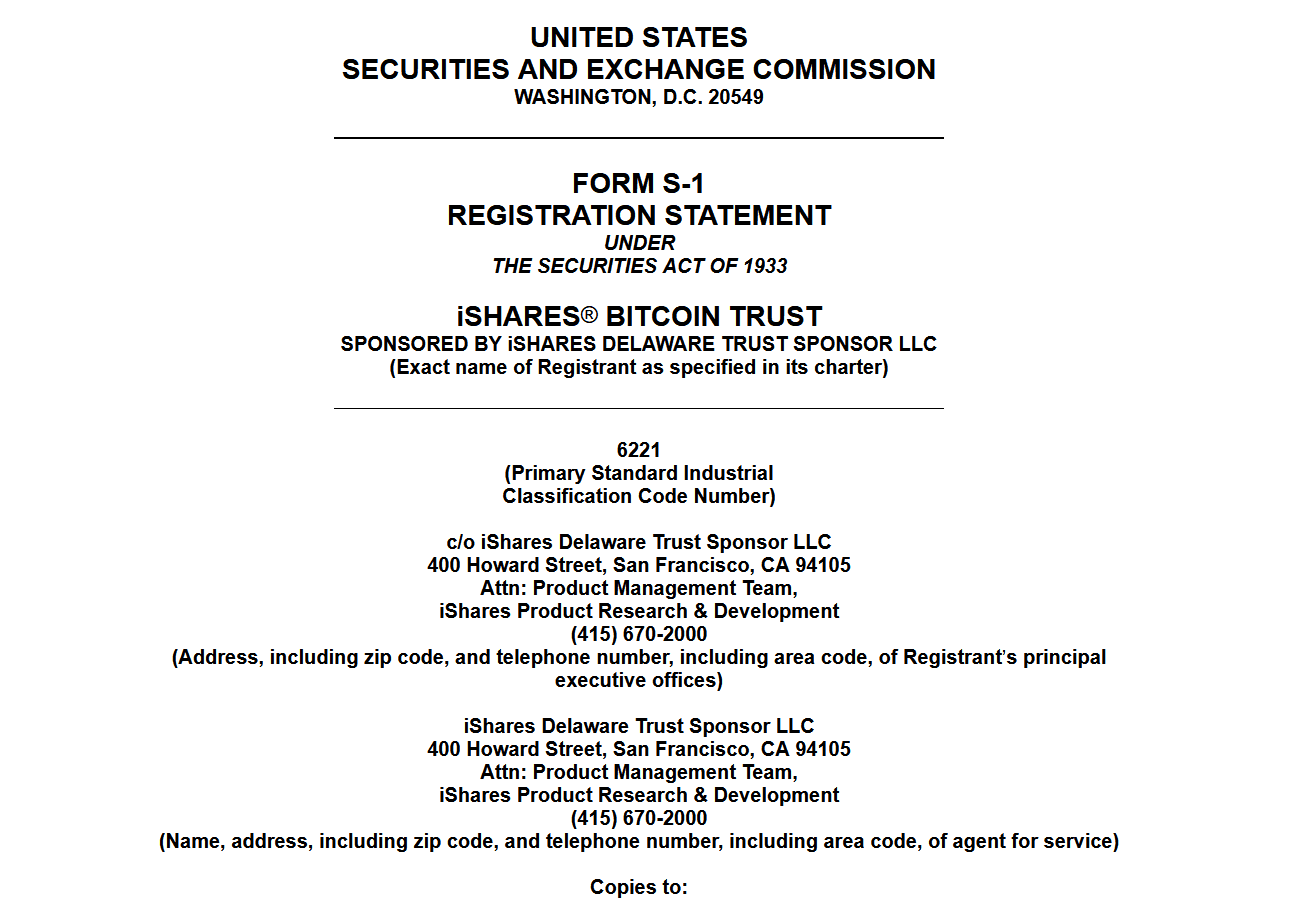

BlackRock, one of the world’s largest asset management firms, has taken its initial steps towards introducing a bitcoin exchange-traded fund (ETF). On Thursday, the company submitted an application to the U.S. Securities and Exchange Commission (SEC) to launch the iShares Bitcoin Trust. If approved, this ETF would provide investors with convenient access to cryptocurrency through a product offered by one of Wall Street’s largest companies.

The BlackRock filing comes amid the SEC’s battle against the crypto industry. Most recently, the regulator, chaired by Gary Gensler, brought lawsuits against Coinbase and Binance. With BlackRock‘s entry, the crypto industry is getting notable and powerful support from the traditional financial industry.

According to the filing, iShares aims to offer a straightforward method of investing in bitcoin, similar to investing directly in the cryptocurrency itself, but without the need to acquire, hold, or trade bitcoin through peer-to-peer networks or digital asset exchanges.

Coinbase is listed as the Bitcoin custodian for the proposed BlackRock ETF. BlackRock has an existing strategic partnership with Coinbase. The companies announced last year that Aladdin, BlackRock’s institutional investment platform, would be connected to Coinbase Prime for crypto trading and custody.

Until now, the SEC has been hesitant to approve a Bitcoin ETF. Currently, the regulator is engaged in a legal dispute with Grayscale over whether the company can convert its Grayscale Bitcoin Trust into an ETF. A decision on this matter is expected later this year.

Numerous other firms have submitted and subsequently withdrawn applications for launching Bitcoin funds. If the SEC loosens its stance, there could be a surge of such products entering the market.

Typically, ETFs take several months to launch after the initial filing, assuming they are eventually approved for trading. Given the anticipated resistance from the SEC, it is possible that the proposed BlackRock fund may encounter significant obstacles, and the filing could be withdrawn before an ETF is launched.

BlackRock‘s decision to pursue a bitcoin ETF comes at a time when crypto prices remain considerably below their previous record highs, and the industry is facing heightened scrutiny in Washington, D.C.