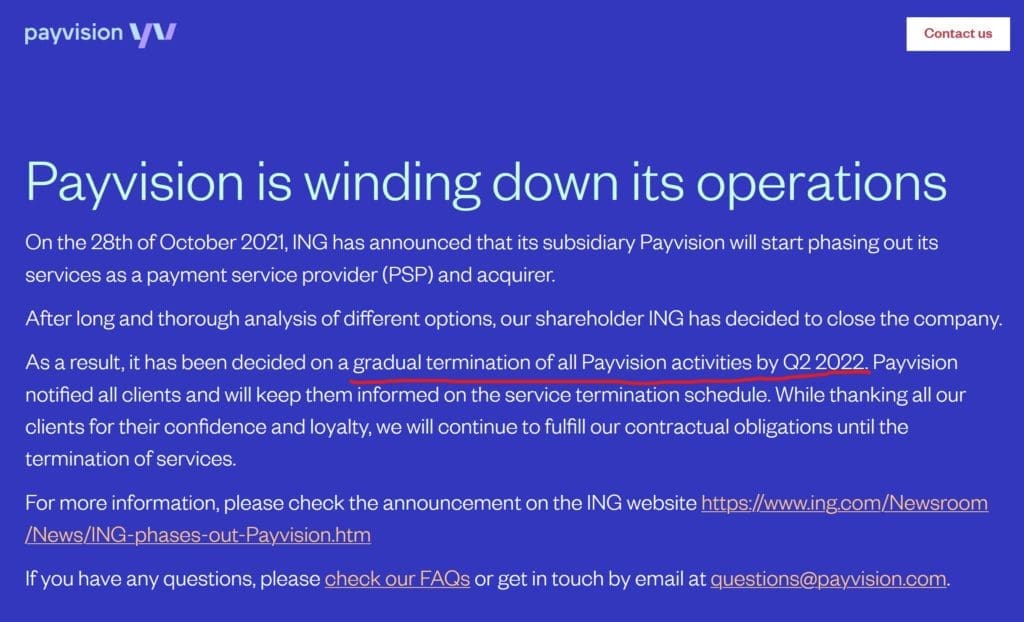

In April 2020, the three Payvision founders Rudolf Booker, Gijs op de Weegh and Chen Liem Li retired from Payvision following the fintech’s acquisition by ING. The Payvision acquisition had become cumbersome for the Dutch bank giant. It turned out that a significant part of Payvision‘s transaction volume was generated either with merchants in ethically problematic areas such as porn or gambling or with scam operators and cybercrime organizations. Thus, ING decided to wind down Payvision, which it acquired just 2 years (spring 2018) ago for €360 million. What a disaster.

As reported by FinTelegram (report here), ING has already sold large parts of the high-risk business of Payvision back to its founders or a symbolic price. This transferred business includes Payvision‘s porn and gambling merchants.

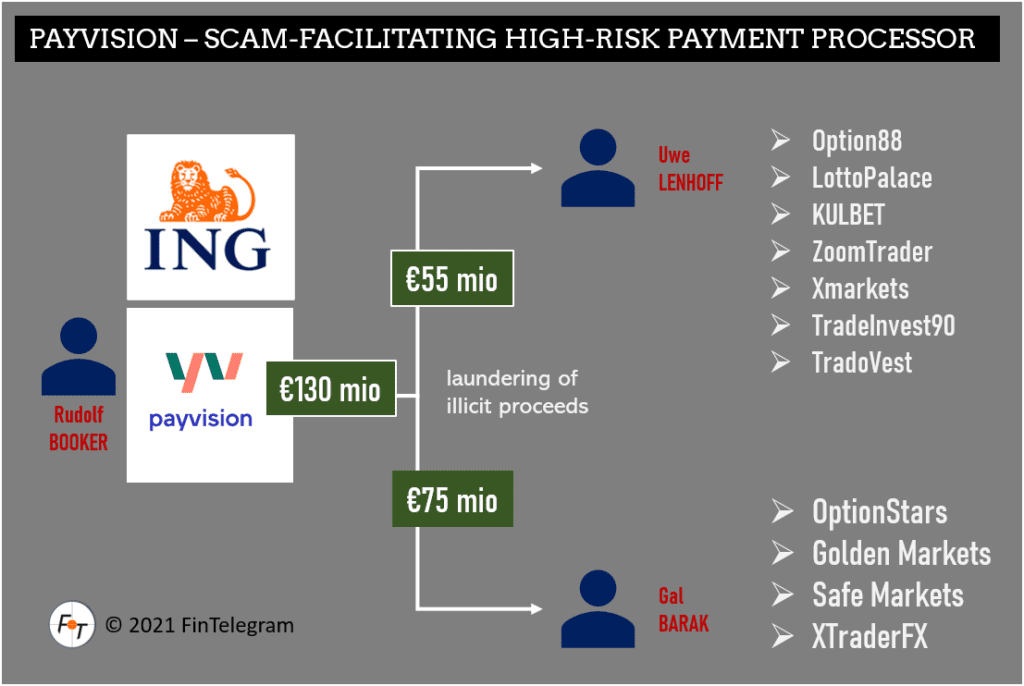

Criminal files of the law enforcement agencies in Germany and Austria show how close the then Payvision CEO Rudolf Booker had been, for example, with the alleged mastermind of a worldwide cybercrime organization, Uwe Lenhoff, who died in prison in 2020. Not only used Lenhoff Payvision to launder the stolen money but also served as a sales agent for the Amsterdam FinTech.

Lenhoff acquired other cybercrime merchants such as Gal Barak. The latter was sentenced in 2020 for investment fraud and money laundering to several years in prison and more than €4 million in restitution payments. Millions of Lenhoff and Barak’s scams were laundered through Payvision. Consumers lost dozens of millions to scams via Payvision.

Safened and Fourthline

Rudolf Booker, Gijs op de Weegh and their long-time companion Tony Solomon are now directors of FCA-regulated payment institution Safened Ltd. The SEC-regulated broker-dealer Safened US, Inc., Delaware, and Safened Deposits B.V. are subsidiaries of the FCA-regulated entity. Safened US, Inc. Together, the three companies operate also as a global liquidity provider for financial institutions and corporate clients.

Until at least Sept 2021, the Amsterdam-registered entity Fourthline B.V. (prev. SafeNed-Fourthline B.V.) (KvK 58905413) had a license from the Dutch AFM (here) and was registered as a payment institution with the De Nederlandsche Bank (DNL) together with Stichting SafeNed Payments B.V. However, Fourthline evolved into a compliance and KYC solution provider for FinTechs and financial institutions. Krik Gunning is one of the company’s co-founders and CEO. Chris van Straeten is the Chief Financial Risk Officer. Both are part of the management team of other Tesselschadestraat 12 companies.

Share Information

Are you a partner or client of the Tesselschadestraat 12 entities or Payvision? Maybe you have information about Payvision and its legacy? We would like to learn more. If you have any information, please share it with us.