A new study calls Malta a money laundering hub in connection with gambling activities. Nothing new here! In May 2017, whistleblower Valery Atanasov, a former MGA employee, exposed email exchanges that demonstrated that the regulator had broken its own rules between 2012 and 2014 and created “conditions that allow suspicious financial operations, money laundering, and other criminal practices.” Joseph Cuschieri, the then-CEO, was awarded the post of CEO of the Malta Financial Services Authority (MFSA).

Recently, a German study on the online gambling market in Europe revealed that it is massively used for money laundering (report here). Malta is said to be the EU’s hotspot for money laundering in connection with gambling. This certainly comes as no surprise to the government in Malta.

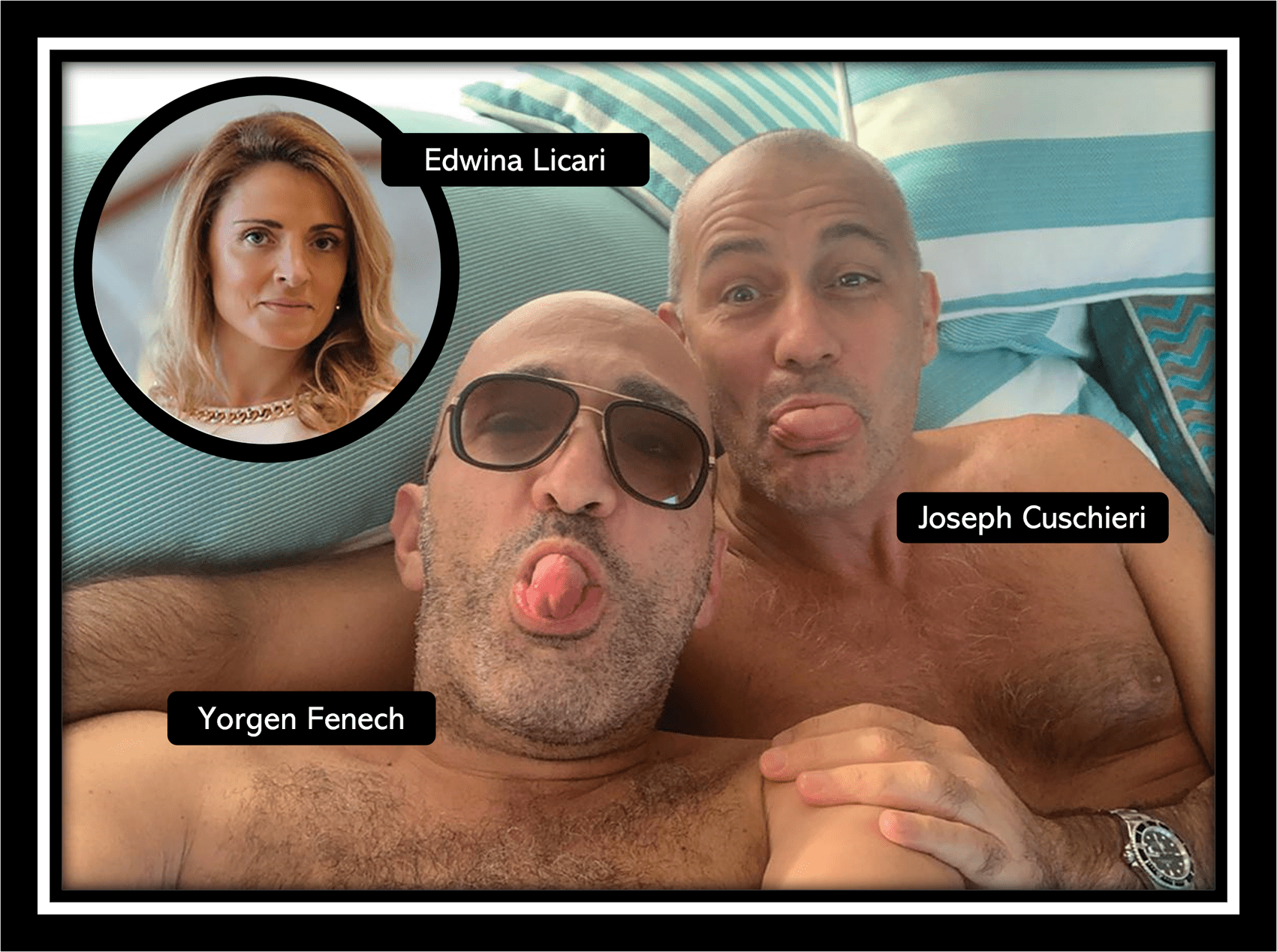

Back in 2017, former MGA employee Valery Atanasov revealed that the MGA was violating its own rules and thus encouraging money laundering. The MGA Chair at the time was Joseph Chuschieri (MGA was then called Lotteries and Gaming Authority – LGA) and Edwina Licari. They were responsible for this regulatory failure. They were not punished for it. On the contrary, they were rewarded.

The independent Brussels-based NGO JournalismFund.eu called “The Malta Files” a roadmap to “how the smallest EU country became a haven for global tax avoidance.” However, there were rules implemented at the MGA but they were not followed. What is the point of more rules?

Theoretically, the gambling industry is “strictly controlled”. However, that only matches the self-description of Malta’s gambling regulator, the MGA. A Forbes article speaks of a corrosive effect of this large influx of money from the betting business on Maltese institutions.

Michael Findeisen, GELDWÄSCHE IM ONLINE-GLÜCKSSPIEL IN DER EUROPÄISCHEN UNION

In 2018, Joseph Cuschieri was appointed CEO of the MFSA. He brought Edwina Licari from the MGA to the MFSA shortly after that. However, Cuschieri resigned in November 2020 after it was revealed that he and Licari had been invited to a luxury Las Vegas trip by Maltese gambling entrepreneur Yorgen Fenech. Fenech is currently in prison. He is accused of being the mastermind behind the murder of investigative journalist and blogger Daphne Caruana Galizia, who died in a car bomb in October 2017.

While the disgraced Joseph Cuschieri had to resign, Edwina Licari is still the General Counsel of MFSA. Question: How can the EU expect Malta to take action against money laundering when officials involved (or negligent) face no consequences for violations but, on the contrary, are rewarded?

Regulation and supervision in the EU is only as strong as the weakest regulator. And in the gambling scene, that regulator is apparently based in Malta.

Complete an utter nonsense. References to European money laundering activity via MT-licensed Casinos is as stupid as it is wrong. Almost every European market has its own local online gambling framework and licenses. If this report talks about Italian Mafia using MT-licensed operators to launder funds, then the Italian online gambling market is not working. Italy has its own licenses and under these, its own requirements and obligations with regards to prevent money laundering. If there were a Casino under MT license that still allows Italians to sign up from Italy, that operator is in breach anyway and it would be difficult to comprehend why such a Casino operating in breach of local laws would then give a damn about other/new European or Maltese AML measures. The operators operating illegally in regulated European markets are usually Curacao-licensed and do not care about any regulations in these markets whatsoever. Whoever compiled this report has no clue, draws the wrong conclusions and does not understand the market.