Deutsche Handelsbank (www.handelsbank.com) is no stranger to FinTelegram readers. The small German bank has always been around Wirecard and is still one of the biggest scam facilitators in Germany. Yet, amazingly, the German authorities allowed the bank to operate for such a long time after the disastrous Wirecard experience. But this supportive mood seems to change in the Wirecard aftermath. Disastrous reports by KPMG, high losses, EFRI’s complaint, and investigations by the public prosecutor’s office for breach of trust and money laundering make life difficult for the small bank.

Protection, Complaints, and investigations

The fact that the owners of Deutsche Handelsbank, the Reimann Family, are among the richest clans in Germany has certainly protected the institution from many things. However, after the collapse of Wirecard, the authorities’ positive (and negligently naive) attitude could change. This would be good news to European consumers and retail investors.

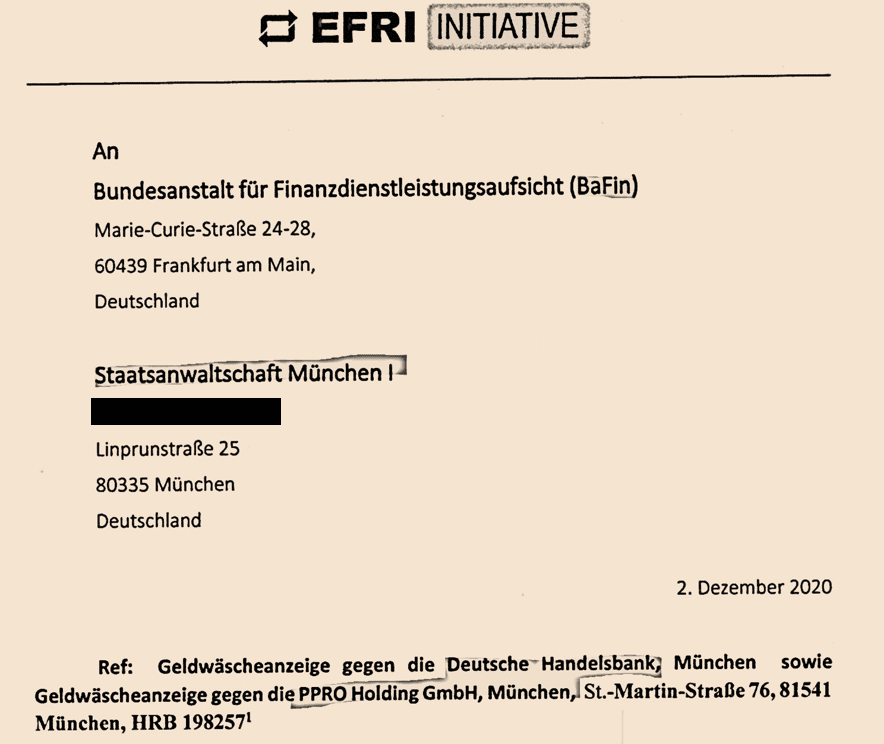

The European Fund Recovery Initiative (EFRI) has filed a complaint with the Munich Public Prosecutor’s Office connected with Deutsche Handelsbank and its facilitation of investment scam activities (file no: 322 UJs 743436/20). The Public Prosecutor’s Office had confirmed the investigations. Likewise, the public prosecutor’s office investigates former board members and supervisory board members on suspicion of breach of trust and money laundering.

BaFin and management

German regulator BaFin had already previously reprimanded the institution for deficiencies in money laundering and has pushed for the replacement of then-CEO Daniel Keis. The latter was replaced by Frank Schlaberg and Jens Munk in October 2019. The supervisory board accuses Kreis of not providing correct information. According to a report in Germany’s WirtschaftWoche, Daniel Kreis is to be sued for damages by the bank connected with the failed UK expansion.

Losses, risk management, and compliance

The institute is also losing significant amounts of money. For 2020, the board of directors expects a loss that should be even higher than the €5 million that had to be booked in losses in the previous year. The Reimann Family had to inject €15 million capital already in early 2020 to master the institute’s financial crisis. Wirecard has perfectly demonstrated how long a bad bank can think about constantly adding new money. But at some point, this will be over, and money ceases to be a remedy to cure it all!

KPMG criticized the bank’s non-functioning risk management in 2019. According to it, the risks had exceeded the financial reserves of the bank by 40%. This is “massive,” KPMG stated.

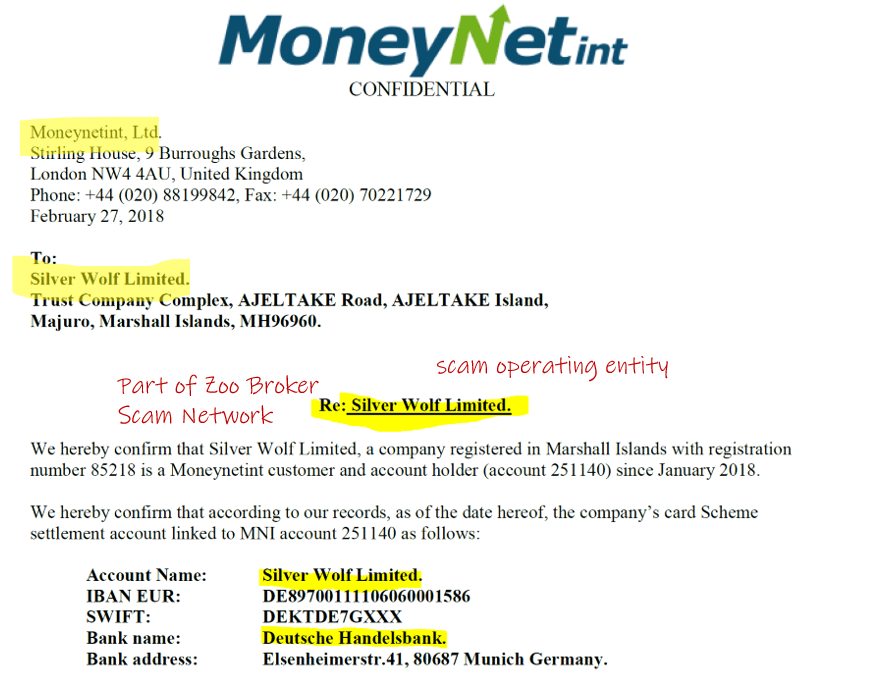

As a matter of fact, Deutsche Handelsbank happily accepts high-risk merchants, as well as scam operating clients and other scam-facilitating high-risk payments processors such as MoneyNetint (see picture left). Evidently, the bank’s KYC/AML procedures are not working properly. Therefore, in the long run, massive claims for damages for the victims of high-risk customers can be expected (see also the EFRI complaint).

Preliminary conclusion

Against all odds! If we were a bookmaker, we would set the odds on bets on the long-term existence of Deutsche Handelsbank accordingly. The prospects for a good future are not really there, despite the Reimann Family. Against the background of the massive support of investment scams and the thousands of victims, an exit of Deutsche Handelsbank would be a very positive development for the German and European financial market and their retail investors.