This report is part of our “European FinTech Ecosphere” series. In it, we want to introduce individual companies and people but also the connections and networks. This is to increase the transparency of the European FinTech scene. The financial industry has traditionally functioned as a network across different regulatory regimes: FinTechs and cyberfinance perfect this borderless and “regulatorless” approach. Our “European FinTech Ecosphere” series aims to provide a path through the dawning European cyberfinance for interested readers.

FinTech entrepreneur Ozan Ozerk is a remarkable man. He has built an impressive empire of regulated and unregulated FinTech companies in various jurisdictions over the last few years. These include European Merchant Bank in Lithuania, Ozan Ödeme Hizmetleri ve Elektronik Para AŞ in Turkey, and several FCA-regulated institutions in the UK. This is the official site of Ozan Ozerk, which he runs together with Iana Dimitrova and Ekmel Cilingir through his Akce Group and OpenPayd Group. And then there are his gambling and forex empires.

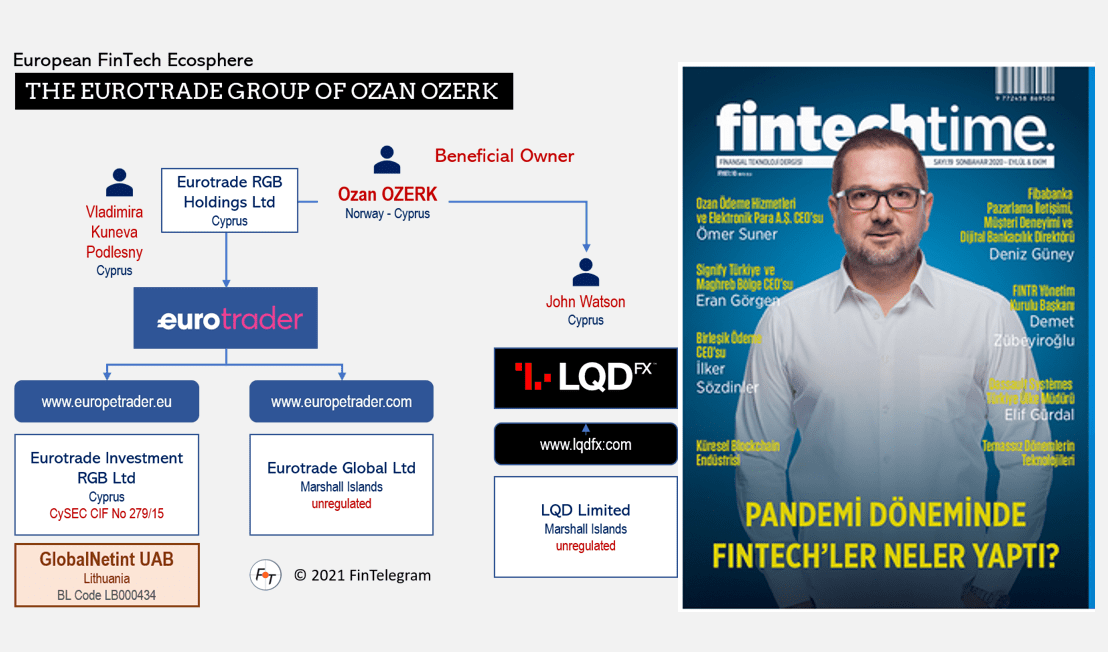

Ozerk is also involved in FX and not always on the good side. He is the beneficial owner behind the two broker brands EuroTrader and LQDFX.

- EuroTrader is an FX brand of EuroTrade Investments RGB Ltd, based in Cyprus. The company is a CySEC licensed investment firm (CIF) with license number 279/15. CySEC has approved the domain www.eurotrader.eu, and thus the broker addresses EU customers. Besides, the brand established EuroTrade Global Ltd in the Marshall Islands through which the domain www.eurotrader.com is operated. This is a typical configuration to operate de facto unregulated via the offshore entity and bypass regulatory restrictions.

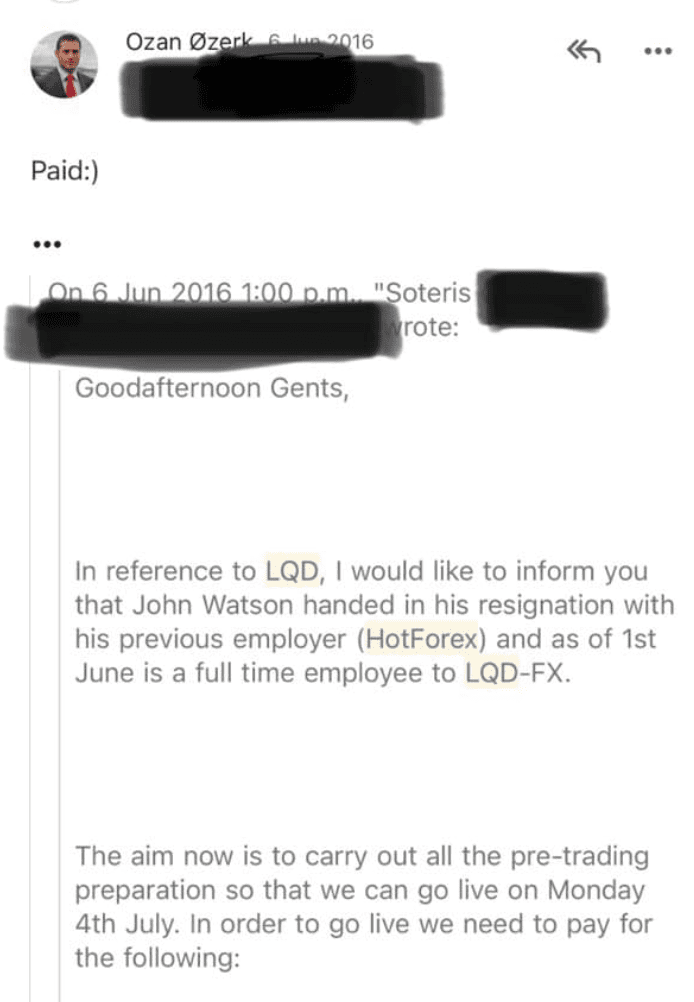

- LQDFX is an FX brand operated by the unregulated offshore-entity LQD Limited in the Marshall Islands. The company’s director and 30% shareholder is John Watson, who previously worked for HotForex. Ozan Ozerk himself hired him and/or agreed to hire him (see email screenshot right). LQDFX has been the subject of warnings from the Capital Markets Board of Turkey (link) and the U.S. SEC (link). In June 2017, LQDFX was actually blocked (blacked out) by the Turkish regulator.

Ozan Ozerk backs both FX brands as the controlling beneficial owner. This is interesting because he operates regulated financial institutions in Turkey and the EU, alongside unregulated FX brokers that regulators deem to be scams and/or illegal businesses. How can a regulated Lithuanian bank – European Merchant Bank – be reconciled with such activities? We don’t know.

We also found Ozerk some time ago as one of the payment processors and players around EMP CORP which is massively involved in the gambling sector (see report here).