The disgraced Austrian real estate mogul René Benko has been convicted for the second time of fraudulent asset transfer, receiving a 15-month suspended prison sentence on December 10, 2025, at the Innsbruck Regional Court. His wife, Nathalie Benko, who stood trial alongside him as a co-defendant, was acquitted of all charges of complicity. The verdict is not yet final, with appeals expected from celebrity defense attorney Norbert Wess—marking yet another partial defeat for the lawyer who previously failed to save former Austrian Finance Minister Karl-Heinz Grasser from an eight-year prison sentence.

The Second Conviction: Hidden Watches and a Secret Safe

This latest conviction centers on Benko’s alleged concealment of luxury watches, cufflinks, and cash totaling approximately €370,000 in a safe hidden at the home of Nathalie Benko’s relatives in the Tyrolean village of Pfunds. Prosecutors from the Economic and Corruption Prosecutor’s Office (WKStA) argued that the safe was installed just five days after Benko filed for personal insolvency in March 2025, demonstrating a deliberate effort to shield assets from creditors.

The court found Benko guilty regarding two luxury watches and four pairs of cufflinks, but rejected other allegations, including claims that watches purportedly gifted to his young sons (aged six and eleven at the time) were fraudulent transfers. Nathalie Benko was acquitted after the court accepted defense arguments that she acquired the safe to protect seven diamond rings valued at €5.5 million during a household move, not to aid her husband’s fraud.

Context: The First Conviction and Mounting Legal Pressure

This second conviction follows Benko’s October 2025 sentencing to 24 months unconditional imprisonment for transferring €300,000 to his mother to conceal assets from creditors. He was acquitted on a second count involving a €360,000 rent advance for an Innsbruck villa. Both sentences will eventually be combined into a single total sentence once the first verdict becomes legally binding—though Austrian law does not permit simple addition of sentences.

Critically, both convictions relate solely to asset transfers during Benko’s personal insolvency—they do not yet address the core Signa Group collapse, which triggered Austria’s largest postwar bankruptcy and left creditors facing losses exceeding €8.35 billion.

The Signa Investigation: 14 Parallel Proceedings and International Reach

The WKStA is currently pursuing more than 14 separate strands of investigation into the Signa complex, targeting over a dozen individuals and two legal entities. Allegations include embezzlement, serious fraud, breach of trust, creditor preference, subsidy fraud, and money laundering. The estimated damage under investigation currently stands at €300 million—though this figure represents only a fraction of the overall Signa devastation.

Investigations span multiple jurisdictions, with Austrian, German, and Italian prosecutors coordinating through a Joint Investigation Team (JIT). In May 2025, coordinated raids were executed across Austria, Germany, and Italy, with Italian anti-mafia prosecutors in Trento allegedly investigating Benko as the head of a “mafia-like criminal organization”. Germany’s Berlin prosecutors are probing subsidy fraud and money laundering related to Signa subsidiaries.

