U.S. authorities have brought parallel civil and criminal actions targeting HyperFund, a global crypto “membership” program marketed with fixed daily rewards and heavy multi-level recruitment. The SEC alleges an unregistered, fraudulent offering; the DOJ alleges a conspiracy that defrauded investors on a massive scale.

Key Facts

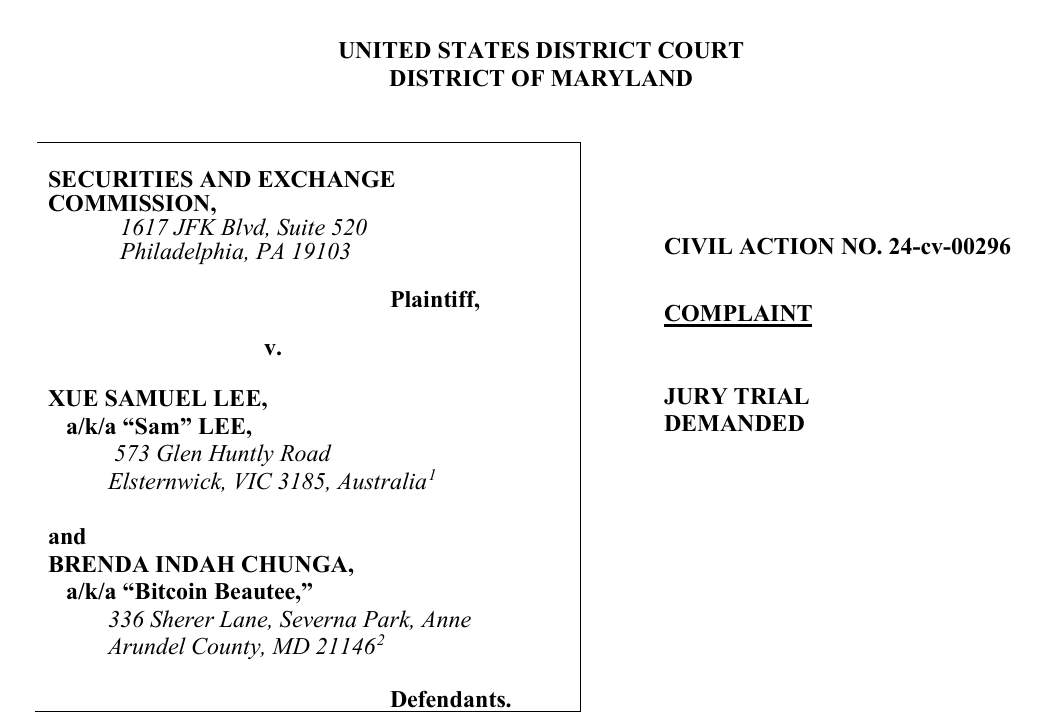

- The SEC charged Xue “Sam” Lee and promoter Brenda “Bitcoin Beautee” Chunga over a purported $1.7B+ HyperFund crypto pyramid scheme (Source: SEC).

- The DOJ (District of Maryland + Criminal Division) announced charges tied to an alleged $1.89B fraud scheme connected to HyperFund (Source: US DOJ).

- DOJ alleges the scheme ran June 2020–Nov 2022, promising 0.5%–1% daily “passive rewards” until investors doubled/tripled their stake, while claiming payouts were supported by crypto mining that did not exist.

- DOJ alleges withdrawals were blocked beginning at least July 2021.

- Criminally: Lee is charged with conspiracy to commit securities fraud and wire fraud; Chunga pleaded guilty to that conspiracy and admitted receiving at least $3M; promoter Rodney Burton is charged with operating (and conspiring to operate) an unlicensed money transmitting business.

Short Analysis

HyperFund is described by U.S. authorities as a classic “membership” investment program: investors bought into an online platform, were shown accumulating internal rewards, and were incentivized to recruit others—features that commonly trigger “investment contract” analysis and securities-registration duties under U.S. law.

The SEC’s civil case seeks injunctions, disgorgement, and penalties, and—critically—conduct-based restraints aimed at preventing repeat “MLM + crypto” offerings. In parallel, the DOJ’s case frames the conduct as a conspiracy using interstate communications to sell the story of mining-funded daily yields, while separately charging alleged money-transmission violations tied to the flow of funds.