Euroinvest was a small bank in Vienna that was a notorious Internet share trading institution in the New Economy hype. The bank was controlled by the brothers Franz Wanovits and Johann Wanovits. In 2013, the latter was sentenced to five years in prison and ordered to pay 10 million in damages for share price manipulation of Telekom Austria. Euroinvest was renamed into Blue Rock and launched the Blue Coin Select 20 crypto bond most recently.

Key Data

| Trading name | Blue Coin Select 20 |

| Short description | Crypto basket bond |

| Issuer | Blue Coin Emissions GmbH |

| Related entities | Blue Rock Group (prev Euroinvest Bank) Blue Rock Management GmbH Blue Rock Capital GmbH S.S.I.F. Blue Rock Financial Services S.A. |

| Jurisdictions | Germany, Austria |

| Total amount | €100 million |

| Security Identification Number | A30V2E |

| Related individuals | Claus Koerner Johann Wanovits Franz Wanovits |

| Compliance rating | Orange |

Short Narrative

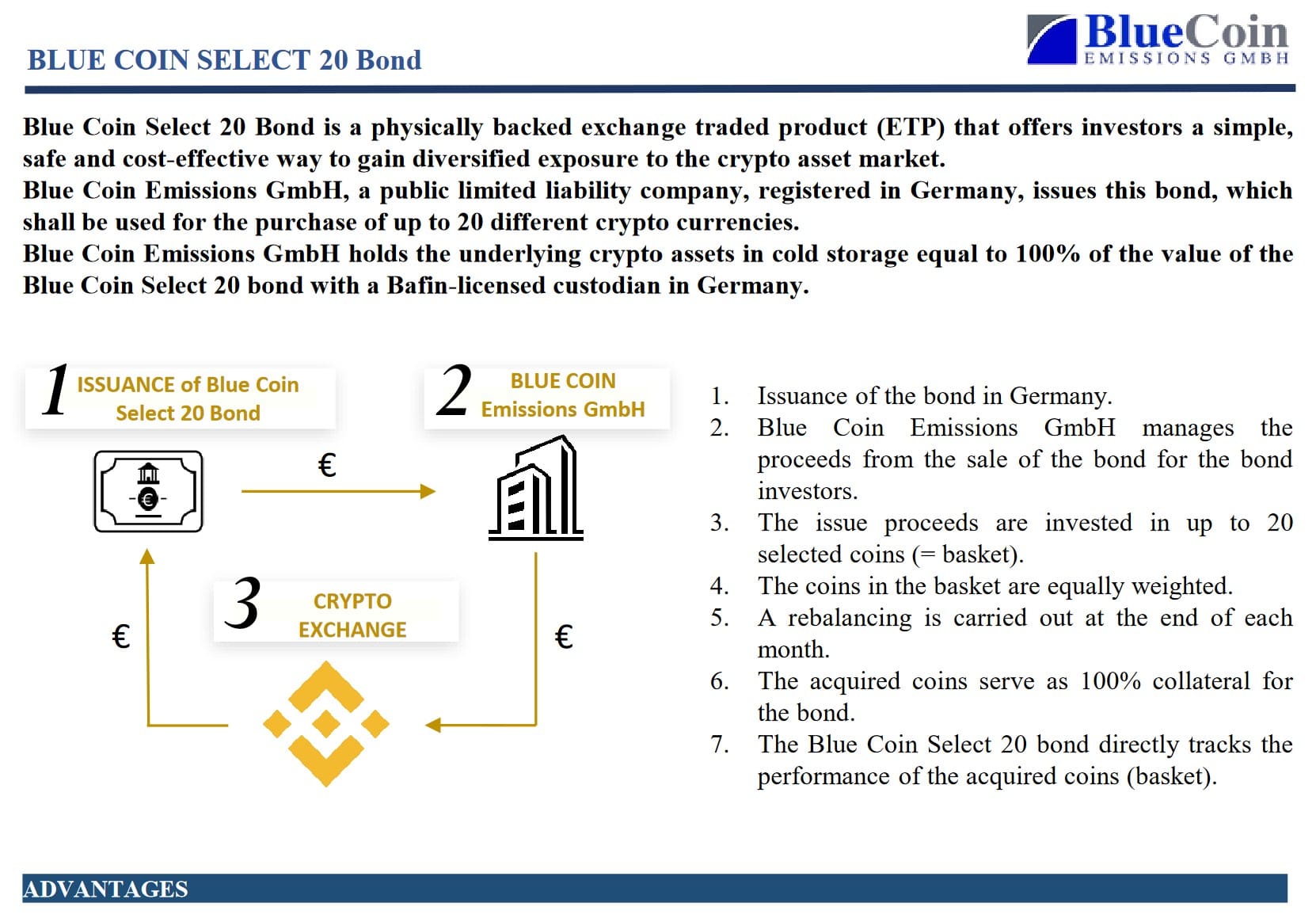

The crypto bond is issued through Blue Coin Emissions GmbH (website), registered in Germany, with a maximum volume of €100 million. According to the description in the info sheet sent via email by Johann Wanovits to potential investors, Blue Coin Select 20 is described as an exchange-traded product that offers investors a simple and safe way to invest in the crypto segment.

The bond issuance proceeds will be used to invest in a basket of 20 cryptocurrencies, including Bitcoin (BTC). A BaFin-regulated custodian in Germany reportedly holds the coins. The crypto bond will be listed on the Vienna Stock Exchange in the MTF segment, the bond documents promise.

The (allegedly) listed crypto bond does not offer too much transparency. The website states a net asset value (NAV) of just over 83. What does that even mean? We can no longer find the Blue Coin Select 20 bond on the Vienna Stock Exchange under its security identification number A30V2E.

The Blue Rock group of companies emerged from the Euroinvestbank of the Wanovits brothers. The Austrian companies Blue Rock Management GmbH and Blue Rock Capital GmbH still reside in Gruengasse in Vienna’s 5th district. The banking license was voluntarily surrendered after the conviction of Johann Wanovits.

S.S.I.F. Blue Rock Financial Services S.A., a company in the Blue Rock group registered in Romania, is registered with the Romanian FSA as a financial intermediary. The managing director of the German crypto bond issuer is Claus Koerner.

Preliminary Conclusion

The Blue Coin Select 20 bond is primarily aimed at large and professional investors with a minimum investment of €100,000. Apparently, the bond is also intended to attract the large amount of Russian and Ukrainian money circulating in Vienna. However, we advise the utmost caution. It is currently unclear why the Vienna Stock Exchange listing cannot be found.

We have included the crypto bond in our Orange Compliance list.

Share Information

If you have any information about Blue Coin Select 20, its operators, or facilitators, please share it with us through our whistleblower system, Whistle42.