The Shadow Network: World Economic Council and Unanswered Questions

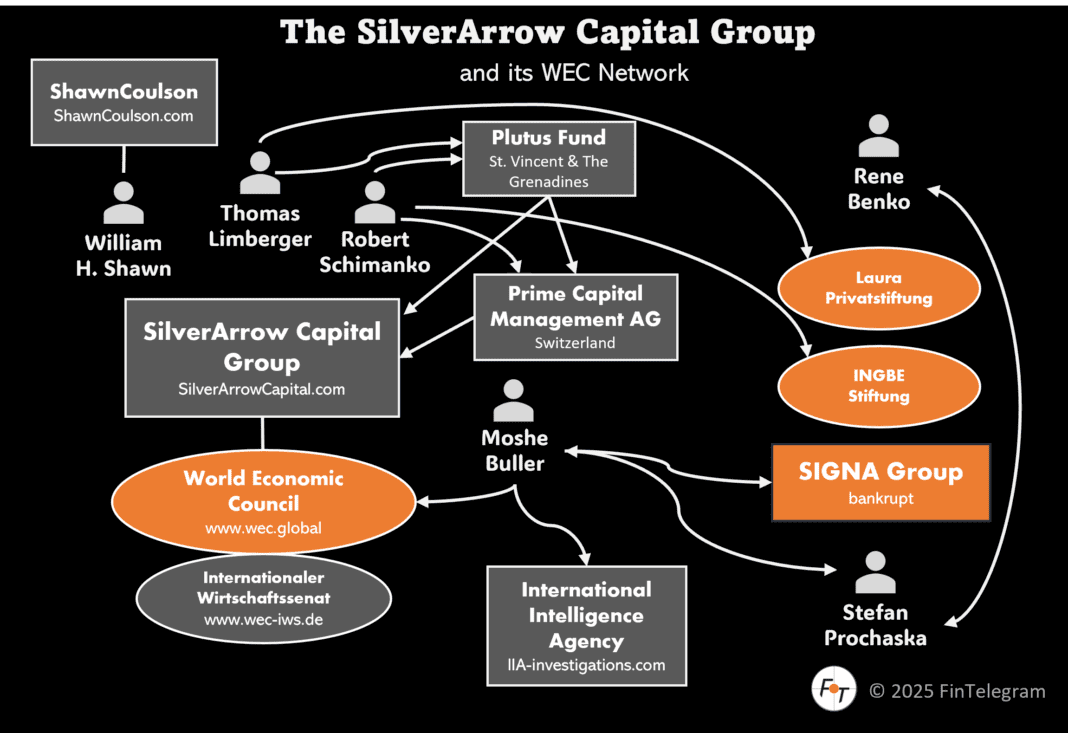

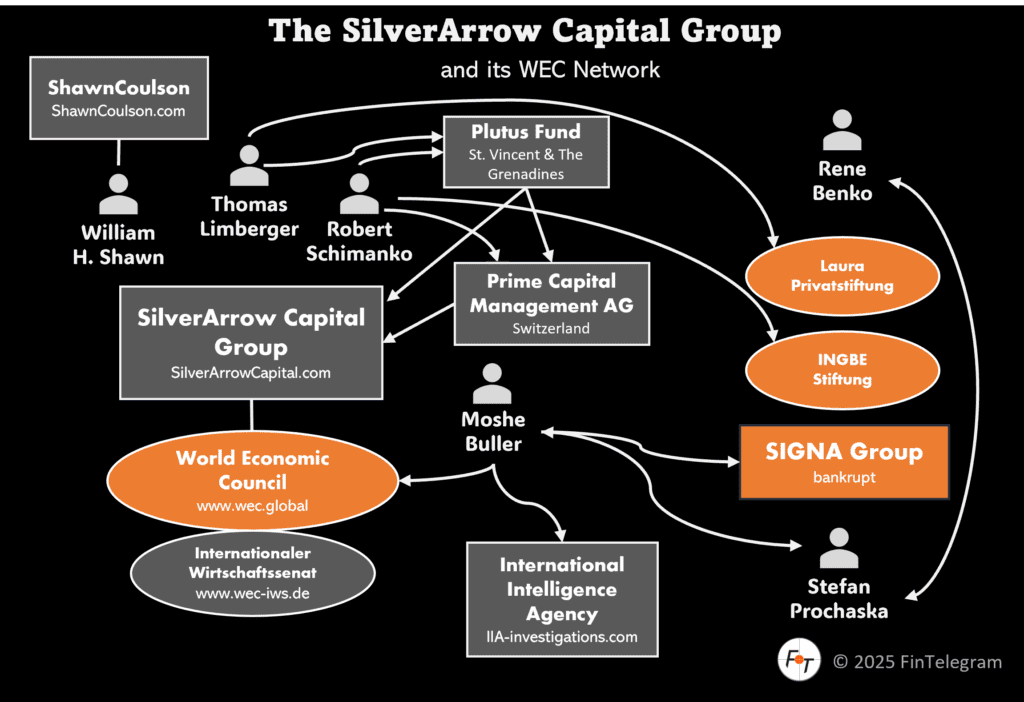

What remains shockingly opaque—and utterly incomprehensible—is the role of the World Economic Council (WEC) and its key figures Thomas Limberger and Robert Schimanko, both of whom sit on the boards of Benko’s private foundations. Despite their central positioning in Benko’s asset network, their involvement has not been adequately explained or investigated publicly.

Robert Schimanko, an Austrian financier operating from Switzerland with a controversial past linked to the Madoff scandal, was appointed to the board of Benko’s INGBE Foundation in November 2024—mere weeks before Benko’s arrest. On the night before Benko’s arrest on January 22, 2025, Schimanko met with Benko at his luxury Chalet N in Lech—a meeting that occurred while criminal investigators were already closing in and phones had been tapped.

Schimanko has been heavily involved in transactions relating to the sale of €30 million in gold by the INGBE Foundation in March 2025 while Benko was in detention. He also participated in post-insolvency auctions, purchasing luxury items—including watches, cufflinks, jewelry, and a motorboat—allegedly on Benko’s behalf and collecting them from the auction house.

Thomas Limberger, Schimanko’s long-time associate and co-partner in SilverArrow Capital Group, was simultaneously appointed to the board of Benko’s Laura Privatstiftung in November 2024. Both men are senior figures in the World Economic Council, a Vienna-based entity that operates not as a traditional NGO but as a private Austrian GmbH, raising serious questions about its true function.

The synchronized appointments of Limberger and Schimanko to separate Benko foundations—coupled with their overlapping roles in WEC and SilverArrow—suggest coordinated asset management and shielding rather than coincidence. Yet, despite extensive media coverage and prosecutorial scrutiny of the INGBE Foundation’s gold liquidation and villa transfers, neither Limberger nor Schimanko have been formally charged.

What’s Next: The Real Signa Case Awaits

These asset transfer convictions are merely preliminary skirmishes in what promises to be a protracted legal war. The main Signa fraud charges—involving alleged investor deception, embezzlement of hundreds of millions, and systematic asset stripping—remain under investigation. Prosecutors are examining €828 million in suspicious inter-company transfers disguised as loans in the months before Signa’s collapse.

Benko has been in pre-trial detention since January 2025, with his custody recently extended to January 12, 2026. His wife Nathalie and mother Ingeborg Benko are now under investigation for money laundering in connection with the INGBE Foundation.

Whistle42: Help Expose the Truth

The Signa collapse represents one of Europe’s most complex financial crimes, with billions in losses, a web of offshore foundations, and a network of enablers operating across multiple jurisdictions. The role of figures like Schimanko and Limberger—who occupy strategic positions in Benko’s foundations yet remain unaccountable—demands full transparency.

Insiders with knowledge of the Benko network, WEC operations, SilverArrow transactions, foundation asset movements, or the Signa collapse are urgently needed. If you have evidence, documents, or firsthand information about these structures, submit securely and confidentially through Whistle42. Your testimony can help pierce the veil of this shadow network and bring accountability to one of the most brazen financial frauds in European history.