In a pivotal chapter of the ongoing narrative on global financial misconduct, the Payvision cybercrime case has emerged as a symbol of the intricate challenges and controversies surrounding cybercrime, money laundering, and regulatory enforcement. This dossier aims to dissect the convolutions of the Payvision scandal, scrutinizing the settlement reached with the Dutch Public Prosecution Service and its broader implications for the fight against financial cybercrime.

The Amsterdam Connection: A Fintech’s Dark Turn

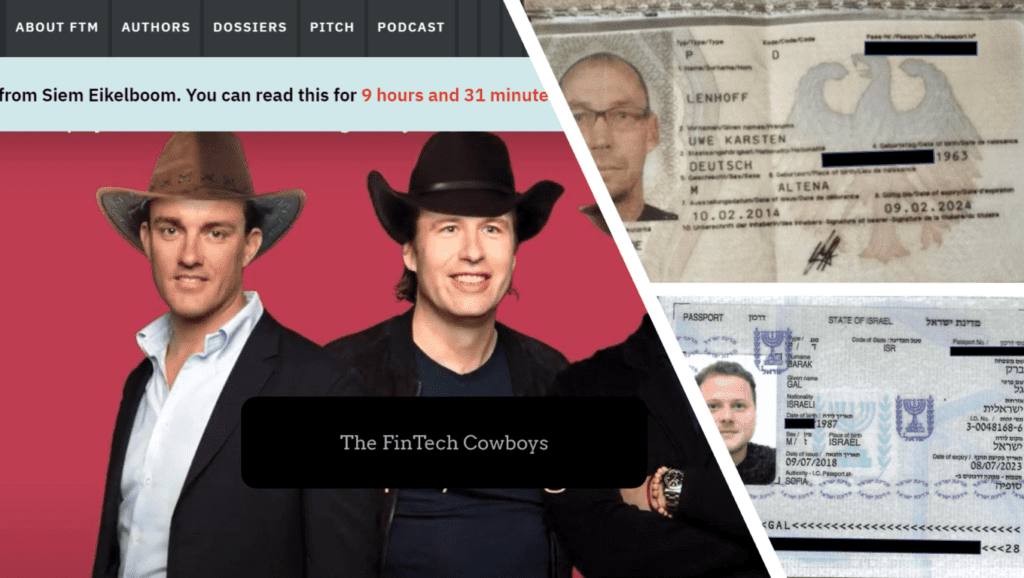

Payvision, founded in the early 2000s by Rudolf Booker in Amsterdam, rapidly ascended as a beacon in the high-risk payment processing realm, servicing sectors often on the fringe of legality. However, its entanglement with notorious scammers, including the German cybercrime mastermind Uwe Lenhoff and the online scam orchestrator Gal Barak, marked a pivot towards notoriety within the cyberfinance community.

The collaboration with these scammers wasn’t incidental but deeply integrated into Payvision‘s operational model, highlighting a period where the facilitation of high-risk transactions became its hallmark. This liaison with cybercrime was underpinned by a series of interactions and partnerships, notably between Lenhoff and the Amsterdam real estate investor Dirk-Jan Bakker, leading to a complex network of cybercrime operations spanning across Europe.

The ING Acquisition: Ambition Meets Reality

ING‘s acquisition of Payvision for an alleged €400 million, celebrated as a milestone, soon revealed its pitfalls as the realities of Payvision‘s illegal engagements surfaced. This acquisition, once seen as a testament to ING‘s digital banking ambitions under CEO Ralph Hamers, became a cautionary tale of due diligence gone awry. The subsequent divestiture of Payvision‘s high-risk segments and a significant write-down on its value underscored the misjudgment.

The Questionable Settlement and Its Implications

The Dutch Public Prosecution Service’s announcement of fines totaling €330,000 against Payvision‘s former directors for serious violations of AML and counter-terrorism financing laws has ignited a debate on the adequacy of such penalties. This settlement, juxtaposed against the extensive financial and emotional toll on the victims of Payvision-facilitated scams, raises profound questions about the deterrent power of financial penalties and the commitment to holding financial institutions accountable.

Regulatory Oversight and the Need for Robust Frameworks

The Payvision case accentuates the paramount importance of diligent regulatory oversight and the enactment of stringent frameworks to scrutinize and monitor financial institutions. The Dutch Central Bank’s investigation into Payvision‘s deliberate bypassing of KYC/AML protocols from 2016 to 2020 exposes a glaring need for a proactive rather than reactive approach in regulatory oversight.

Conclusion: A Call to Action for Global Regulators

This dossier concludes with a call for enhanced regulatory vigilance and deterrence measures. The Payvision settlement, perceived by some as a lenient response to grave regulatory violations, underscores the necessity for a critical reassessment of how financial crimes are penalized. It advocates for a regulatory environment that imposes stringent penalties, fosters rigorous oversight, and ensures that financial systems are safeguarded against the scourges of cybercrime and money laundering.

Expert Commentary: Elfriede Sixt on the Payvision Settlement

In an insightful discussion with FinTelegram, Elfriede Sixt, co-founder of the European Funds Recovery Initiative (EFRI), lambasts the settlement as a paltry acknowledgment of Payvision‘s role in abetting cybercriminals, suggesting it hardly serves as a deterrent. Sixt calls for an overhaul in regulatory and legal frameworks to ensure accountability, enforce stringent penalties, and offer unwavering support to victims, underscoring a collective imperative to reforge the mechanisms of financial justice and integrity in the digital age.

Through its complexities and controversies, the Payvision saga serves as a critical lens through which the challenges of combating financial cybercrime are viewed. It demands a recalibrated approach to regulatory enforcement and legal accountability.